[ad_1]

Many people may think that money management is a boring subject, on the same level as accounting, but practitioners usually wear better suits.

If you think so, you admit that you don’t understand one of the important reasons why the rich keep getting richer. Specifically: Asset managers are twice as likely to become billionaires as technicians. During the period when economists were studying the causes of the “long-term stagnation” after the financial crisis, many papers, even one by the International Monetary Fund, concluded that the overdevelopment of the financial sector is the main part of the problem. The asset management industry is the biggest loss of resources.

A new paper by the retired chairman of EnnisKnupp and former editor of Financial Analyst Magazine. Richard Ennis. Provides a window to understand how these results are produced. We have embedded it at the end of this article.

Ennis evaluated the performance of large US endowments over the past 47 years. Endowments are important because they are considered the best and smartest among the big investors. For example, the Harvard Business School Finance Professor Josh Lerner (Josh Lerner) described endowments as investors to imitate in a speech to CalPERS, and pointed out that their performance in private equity is much better than public pension funds. , In order to prove that the endowment fund has excellent acumen.

Ennis’ analysis paints an extremely unflattering picture. One way to summarize it is that the employees of the endowment fund and their external managers add negative values, or in financial terms, negative alpha. Please note that Ennis’s estimate is charitable because he did not add the costs of the endowment fund investment office, which accounted for 0.50% to 0.75% of the assets. The most important thing is that all their tricks, well, diversified exercises have not yielded any results. Their results are functionally the same as investing entirely in U.S. stocks. From his overview:

For the 13 years ending June 30, 2021, the endowment fund’s performance has lagged by 2.5% each year. I estimate that the annual investment cost of the endowment fund is approximately 2.6% of the asset value. Given the extreme diversification of this portfolio, which includes more than 100 large endowment funds, each with an average of more than 100 investment managers, we have every reason to believe that cost is the main reason for the underperformance of endowment funds. In the last 5 to 7 years, what I call the modern era, the effective exposure of endowment funds to US stocks accounted for 97% of the asset value, and frictional cash accounted for 3%. The massive investment in the US stock market has raised important strategic issues related to the risk tolerance and diversification of trustees and fund managers.

He later elaborated on his methodology:

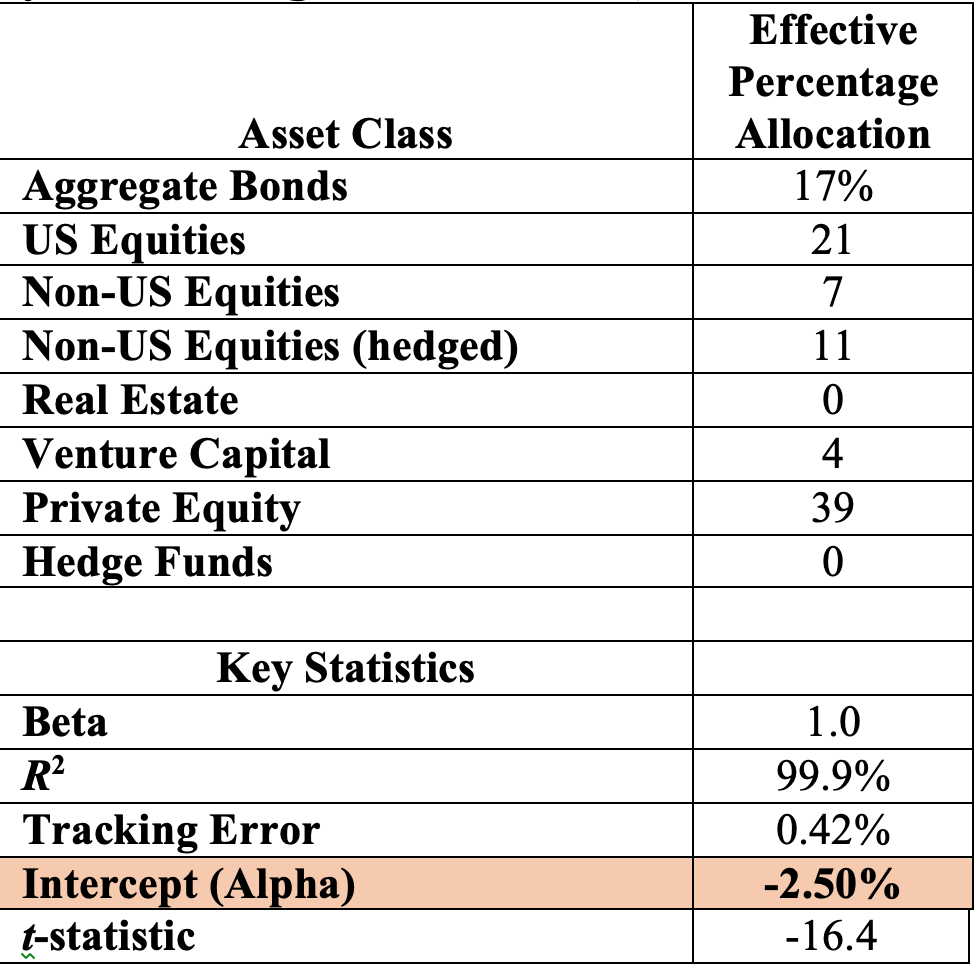

Exhibit 10 shows the results of the regression of the composite return on a benchmark composed of 97% of US stocks and 3% of investment grade bonds for the six years ending June 30, 2021. The beta coefficient of this comprehensive return relative to the benchmark is 1.0 and R2 0.998 (tracking error is 0.8%). Figure 10 also shows that the intercept (alpha) is -4.2%. In other words, in terms of its volatility in the modern era, the volatility of the composite index is like the total amount of US stock market index funds (3% friction cash), but the annual performance is 4.2% lower than such a portfolio.

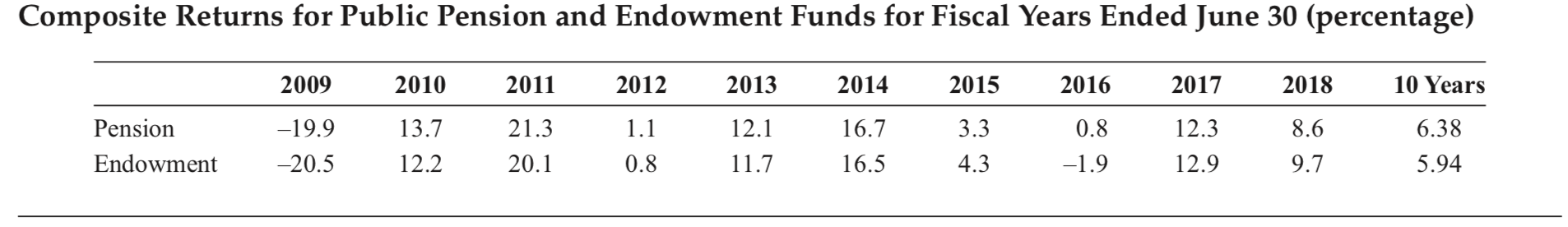

Please note that Ennis reached a similar negative conclusion on the endometrial results In an earlier paper researching the ten years ending June 30, 2018:

What’s more surprising is that endowment funds only get returns in the stock market and the brain suffers more damage is that their commitment to private equity is very high. Heck, shouldn’t private equity provide performance that other investment strategies can’t match? The following table covers the 13 years ending June 30, 2021:

For those who follow Oxford University professor Ludovic Phalippou, this result is stale. As we wrote in 2018:

With more and more funds chasing an incomparably expanded area of ??trading, the premise that private equity will return better than public stocks has been shattered. Since the early 2000s, the share of private equity in the global stock market has more than doubled. Although the level of “dry powder” of private equity funds has reached a record high, which means promised but unused cash, more and more investors are investing in this strategy out of desperation to obtain higher returns.

We also point out that trustees like CalPERS continue to be fanatically loyal to private equity, even though its own indicators indicate that the return of private equity in the past decade is not sufficient to justify its additional risk.

Oxford University professor Ludovic Phalippou is one of the few scholars who are not interested in private equity. His recent work paints a more severe picture of the performance of the private equity industry since 2006. As stated in the Financial Times, Phalippou used his description to determine that as a conservative (meaning that the private equity industry favors) assumptions, the private equity industry only matches the S&P 500 index. This is particularly annoying because, as we have repeatedly described in past posts, the use of the S&P 500 is a compliment to private equity because its average company size is much larger than the typical private equity portfolio company size , So you would expect a higher growth rate. For novices, don’t forget that the rule of thumb is that private equity should be 300 basis points (3%) higher than the relevant public equity benchmark…

In fact, if you read Phalippou’s blog post, which describes his analysis in more detail, he does stoop back for fairness, and it can be said to be fairer for private equity managers.

Ennis came to a similar conclusion in his study of the 2018 results. As we reviewed:

The performance of educational endowments is even worse than that of public pension funds because of their higher level of commitment to “alternative” investments such as private equity and real estate. Ennis explained that these types of investments will only lead to “over-diversification.” Since 2009, they have been so relevant to the stock and bond markets that they have not added value to the portfolio.

We’ve said that Buffett explained this more than once His analogy to the Gorlock family, Owns all American companies. Everything is fine, until some helpers show up and persuade some family members to try to surpass their relatives… of course there is a fee. They have gone through more and more iterations… first transactions and incurring transaction fees, then hiring fund managers, then hiring consultants, and then “super helpers” for private equity and hedge funds, claiming that they can get paid Do better and more.

As a result, according to Buffett:

This is where we are today: a record portion of the income will go to the owners — if they all just stay in the rocking chair — now it will flow to the ever-expanding army of helpers. Particularly expensive is the recent pandemic of profit arrangements. According to this arrangement, when assistants are smart or lucky, they will receive most of the bonus, and when assistants are stupid or unlucky, let family members bear all the losses—— And a huge fixed fee to start (or occasionally bend). There were enough arrangements like this-the head, the assistant took most of the bonus; the tail, the Gotrocks lost the privilege of doing so and paid a high price for it-perhaps more accurately called the family Hadrocks.

But, of course, the mistake of trustees such as endowment funds and public pension funds is to treat them as businesses trying to get the best results for the beneficiaries. If so, they will put their assets in a relatively small number of index funds and enjoy a simpler life and higher returns. But money management is about avoiding debt, which means completing asset allocation, manager due diligence, selection, and continuous review. As more complicated circumstances justify higher rewards, the whole system is another self-licking ice cream cone.

[ad_2]

Source link