[ad_1]

This article is a live version of Martin Sandbu’s free lunch newsletter.register here Send the newsletter directly to your inbox every Thursday

When the coronavirus hits us, it seems that a pandemic might trigger The politics of “we are all together” ——This is the motivation for the rhetoric of “rebuild better.”But this kind of politics is always accompanied by challenges Economy The forces unleashed by the pandemic may have the opposite effect, exacerbating the inequality that has increased in the past four years. At least, this is what many observers worry about, including me.

So what is inequality?The latest issue this week World Inequality Report Published-a huge database of information, drawing on the latest discoveries World Inequality Database (width).

It pointed out that there is evidence that the embargo has more severe effects on low-income workers than high-income workers. Although the rich can increase savings, the poor often have to reduce savings or their own debt. But it emphasized that it is still too early. Part of the reason is that the income distribution data takes time to arrive. But this is also because the governments of rich countries have taken on huge deficits to cushion the blow-the overall result of inequality depends on how the new debt is handled in the future. Historical evidence shows that Premature fiscal austerity increases inequality.

There are many– a lot of -More reports on current inequality, even if the impact of Covid-19 is elusive. Among the rich choices, the following three findings made me particularly interesting.

First, compared with the previous year, global inequality (between countries) is fairly stable in 2020-but this has prevented the downward trend in inequality since the early 2000s.

Second, global personal wealth inequality increased last year. The share of global wealth owned by global billionaires increased by half (from 2.2% to 3.3%), while the share of global wealth held by the richest 0.01% increased by approximately one percentage point ( From 10.3% to 11.1%). At the same time, in the United States and Europe, the wealth of the broader top 1% has remained stable, so the winners with increased wealth inequality are extremely concentrated at the top.

Third, Europe is the most equal continent. Whether measured in terms of income inequality, wealth inequality, or personal carbon emission inequality, WID’s data are fascinating and important. (They show that middle-income people in rich countries emit less than the top 10% in some poorer regions.)

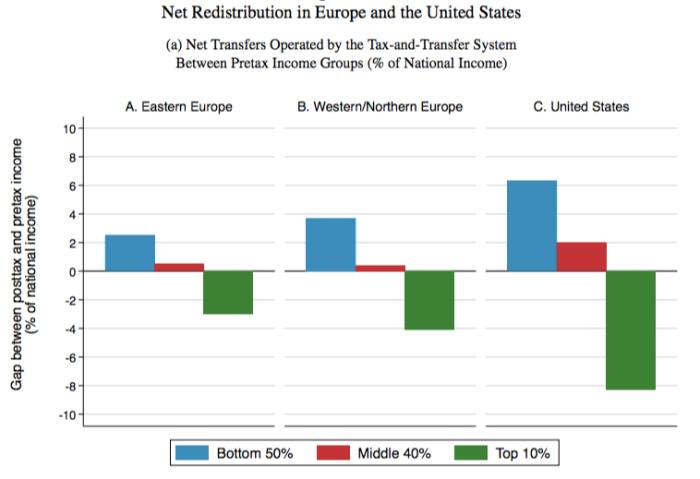

What makes Europe more equal than the United States? Many people think this is because European governments tax and redistribute more than Washington and the US governments.But in the just published Paper (With good Twitter thread summary For those who don’t have time to read), Thomas Blanchet, Lucas Chancel, and Amory Gethin show that this is wrong. What makes Europe the most equal continent in the world is not redistribution, but “pre-distribution”—that is, it distributes rewards more equally in the market itself. forward The government transfers any funds from high-income earners to low-income earners.

I have done About this in northern Europe In the past. People are surprised to find that the prestigious equality of these economies is not due to redistribution—they behave roughly in the same way as other Western European countries—but because market returns have been more equal from the start. I illustrate this by comparing the distribution of income transferred before and after tax.

Facts have proved that compared with the United States, this applies to Europe in a wider range. This is not obvious by simply looking at pre-tax and after-tax income. In contrast, Blancchet, Chancel, and Gethin used a more sophisticated method called distributed national accounts. As the name suggests, it uses the concept of national income accounting to distribute everything produced in the economy during the year—including those that do not appear on anyone’s payroll, such as the company’s undistributed profits—to some beneficiaries. (For example, it makes sense to attribute undistributed profits to shareholders.)

By doing this, two things will become clear. Compared with European countries, the pre-tax income distribution in the United States is even more uneven. This may not be surprising, but the difference is more obvious than we thought.But the U.S. tax system is actually more Advanced than Europe: “[A]After accounting for all taxes and transfers, the United States seems to redistribute more national income to the poorest 50% than any European country. One of the reasons is that Europe uses more indirect taxes, such as value-added taxes, which are not as progressive as direct taxes.

Europe’s relative success in extending prosperity to all is the result of creating an economy that reduces inequality before taxes and transfers. This is not to say that government taxes and expenditures do not contribute to equality-what Europe proves is that it takes effort to create an economy that provides opportunities for all. For example, even if inequality is not reduced in arithmetic (because they benefit roughly the same for everyone), large public expenditures on services also play an important role. On the contrary, mere redistribution will not have much impact on very skewed market opportunities. The prosperity of all people needs to repair the market, not just compensate for the result of the market.

This brings us back to taxation, because public services need to be funded. Since one thing we do know is that overall wealth and wealth inequality seem to have increased during the pandemic, it is natural to think that high wealth is a good tax base.Resolution Foundation, in a new reportPointed out that the £3 trillion windfall gained by homeowners in the UK over the past 20 years due to rising house prices (accounting for one-fifth of the country’s total private wealth) was “unequal, unearned and untaxed”, and explored Options for taxing it. The World Inequality Report estimates that imposing a moderate net wealth tax on the top 1% of wealth owners in the world can increase global income by 1.6%. The debate on wealth tax will only become more intense.

Other readability

-

The EU has initiated a response to China’s large-scale “Belt and Road” infrastructure projects. My point of view This is a step in the right direction, but it requires more ambition.

-

There are indications that, as we suggested last week, The German government’s goal is to make both domestic with European Fiscal rules allow more public investment.

-

We also noticed New economic thinking In President Joe Biden’s White House, I think this is gradual supply-side economics.This week, the U.S. Treasury Department presented a new example speech Regarding how wages have stagnated due to insufficient competition among employers, economists call it a monopoly.

Digital news

-

Can higher wages bring about productivity growth?A sort of New survey The leading economists in the United States indicate that most people believe this may be true under certain circumstances, but are skeptical about the government’s ability to take advantage of such situations.

[ad_2]

Source link