[ad_1]

European Central Bank policymakers are reassessing their level of commitment to additional stimulus measures, reflecting the growing suspicion about how quickly inflation is expected to fall as the Omicron coronavirus variant intensifies concerns about further price increases.

The three recent incidents have cast doubt on some of the European Central Bank’s interest rate setters, who have been predicting that inflation will fall below the target for months, and have justified the continued implementation of large-scale stimulus policies.

The first is that the inflation rate in the Eurozone soared to 4.9% in November, which is far higher than the European Central Bank’s 2% target and the highest record for the euro since its creation 20 years ago.Then there appeared a New coronavirus variants, which one threat To prolong the pandemic and the supply chain bottlenecks that pushed up prices.

Then later last week, the Fed Said It will speed up the end of its bond purchase program to deal with inflation, thereby putting pressure on the European Central Bank to control its asset purchase program.

Before the European Central Bank meeting next week, analysts worried that they would jointly increase the possibility that interest rate makers would “hawkish” shift to exit stimulus earlier than investors expected, thereby increasing the possibility of a sell-off in the euro zone government bond market.

A member of the ECB Management Committee said: “On Omicron, it is clear that it will keep inflation for longer, because the interruption in the supply chain will last longer.”

“The pandemic has changed the structure of the economy, with more household jobs, higher carbon prices, and a shift away from globalization,” the council member continued. “In the medium term, inflation may be higher than our target, and then we will have to take action.”

The central bank is expected to announce at its meeting next Thursday that it will stop buying new bonds in March according to the 1.85 ton emergency plan launched in response to the pandemic. But European Central Bank policymakers may also postpone further decisions on how many bonds they will buy in 2022 until early next year.

“I will feel very uncomfortable to make any promises after the end of the second quarter of next year,” another board member said. “The market will have to accept this.”

The third council member stated that “according to the epidemic situation and new data in the next two weeks”, it is possible to postpone the decision to purchase future bonds.

In the past two years, the European Central Bank has purchased more than 210 million euros of bonds and absorbed more than the total net issuance of the euro zone government to keep borrowing costs low.

However, UniCredit analysts have calculated that this situation may change next year, although governments in the euro zone are expected to reduce debt unless the central bank doubles the number of bonds purchased under its earlier asset purchase plan from April to the end of the year. 40 billion euros per month in 2022.

Compared with other central banks that plan to stop asset purchases soon (including the Federal Reserve and the Bank of England), the European Central Bank will continue to purchase bonds on a large scale next year, which will be an important outlier. The Bank of Canada has already done so.

Two members of the Council of the European Central Bank said that more and more people agreed that increasing monthly asset purchase flows would provide little additional benefit in terms of pushing up inflation. “It doesn’t make sense to expand the asset purchase plan after March,” said one person.

Analysts believe that the European Central Bank may promise to purchase additional bond “envelopes” after March next year. But they said that their decision is complicated because they are almost certain to raise their 2022 inflation forecast to well above 2% next week, which makes the commitment to continue buying large amounts of bonds more difficult to prove.

Frederik Ducrozet, a strategist at Pictet Wealth Management, said: “The upside surprise in inflation is quite big, and the revision to the ECB’s 2022 forecast will be the highest in the history of these forecasts.” He expects the central bank to raise its inflation forecast for next year from 1.7% to 2.7%.

Reinhard Cluse, an economist at UBS, said: “Given the very different pressures on its inflation task, the upcoming meeting may be one of the most difficult meetings of the management committee in the near future. He added that the government bonds of peripheral countries in southern Europe “seem to be vulnerable to changes in the ECB’s communication.”

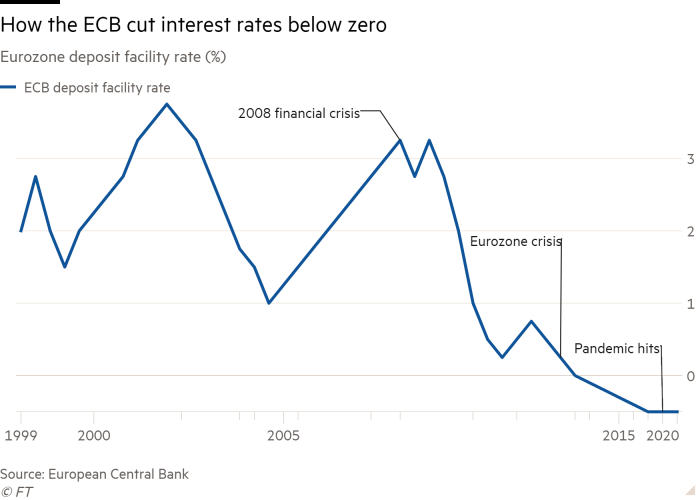

Christine Lagarde, President of the European Central Bank Said Last week, the bank was “very unlikely” to raise its deposit interest rate from minus 0.5% next year because it still expects inflation to fall below its target by 2023.

Despite Lagarde’s comments, the market still expects the European Central Bank to raise interest rates by 0.1% at the end of next year, despite investors betting on two interest rate hikes in 2022 a month ago.

ING interest rate strategist Antoine Bouvet said: “They put too much pressure on this information, so that it finally got passed.” “The reason why it is so difficult, partly because the Federal Reserve, its influence penetrates into the euro zone interest rate pricing. “

The European Central Bank has promised not to raise interest rates until it stops asset purchases. Economists say this is unlikely before 2023, even if it continues to reinvest the proceeds from maturing bonds for a long time thereafter. Allianz economist Katharina Utermöhl said: “They may complete the asset purchase in the middle of 2023, and then it is feasible to raise interest rates for the first time at the end of 2023.”

[ad_2]

Source link