[ad_1]

Cryptocurrency exchange It is an online platform where you can trade (buy and sell) between cryptocurrencies based on actual market prices. In order to value cryptocurrencies, investors and market participants determine demand and supply. This is similar to the concept of a stock exchange that buys and sells company stocks.

By using a cryptocurrency exchange, one can buy cryptocurrency and sell it for profit when the price rises. The key is to enter and exit the market at the right time. Just like traditional stock exchanges, cryptocurrency exchanges also involve transaction fees levied on transactions conducted by traders. In this article, we will introduce the types of fees charged by the exchange, which is very important for investors to understand.

Cryptocurrency transactions usually involve three types of transaction fees. Investors are advised to understand them.

Exchange fee

This is the first type of fee that investors need to pay attention to when using the exchange. Exchange fees are fees charged by the exchange to complete a user’s buy or sell order. Although most exchanges charge a fixed fee, smart investors must research the exchanges with the lowest fees on their own to save the ultimate cost of trading.

Another aspect of crypto exchange fees is the Maker-Taker fee model. In this model, Maker is a trader who uses limit orders to provide liquidity to the order book, while Taker is a trader who uses market orders to take away liquidity. As a reward for participating in the order book, Maker fees are often cheaper than Taker fees. In addition, in his model, the exchange also incentivizes traders with larger trading volumes.

Transaction fees are the main source of income for cryptocurrency exchanges and are still an integral part of their business practices and existence.

Related Reading | Cryptowisser publishes report on lowest transaction fees

network fee

Network fees may be what makes encryption so unique and legitimizes it as a reliable and energy-efficient store of value. Any cryptocurrency network runs with the support of miners to complete the work they do. Crypto miners are individuals or groups that use powerful computers to verify and verify transactions by checking that the token has not been spent twice and that all transactions are real-time and authentic. This makes mining cryptocurrency a lucrative source of income and is becoming more and more popular all over the world.

Only when investors transfer their cryptocurrency between exchanges and wallets, network fees will be collected from investors and paid directly to miners.

It should be noted here that the exchange cannot directly control the network fees, but directly pays to the miners/validators of the encrypted network for the work they do. When the network becomes very busy and congested, the network cost can increase according to demand.

Related Reading | The Bitcoin Mining Museum opened in Venezuela. Is this the first time in history?

Cryptocurrency wallet fees

The cryptocurrency is stored in a digital wallet. It is like an online bank account where users can safely store their cryptocurrency. A cryptocurrency wallet allows to store, send and receive cryptocurrency. Generally speaking, wallets do not charge any fees for the deposit and storage of cryptocurrencies, but charge fees for withdrawals from the wallet, which are basically network fees. Most wallets are very advanced and even allow the systematic purchase of cryptocurrencies. Some wallets also integrate merchant gateways that interact with real-world applications.

All exchanges provide a built-in wallet where users can store their cryptocurrency in one place without paying storage and deposit fees.

Related Reading | Wallet: How to store, send and receive cryptocurrency

In general, transaction fees and charges play an important role in the operation of the financial and investment services sector. The collected funds are very important to these companies, which enable traders and institutions to invest in cryptocurrencies in the comfort of their homes and offices by simply clicking a button on a digital online platform. These services are operated by a dedicated team of professionals and are at the forefront of the fintech revolution that is slowly replacing traditional financial institutions.A list of all cryptocurrency exchanges listed by level can be found here.

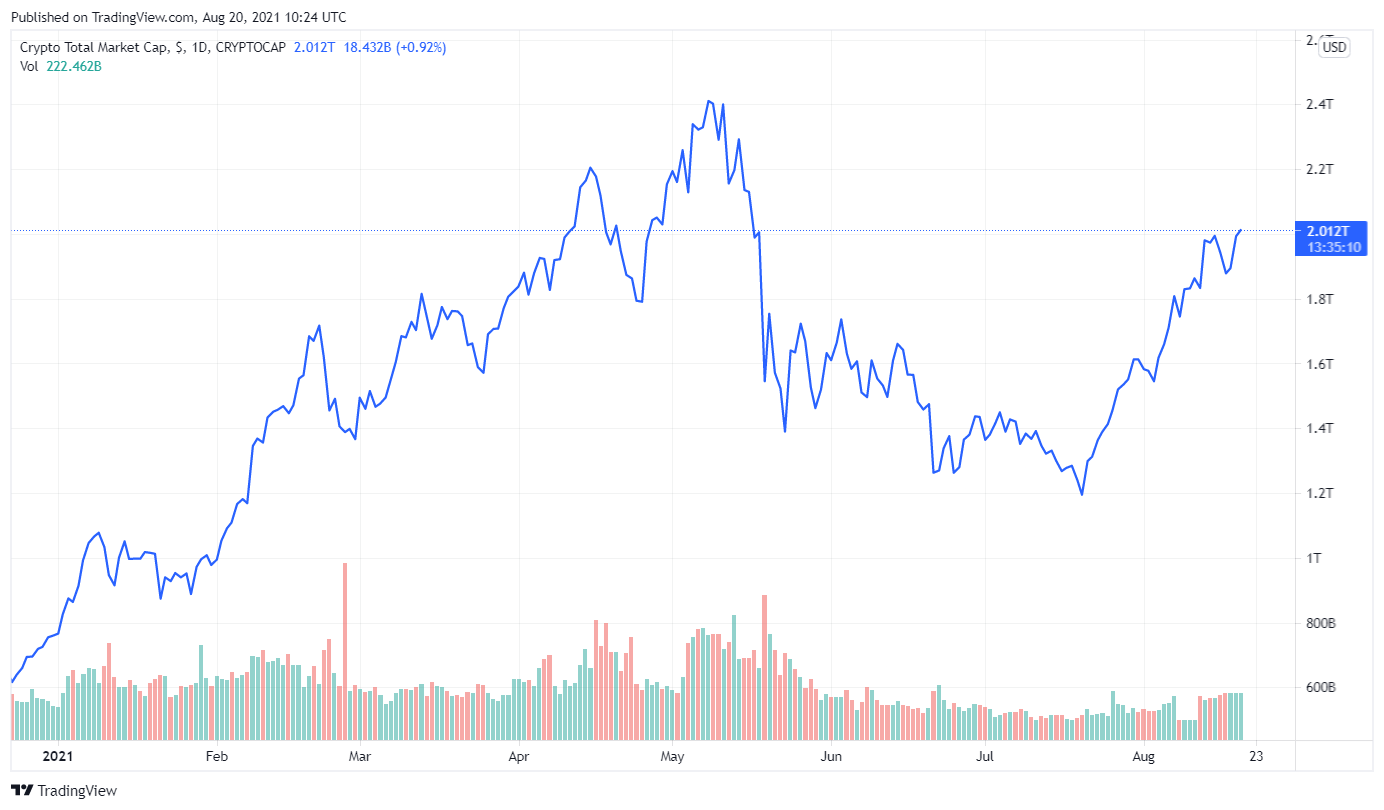

Featured image from iStockPhoto, Charts from TradingView.com

[ad_2]

Source link