[ad_1]

According to reports, e-commerce giant Amazon recently invested in a part of the sports trading card market called Dibbs. The platform is built on the Wax blockchain and allows users to buy and sell some collection trading cards. The report further added that the financial terms of Amazon’s support for Dibbs have not been disclosed.

Report reveals that Amazon has entered the field of digital collectibles

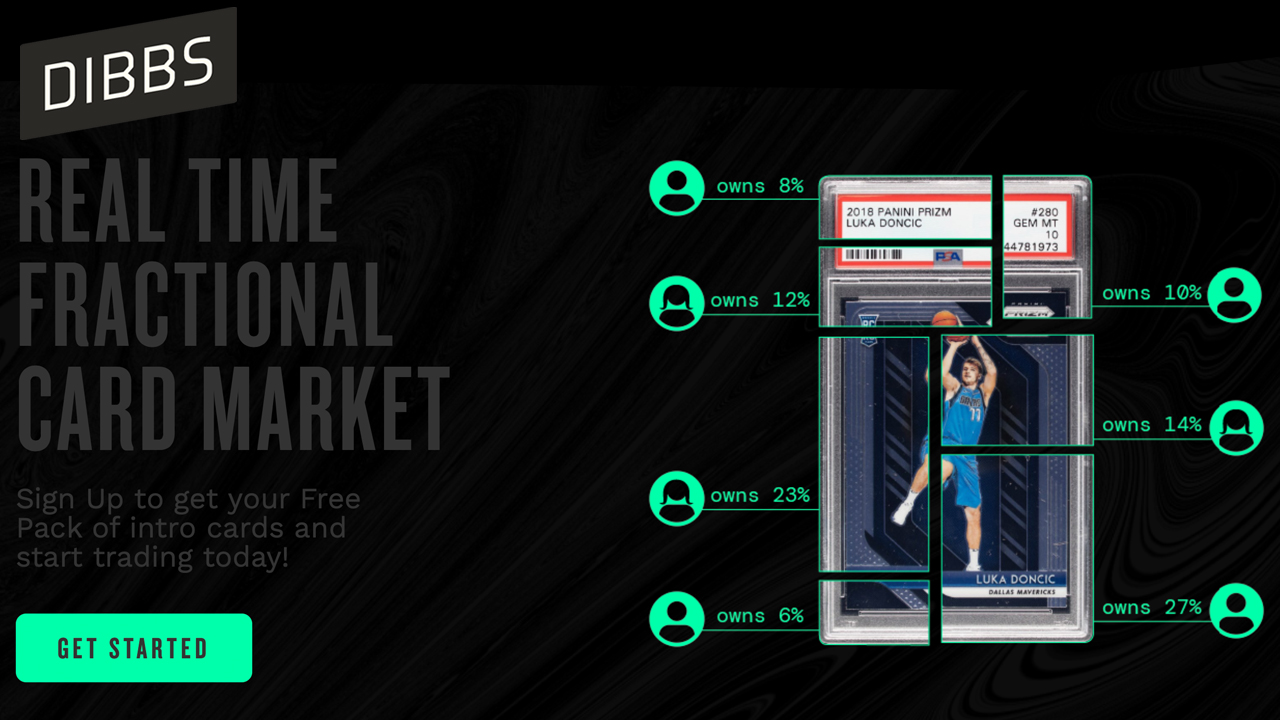

Non-fungible token (NFT) assets and digital collectibles have gathered a lot of momentum in 2021, and it seems that everyone wants to take a share in this multi-billion-dollar industry.just Disclosed report An online marketplace where Amazon invests in trading card platforms Dibbs“We are pleased to announce that Amazon has entered the collectibles field through investment [Dibbs.io],” the official Wax blockchain Twitter account tweeted on December 8.[Dibbs] It is a real-time score card market using Wax vIRL NFT technology. “

Dibbs was established in 2020. The platform allows members to list their favorite trading cards and cast them into NFTs, which can then be subdivided. Although Amazon’s investment has not yet been made public, the startup raised $16 million in its Series A financing in July. Investors in Series A Dibb include athletes like Chris Paul, Channing Frye, DeAndre Hopkins, Kevin Love, Kris Bryant and Skylar Diggins-Smith. In addition, the A series in July also received support from Foundry Group and Tusk Venture Partners.

The company officially launched a market called “Sell with Dibbs”, which allows owners to sell their collections and price and subdivide products. Dibbs founder and CEO Evan Vandenberg explained that NFTs and digital collectibles in general make the collectibles market more accessible. “For a long time, the collectibles market has been flooded with barriers to entry, making it difficult and unfair to enter,” Vandenberg Say In a statement in the past week. The Dibbs executive added:

Traditional ownership has the limitations of the emerging metaverse elimination. The transfer of these collections that truly represent personal online roles to the digital realm is critical to the future of ownership and identity.

Dibbs looks at other types of digital collections, and subdividing collections will become a major event in 2021

The Dibbs CEO also pointed out that cards are not the only focus of his startup, and the company is also considering switching to other channels. “The card is one thing we do, but it is one thing,” Van den Berg commented. “This can be much bigger than a card.” In addition to the Dibbs concept, Grade NFT It has become an important trend of exponential growth.Blockchain projects that have made progress in some NFTs include such as Otis, CIS, Fraction, and Daofi.

The Cryptopunk collection has been subdivided And the famous Doge NFT. Last week, the Ross Ulbricht Genesis NFT series raised more than $6 million in auctions and collections Will be broken into pieces And divided among the members of the Decentralized Autonomous Organization (DAO).

Tags in this story

According to reports, what do you think of Amazon’s investment in a fragmented NFT trading card platform built on the Wax blockchain called Dibbs? Please tell us your thoughts on this topic in the comments section below.

Image Source: Shutterstock, Pixabay, Wiki Commons, Dibbs, Amazon,

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link