[ad_1]

source: JPMorgan

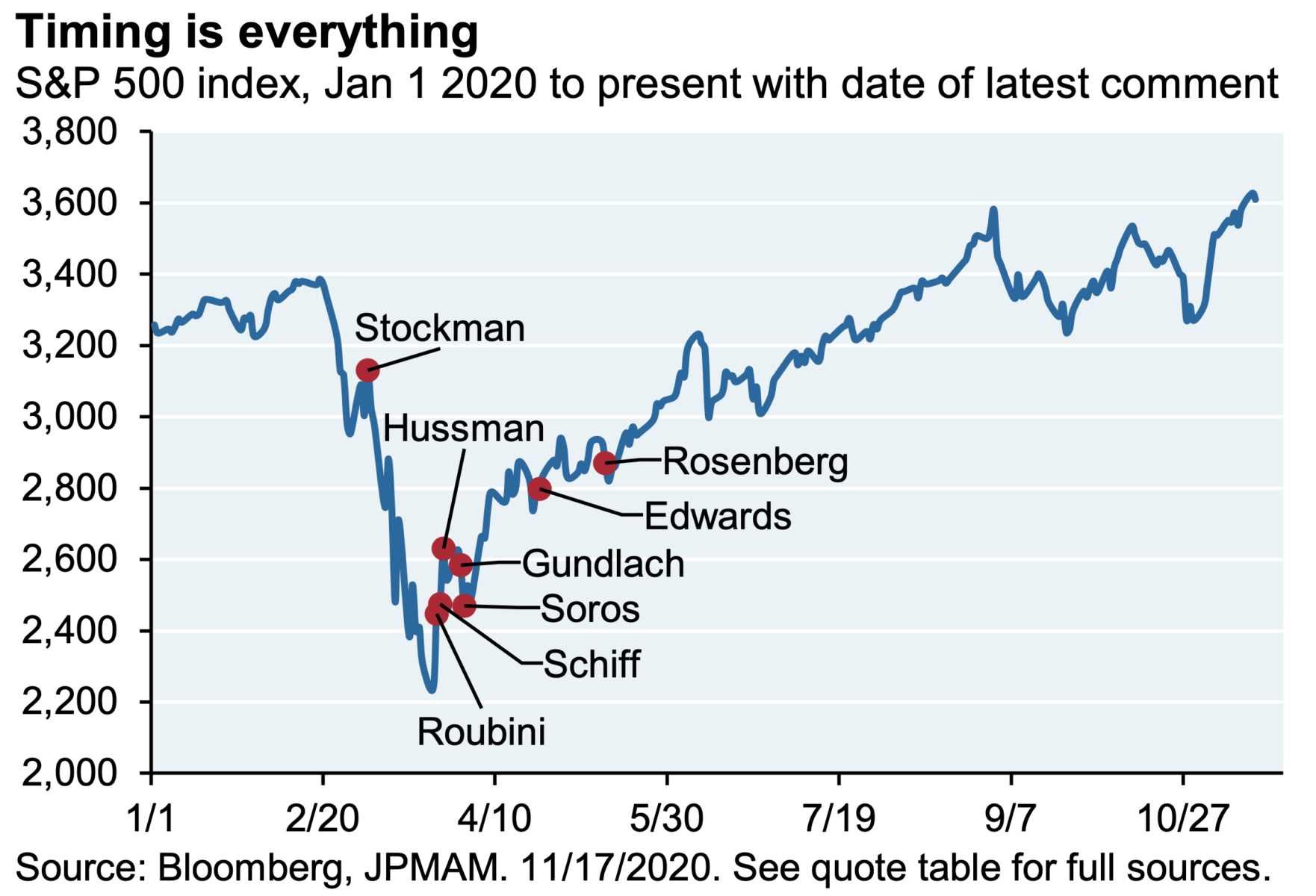

I keep saving this table with chart Since Michael Cembalest Published by JPMorgan Chase November 2020.because it is That Time of year, I think it’s worth reminding you something about experts and year-end forecasts, and all other noise that is usually unhelpful.

1. Agenda: Everyone has their own plan. Whether it’s selling their consulting services, ETFs or IPOs, or clicking on their ads, authority figures always want something from you.

Me too: I have a Wealth Management Company, So I want your portfolio; I host one podcast, So I want you to listen; I wrote books with List with Blog So I hope you read them carefully. But not everyone’s agenda is clearly disclosed. When people argue for or against any particular investment idea, be aware of what they might want from you.

2. Your goal: You should think for yourself and don’t imitate any extreme: ministers or billionaires without portfolios or other people whose financial needs are very different from yours. Billionaires are protecting their wealth and leaving a legacy; your needs may be very different from their needs.1 Recognize this and adjust accordingly.

3. Narrate carefully: One of the strangest aspects of this is the ever-changing storyline surrounding the characters in various conversations.My favorite work in this area is Josh’s discussion of Joe GranvilleThe modern version has always been a strict censorship of ARK’s Cathie Wood by the media. In 2020, the narrative is that Wood is a prophet, a person who can’t do anything wrong; 2021 reveals a new story: she was only lucky the previous year.

as always the truth Far more subtle and complicated than these two statements. Wood runs a concentrated portfolio of highly volatile innovative technology companies. When they are favored, they perform very well; when they fall out of favor, they lag seriously. Compared with 1) her “magic crystal ball” and 2) “suddenly broken”, this nuance is a less interesting media story.

4. Fashion: Authorities enter and exit fashion, just like fashion. The skirts rise and fall, the colors come and go, and the styles are constantly changing. The apparel industry changes fashion to prompt consumers to make new purchases to update their wardrobes. The media see the rise and fall of certain authority figures for the same reason: fresh meat is always needed to feed the daily beasts.

5. Attribution on header: I find it very helpful to build a stable person I can rely on. They have a long-term record of “providing light” instead of heat; they come up with interesting ideas in smart ways and force me to think in ways that other ways might not.The list of these people I made is long, but you can find most of the people I depend on and value most Weibo Or work with me at RWM.

You should create your own list—not just people you agree with, but people whose track record and communication skills really add value. They should inform and irritate you and make you rethink your own assumptions. If they allow you to clarify your thoughts and sharpen your arguments, then they may be worthy of your list.

~~~

On Monday I mentioned that this is “most predict Time of year,” But in fact, this is an issue that deserves attention throughout the year. Whether you are bullish or bearish, there is an expert waiting to satisfy your confirmation bias. Instead, find a better way to make smart and insightful Of people inform your worldview while still maintaining your own independent thinking.

Before:

Unofficial Authoritative English Translation Guide (June 29, 2016)

The halo effect: a bad forecast for billionaires (December 18, 2015)

Why don’t we hold authority figures accountable? (June 11, 2014)

Pundit Suckitude: It is a feature, not a bug. (July 30, 2013)

PermaBear to English Translation Guide (October 15, 2010)

Forecast and forecast discussion

________

1. My favorite example is an article in 2006 that touted Michael Dell’s purchase of $70 million worth of Dell stock. This is the first time he has bought stocks in the company of the same name—he has been selling steadily every year since 1988, and this is how he accumulated 19B dollars in wealth.This is roughly equivalent to an average investor buying 100 shares of Dell stock-for more information, see Dell makes a purchase (wow!).

Doomsday

source: JPMorgan

[ad_2]

Source link