[ad_1]

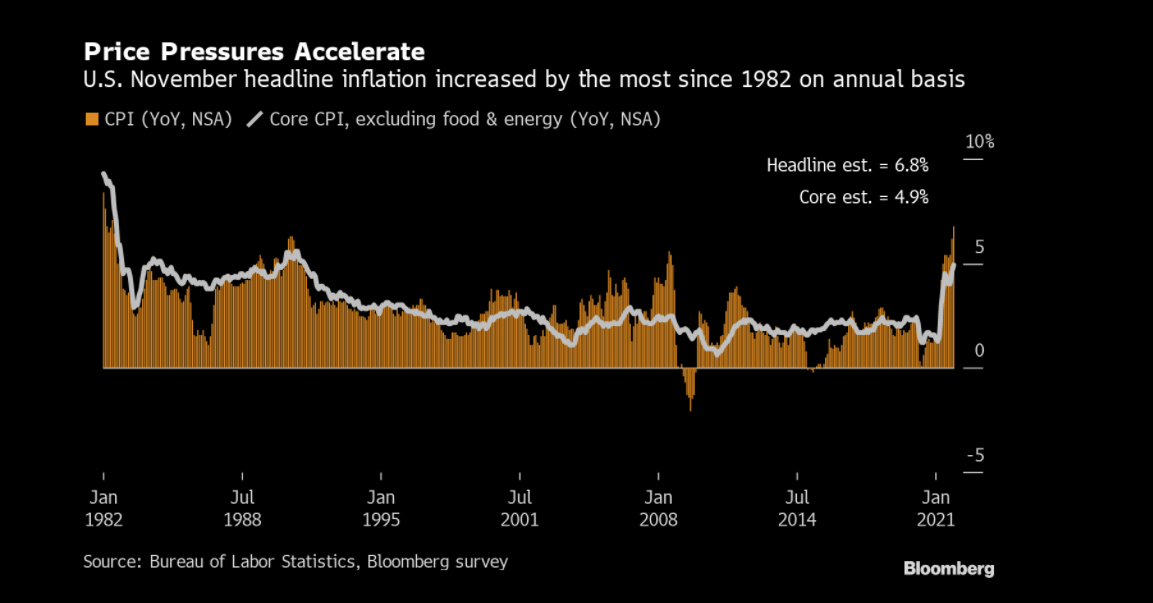

The Consumer Price Index (CPI) data released by the US Bureau of Labor Statistics on Friday showed that US prices in November rose 6.8% from 12 months ago. This is the largest increase in nearly 40 years, and US policymakers are quickly giving up saying that inflation is temporary.

U.S. inflation accelerates

As 2021 approaches the end of the year, the cost of goods and services continues to rise, and inflation continues to rise in the United States. On Friday, the Bureau of Labor Statistics under the US Department of Labor released its Consumer Price Index (CPI) report for November, and the statistics look terrible. Basically, CPI is an indicator that measures a basket of commodities that urban households often consume. This indicator rose to the highest level in nearly 40 years, an increase of 6.8% over the same period in 2020.

Of course, economists and analysts around the world have something to say about rising inflation in the United States. Journalists and “market madmen” Holger Zshapitz Discussed the latest CPI report from the Bureau of Labor Statistics:

“Ouch! U.S. inflation rate jumped to 6.8% [November]To meet the expectations of economists,” Zschäpitz Say“The reading shows the fastest rate of price growth since Ronald Reagan became president in 1982. As the supply crisis and strong spending pushed prices up, inflation accelerated throughout the fall.”

According to the latest CPI report, since October, American households’ payments for consumer goods and services have also increased by 0.8%. Sven Henrich, Founder Northman Trade Network, Ironically Tell His 323,800 Twitter followers “As long as you don’t need cars, housing, food or energy, the inflation rate is only 6.8%.” Blog post Market analyst Henrich criticizes the Fed chairman Jerome Powell Because of the long-term insistence on temporary inflation.

“What a huge embarrassing mistake,” Henrich said. “Once again, the Chairman of the Federal Reserve completely denies reality. Just like Ben Bernanke announced in 2007 that subprime mortgages were controlled rather than threatened to the economy, sustained inflation suddenly posed a risk to the economy, and it is speculated that inflation does not It will continue throughout the year, but the data has always made it clear that this is the case.” The analyst further added:

The Fed not only mistaken inflation, but also generalized it. Their policy is completely wrong, and I find myself very well confirmed here: They are completely excessive in terms of liquidity because they continue to print like lunatics. They deny the existence of an inflationary environment.

Grant Thornton Economist: “This is an inflation that is unlikely to become insignificant in the short term”

Grant Thornton Chief Economist Diane Swonk (Diane Swonk) Recently spoke Washington Post reporter Rachel Siegel (Rachel Siegel) said that inflation may subside, but this particular situation may be problematic. “Yes, inflation can be reduced, but what [policymakers] The concern is: Is it important or unimportant to people’s lives and decision-making? Swank emphasized. “This kind of inflation is unlikely to be insignificant in the short term. This is a problem. “

Long-time critics of the Fed, Peter Schiff I believe that the central bank’s plan will only add fuel to the fire. “Maybe investors think the Fed can heal the cause of the worst inflation in U.S. history by raising interest rates slightly above zero. [is] Because they know that even a small interest rate hike will cause the economy to collapse, and they think it will stifle inflation.But in fact, it will extend the lifespan,” Schiff Say on Friday.

Tags in this story

What do you think of the US inflation rate rising at a rate that has never been seen since 1982? Please tell us your thoughts on this topic in the comments section below.

Image Source: Shutterstock, Pixabay, Wikimedia Commons

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link