[ad_1]

Should the central bank take some measures against inequality, and if so, what should it do?This has become a hot topic, prompting the Bank for International Settlements in its latest annual reportIts conclusion is what people expect: monetary policy is neither the main cause of inequality nor the solution to inequality. Broadly speaking, this is correct. But in a world where central bankers have become such radical actors, this may not be enough.

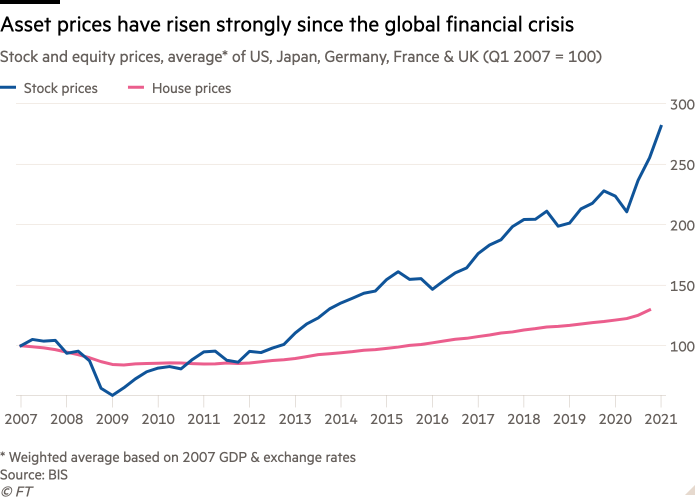

An astonishing fact that the Bank for International Settlements has noticed is that since its so-called “Great Financial Crisis,” central bank governors have mentioned soaring inequality in their speeches. To a certain extent, this reflects political concerns about inequality. But it also reflects a specific criticism. In the words of the report, this is that “the central bank has deployed policies characterized by extremely low interest rates and extensive use of balance sheets to support economic activity and reduce unemployment. The actions of high asset prices mainly benefit the wealthy.”This criticism is Popular among conservatives who hate radical central banks(See chart.)

However, some people have made the opposite criticism, accusing the central bank of not being active enough. People in this camp believe that failure is too passive, keeping inflation too low and the labor market too weak. At present, the central banks of various countries, and even the European Central Bank, are far closer to this position, rather than a more conservative position. One might assert that the central bank has become more than just a little “awakening.”

This is an important debate related to the legitimacy and consequences of the central bank’s actions, especially in this era of crisis. The views of BIS itself are threefold. First, the increase in inequality since 1980 is “mainly due to structural factors, far beyond the scope of monetary policy, and it is best to resolve it through fiscal and structural policies”. Second, by fulfilling its monetary responsibilities, the central bank can reduce the short-term impact of inflation, financial crises, and undoubtedly actual shocks (such as epidemics) on economic welfare. Finally, the central bank can also resolve inequality through good prudential supervision, promoting financial development and inclusiveness, and ensuring safe and effective payments.

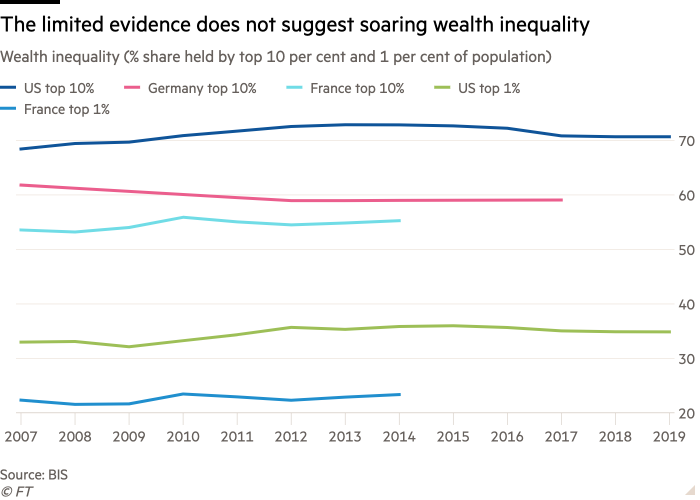

For now, all of this is wise. For example, it is clear that falling real interest rates and loose monetary policy tend to raise asset prices, benefiting the wealthiest. However, it is interesting that the impact on the measurement of wealth inequality is not as dramatic as one might expect. More importantly, it is meaningless to deliberately adopt stricter monetary policies just to reduce asset prices. This will reduce activity and increase unemployment. For those who rely on wages for their livelihoods, this is the worst thing. At the same time, since billionaires are poorer, how will most people with little assets live better? It is crazy for the central bank to cause a plunge in order to reduce asset prices.

The demands of the contemporary dominant “operating economy” raise more relevant concerns. This raises two real (possibly related) dangers: inflation and financial instability.

For the former, supporters of this approach believe that if the economy is not pushed to not only reach or exceed its limits, it is impossible to know where the risk of severe inflation lies. But this may prove costly if, Because I’m a little scared, Inflation soared, and this overshoot proved to be very expensive.

For the latter, it is hoped that complex supervision can curb financial instability, even in the simplest currency environment imaginable. Under ideal supervision, this might be true. But regulation has never been ideal. In addition, it has been easy to identify vulnerabilities, especially in the non-bank financial sector. It is simply high debt. If interest rates remain low, it may be okay. But will they?focus on result, Rather than forecasting, makes this unlikely.

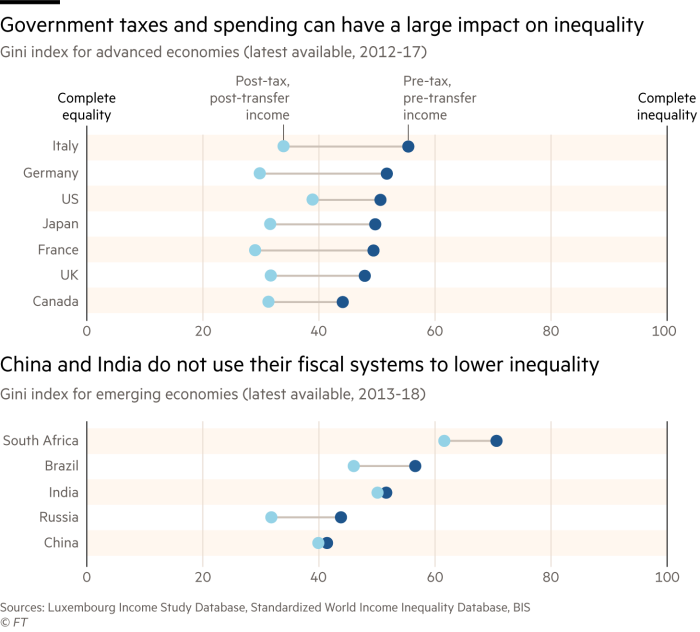

Where BIS is clearly correct is that fiscal and structural policies are the main way to solve the problem of inequality. In fact, some high-income countries use the former in this way to be quite effective. For example, the huge contrast in income inequality between the United States and other high-income countries lies in the relative lack of redistribution in the former. In some large emerging economies, there is almost no redistribution, especially in so-called socialist China.

Structural policy is a more complex issue. In many cases, this is just synonymous with market liberalization. But financial liberalization has undoubtedly increased inequality and financial instability. Therefore, good structural reforms will almost certainly seek to restrict finance. Similarly, in a labor market with a significant monopoly, deregulation of the labor market is likely to be detrimental to employment and inequality. and, Increased inequality It is almost certain that this is a factor in the weakening of structural demand, which explains the characteristics of falling real interest rates and soaring debt in our era.Long-term stagnationFor all these reasons, the structural reforms we should consider are much more difficult than conventional wisdom imagined.

The Bank for International Settlements is correct that monetary policy cannot resolve inequality. It can only aim at macroeconomic stability. Given our long-term dependence on expansionary monetary policy, even this is difficult to achieve. In this case, financial surplus will surely reappear, making supervision an endless “mole” game. The Bank for International Settlements is right to call for thorough structural reforms. But they must be correct structural reforms.

[ad_2]

Source link