[ad_1]

Violent charge Treasury bond yield It is causing repercussions in the global financial market. The stock prices of fast-growing technology companies hit new highs and lowered corporate borrowing costs, but they have triggered new concerns about the prospects of financial returns.

It took several months to reach an investor consensus that strong economic growth and rising inflation will cause interest rates to rise sharply, but it has now broken down. pain For those involved in the transaction, with The past few days.

Across Wall Street, in the context of what Jim Cullen, portfolio manager of Morgan Stanley Investment Management Company, described, “In the context of peak growth, peak inflation, and peak policy stimulus, investors are suddenly forced to think about how to reposition themselves.”

The market has taken clues from the Fed’s consideration of signals that it will cut monetary support earlier than previously expected, and it looks like it may raise interest rates within ample time to prevent inflation from getting out of control.At the same time, as the United States has lifted most of the restrictions on the coronavirus pandemic, it has become more contagious Delta variant It is now prevailing in the country-strategists believe there is little room for unexpected growth upside.

The 10-year U.S. Treasury bond yield peaked at 1.77% in March, fell by 0.11 percentage points in just two trading days this week, and briefly fell below 1.3% on Thursday.

“Cash costs are falling, and people are looking for places to deploy cash,” Karen said. “This supports the broader asset market.”

Stocks: Record and Reversal of Rotation

The U.S. benchmark Standard & Poor’s 500 Index hit 8 highs in the past 9 trading days. Apple, the largest company in the index, closed at a high on Wednesday, setting its first closing high since January, and then profited on Thursday. Vomiting.

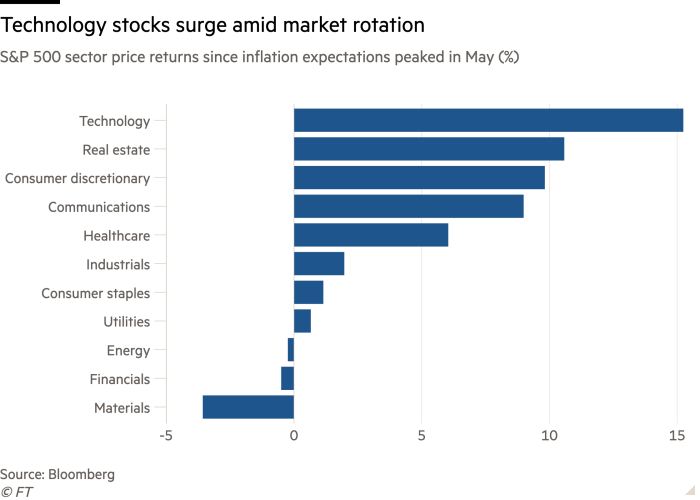

In fact, since inflation expectations peaked in May, the stocks of fast-growing companies such as Apple have been pushing the market to rebound, reversing the months of rotation of value stocks. The fate of these stocks is more closely related to the economic cycle.

Year-to-date returns on growth stocks in the Standard & Poor’s 500 index surpassed the returns on value stocks on Tuesday after lagging for most of the year.

From the beginning of the year to mid-May, the S&P 500 Technology Index rose less than 1%. But since then, as of Wednesday’s close, stock prices have risen by more than 15%, and shares of Microsoft, Salesforce and Qualcomm have all risen by more than 10%. Since mid-May, value stocks have begun to get involved.

As interest rates fell and investors began to question the durability of the US economic boom, banks were particularly lagging behind. The decline in long-term Treasury yields threatens the profitability of banks’ lending to customers, and this is reflected in the closely watched KBW Bank Index, which has fallen 5% since mid-May.

“The market may be at a major turning point,” said Maggie Patel, portfolio manager at Wells Fargo Asset Management. “There is a feeling that after the middle of the year, the amazing recovery growth we have will slow down.”

In early trading on Thursday, the nervousness about the economic recovery came to the fore in the broad stock market sell-off, causing the S&P 500 index to drop by more than 1% at the opening.

Capital Investment’s macro market economist Oliver Allen said: “We don’t expect re-inflation and rotation transactions to return to their former glory,” adding that “the room for further improvement in growth expectations is limited.”

Corporate bonds: Is it time to increase debt?

The corporate bond market has been synchronizing with the Treasury bond market.

As government bond yields rose earlier this year, the yields on higher-rated bonds in the corporate bond market also rose—albeit to a lesser extent.Now the sharp reversal of U.S. Treasury bonds has sent investment grade Corporate bond yield According to data from Ice BofA Indices, it fell to its lowest level since February.

Margaret Kerins, global head of fixed income strategy at BMO Capital Markets, said that she expects a sharp drop in borrowing costs to prompt many companies to enter the bond market.

“If you haven’t posted it yet, you have to jump on it now,” she said. “How can you not use it?”

Some investors and analysts have become more cautious because credit is provided to increasingly risky companies at low interest rates.

BlackRock this week lowered its outlook for US high-yield bonds, warning that potential yields are too low to compensate for the risks involved in providing loans to such low-rated companies.

In recent weeks, the yield on junk bonds has fallen below 4%, this week setting the lowest level since ICE BofA Indices began tracking the data in 1992.

While others are cautious, they are still optimistic about the resilience of the US market in the context of supportive growth, even if they expect interest rates to retreat and rise later this year.

“The market is like a pendulum. They go too far on the one hand, and they go too far on the other,” said Adrian Miller, chief market strategist at Concise Capital Management. “We worried that inflation went too far in March. We were too complacent today.”

[ad_2]

Source link