[ad_1]

“You’re talking too loudly, I can’t hear what you’re saying.”

—Ralph Waldo Emerson, “The Purpose of Society” (1875)

I’m not a big fan of most surveys: Consumer Surveys, holiday shopping investigation, election polling survey. The main reason is that when a random stranger asks anyone about their own future behavior, the answers they get are completely unreliable.

There are many reasons for this, but the most important one is simple: We don’t know what our future behavior will be. I’m not trying to be pedantic, but to state a truth about how humans think, communicate, and behave in the real world.

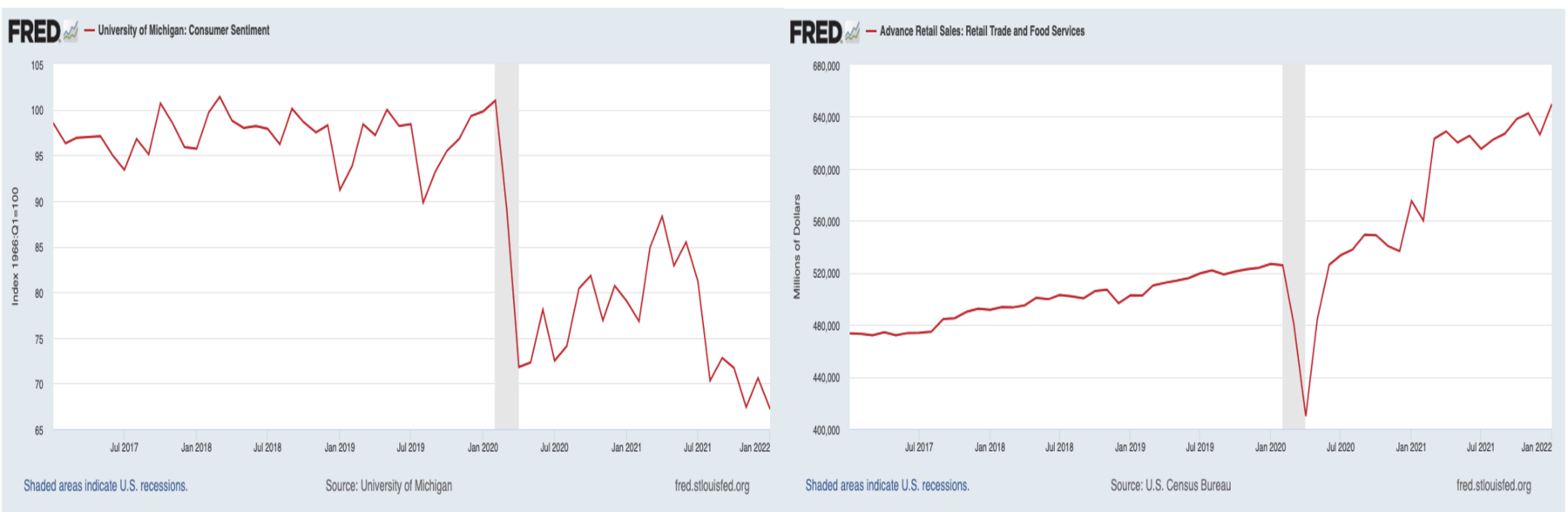

For example: credit card spending. In their first-quarter earnings reports, all the big banks listed their customers’ credit card spending.These numbers do not reflect the harshness of consumers, but an economy on fire: Citi credit card spending up 23%; Wells Fargo up 33%; JPMorgan Chase +29%.

In fact, Wall Street Journal JPMorgan clients spent “37% higher than the first quarter of 2019 and 59% higher than the 2020 low,” the report said. Chase’s credit card customers spent $236.4 billion:

“U.S. consumers say they don’t feel good about the economy. But they have a weird way to show it. Pessimism about the economy has persisted since the expiration of the pandemic-related stimulus package due to soaring inflation and falling household incomes It’s on the rise. But the latest round of bank earnings shows that worry isn’t stopping Americans from using their credit cards.”

Do people really feel that bad about the economy? Our analysis is generally that if they do feel so bad about their future prospects, they will cut back. The opposite: part pandemic spending on goods rather than services, part race before inflation pushes up prices.

Partisan politics, setbacks, covid exhaustion, legitimate concerns and irrational fears have created a volatile mixture. When you ask people survey questions, you don’t always get a simple, accurate answer. People say things for all sorts of incomprehensible reasons, but what they do is more specific and quantifiable.

My disdain for the investigation and my admiration for Emerson/Ro come from the same place. We often don’t know and can’t figure out what people really think. Instead, we get wishful thinking, false memories, and the best of intentions. And assume that the question is carefully worded, easy to understand, and doesn’t affect the answerer’s answer. Measuring is hard, and few people can do it well.

Thinking – when we don’t even bother to do it – is complex, subtle, paradoxical, and sometimes even unknown to the thinker.

Before:

exaggerate negative results (11 April 2022)

Judgment under uncertainty (March 25, 2022)

Consider Buying: Make Better Buys (October 6, 2020)

source:

bullish paradox

Sam Lo

TKer, February 20, 2022

https://www.tker.co/p/retail-sales-jump-sentiment-down

Credit card spending masks consumers’ pessimistic view of the economy

By: Charlie Grant and David Benoit

Wall Street Journal, April 16, 2022

https://on.wsj.com/3KWGMGI

_________

1. To avoid skewing recent consumer surveys due to the impact of Russia’s invasion of Ukraine, Ro’s discussion comes from the pre-war period. But the credit card data cited by The Wall Street Journal includes both prewar and wartime results.

[ad_2]

Source link