[ad_1]

Economists said that the UK’s economy recovering from the coronavirus is expected to withstand the implementation of the government’s “Plan B” restrictions, but the Bank of England may postpone rate hikes.

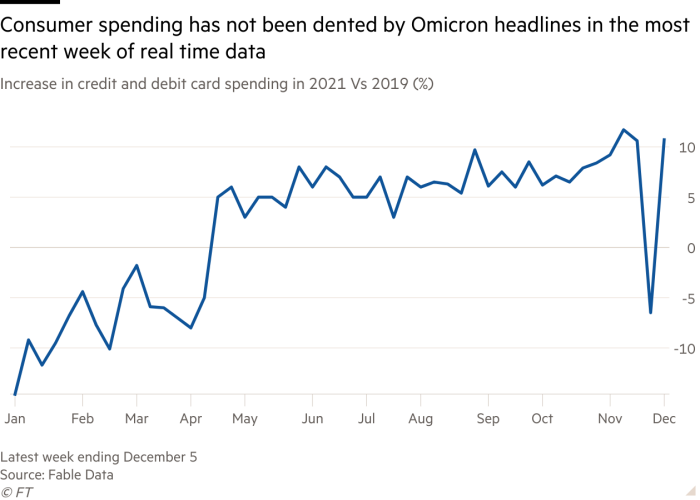

Real-time data shows high spending levels since 2018 Omicron variants It was discovered at the end of November that the family seemed determined to enjoy Christmas, even in certain sectors, such as Inner city hospitality, Will be hit by new works from family rules.

The latest data from the UK National Bureau of Statistics and evidence that companies and individuals have learned to adjust their operations in accordance with Covid-19 restrictions have prompted economists to believe that the impact of Omicron on the UK economy will not be as severe as before.

under Plan B measures, The legal requirements for wearing masks have been extended, with the introduction of Covid passports or negative horizontal mobility tests for large-scale events, and work-from-home recommendations starting from Monday.

Alan Monks, a British economist at JP Morgan Chase, said that work-from-home in Plan B is the most important measure because “it will prevent certain forms of spending from happening”, but he believes that “the economic impact may be small”.

Peter Cheese, chief executive of CIPD, an industry body for human resources professionals, said that even avoiding office requirements should not cause much damage to economic growth.

Cheese said: “During the pandemic, many companies and their employees have learned how to work remotely on a large scale and quickly, so they will be able to respond to this change in guidance.”

Contrary to Prime Minister Boris Johnson’s view that even if people should avoid the office, the Christmas party should continue. “

As many Christmas parties have been cancelled, the hotel industry has paid a price, and the abandoned spending has not significantly weakened recent economic activity, which indicates that the economy will be at a high level by the end of the year.

Thursday, official Real-time data Data from the clearing house’s automated payment system Chaps shows that in the week ending December 2, purchases of credit and debit cards were 21% higher than pre-pandemic levels, the highest level since Covid hit the UK.

Separate debit card data compiled by Fable Data shows that as of the week of December 5, household spending recovered strongly, 10.7% higher than the same period in 2019.

Bank of America’s own proprietary survey data confirms that the arrival of Omicron appears to have “almost no impact on confidence”.

Before the announcement of Plan B restrictions on Wednesday, Citi economist Christian Schultz stated that these measures “may prove to be much less destructive than a complete lockdown, and we still believe that this will be avoided.”

Some economists and industry groups have sent out more worrying news about the government’s plan, and the union conference called for the reintroduction of vacation plans for employees and companies hit by work-from-home measures.

In a somewhat unlikely alliance, the free market think tank Institute of Economic Affairs warned that Plan B could cost the economy 4 billion pounds a month, or about 2% of GDP.

Julian Jessop, an economics researcher at the institute, said this would “force taxpayers to pay billions of dollars to prevent a new wave of bankruptcies and unemployment”.

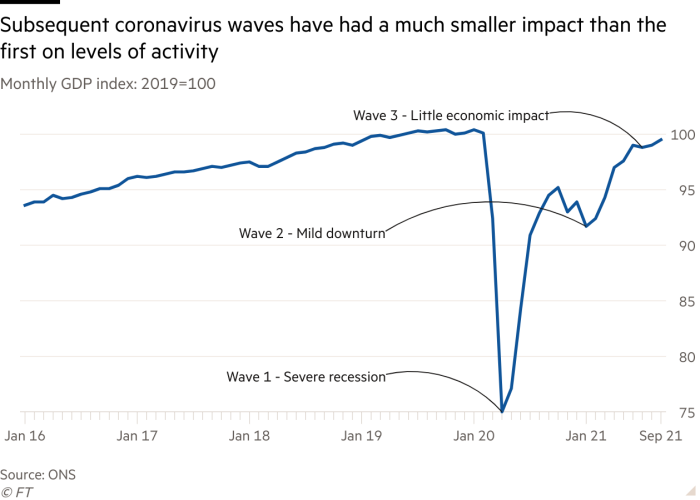

Most economists believe that the IEA’s estimates have overstated the economic impact and are far below the 25% drop in GDP caused by the outbreak of the pandemic in April 2020.

Monks of JPMorgan Chase estimates that the losses in December and January accounted for only 0.5% of GDP after experiencing a strong autumn economy.

With the help of government employee support measures, as people adapt to health restrictions, each subsequent wave of Covid-19 has caused less damage than the previous one.

But economists said that the Omicron wave will have more serious risks than the previous variant, and further measures need to be taken later, which may be enough to persuade the Bank of England not to raise interest rates at its meeting next Thursday.

Steffan Ball, a British economist at Goldman Sachs, said he has changed his previous forecast that the Bank of England will raise interest rates this month. He believes that the Central Bank’s Monetary Policy Committee will find it difficult to explain the increase just after the implementation of the new restrictions.

“We now believe that risk management considerations will dominate the MPC review next week,” Ball said.

“We expect the MPC to send a signal that this is just a short delay to gather more information about Omicron, and that it is still appropriate to raise interest rates in the next few months.”

The financial market agrees with this assessment, and the possibility of raising interest rates next Thursday is very small, and will increase it from 0.1% to 0.25% at the next Monetary Policy Committee meeting in February.

Martin Beck, chief economic adviser of EY Item Club, said that investors’ current prediction that the committee will not raise interest rates in December looks like a “more reliable bet”.

[ad_2]

Source link