[ad_1]

]Texas and 15 other states, as well as Puerto Rico, have sued Google over antitrust abuses in the online advertising market. Late last week, the Southern District of New York released the complaint, the third revised complaint. We have embedded the documentation at the end of the post.

As we’ll discuss, the complaint paints a damning picture of how Google has a monopoly on all key information chokepoints in the online advertising business between publishers and advertisers. As one employee put it, it’s as if Google owns a bank and the New York Stock Exchange, and more so.

Google shamelessly commits fraud; in fact, these violations are so serious that one wonders why the attorney general doesn’t pursue these charges alone.Let’s start with The Wall Street Journal’s summary of one of the Google scams:

New unedited details provide more information about a series of programs Google runs called Project Bernanke, Reservation Price Optimization and Dynamic Revenue Sharing. The Bernanke scheme has been reported before, but the new unredacted complaint shows it had three versions between 2010 and 2019.

According to Google’s allegations, in the first version, Google misled publishers and advertisers into believing they were participating in a “second-price auction” in which the winner paid the second-highest bid when using its ad exchange AdX s price. complain. However, under Google’s Bernanke program, AdX sometimes knocked out the second-highest bid, allowing the third-highest bid to win, depriving publishers of revenue, according to the complaint. At the same time, Google will charge advertisers the second-highest bid and pocket the difference, the complaint said.

The lawsuit alleges that Google pooled overpayments from advertisers and used the money to manipulate auctions on its systems, sometimes raising advertisers’ bids through its ad-buying tools to ensure it could win what it otherwise wouldn’t. auction.

Another interpretation of Bernanke’s plan:

For the extra $9 between bids, Google put in a “pool” that it would use to secretly raise bids for advertisers to use its tools to ensure they always win over advertisers using non-Google tools. pic.twitter.com/gE5O8Yvvbv

— Leah AntiTrustButVer1fy Nylen ? (@leah_nylen) January 14, 2022

Note that I can’t judge the merits of this lawsuit because antitrust enforcement has become so weak and precedent has shifted in favor of the big boys. One of the common ways to successfully muddy the waters in antitrust litigation is by arguing over the definition of the relevant market, e.g. arguing that there is more room for competition, if you define that an evil potential monopoly does not have a dominant share of its market “appropriately”. Platform Law set the context in publishing an earlier version of this complaint, Unedited late October:

This original complaint Submitted in December 2020, echoing findings of numerous competition authorities, including the UK Competition and Markets Authority, French Competition Authority, and the Australian Competition and Consumer Commission (more on this later), all of which have found Google to engage in various competition-distorting leverage tactics using its market power across the ad tech supply chain.Meanwhile, according to reports, the U.S. Department of Justice ready to archive It has filed a lawsuit against Google itself, and the European Commission is Tentative The latter is about its ad tech practice.

As a reminder, since it get After merging with DoubleClick, Google has become the largest ad tech provider in every segment of the value chain, with a market share of 90-100%, and a major publisher (selling ad inventory on properties it owns and operates such as YouTube) ).While most of it is more or less known, the Texas complaint made headlines claiming that when faced with the prospect of Facebook backing a disruptive technology called Header Bidding, Google sees it as “survival” threat”, Google and Facebook reached an agreement. According to the so-called Jedi Blue Under the deal, Facebook will scale back its Header Bidding program in exchange for the privilege of bidding in Google’s auction.

While a significant portion of the original complaint has been redacted, we now have access to the full lawsuit thanks to a U.S. District Court order. Most of the previously edited paragraphs are (pretty juicy) Quotes from internal Google and Facebook documents, and information on Google fees. Therefore, the unredacted complaint does not include any new content in the claims against Google or the damage theory proposed by the United States. Even so, the unredacted lawsuit shows that these injury theories are supported by a fairly extensive set of damning internal documents.Internal evidence is important because it makes it harder for the target of the complaint to make an argument that directly contradicts its internally expressed views time is unquestionable.

You only need to read part of the header of the document to understand the essence of the argument. For example:

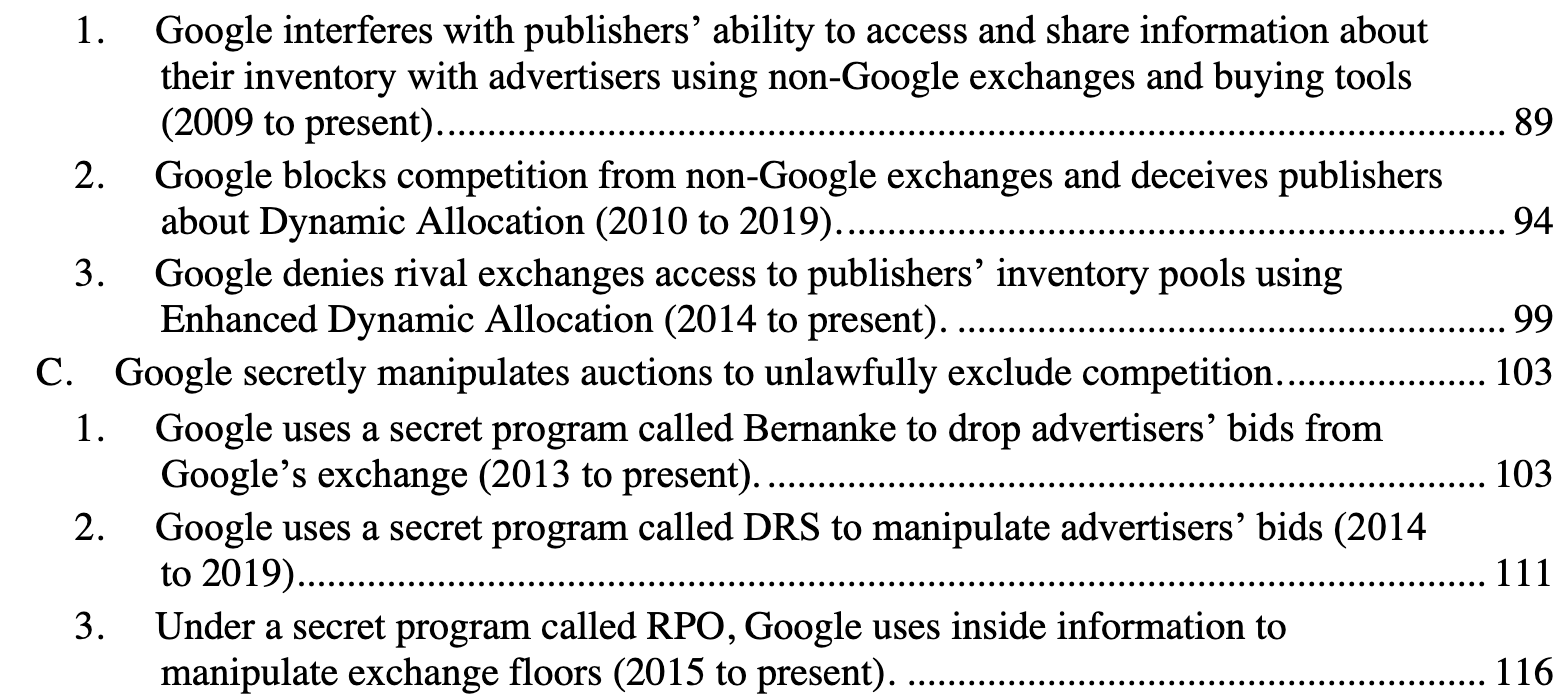

Bad behavior is listed from A to H. It’s just A to C:

AdExchanger description Sordid revelations in the October and January complaint unsealing:

In October, a New York judge unsealed the lawsuit, which revealed a number of interesting details, including Google’s AdX adoption rate (between two and four times that of its closest competitor), Google’s tendency to deliberately slow down Load times for non-AMP ads and more about Jedi Blue, a secret plan with Facebook to kill header bidding…

The new complaint also claims that Google CEO Sundar Pichai and Facebook (nice! Meta) CEO Mark Zuckerberg approved the 2018 Jedi Blue deal, in which Facebook agreed not to create its own header bidding product , in exchange for Google offering Facebook information along with speed and other advantages in the auction.

The rise of head bidding around 2015 posed a huge threat to Google, as it allowed rival exchanges to compete with Google on a more equal footing.

The previously unredacted lawsuit cites an email sent by an unnamed Google executive who wrote that the header bidding threatens to cut Google’s profit margin from 20% to around 5%. to Google’s ability to justify its fees.

Google then allegedly developed a plan to protect its position by forging partnerships and developing software, including an open auction, which allows publishers to route their inventory to multiple exchanges simultaneously.

The whole “Jedi” program was designed to get publishers to stop using header bidding on their own, as Google got its name from playing “Jedi thinking tricks” in the industry.

Platform Law sees Google’s header bidding practices as one of its biggest loopholes, along with the ad deal issues discussed above (new complaints raise more taint) and its hypocrisy about privacy. About header bidding:

In fact, if there is a common theme among the various internal documents cited in the unredacted lawsuit, it is Google’s public positions on various issues are at odds with, or even starkly contradictory to, the views of its own employees and executives…

While it has publicly stated that it does not view Header Bidding as a “threat” to its business, internal documents show that Google views Header Bidding as an “existential threat.” For context, headline bidding was invented by publishers and rival ad tech vendors in response to Google’s preference for its own ad deals, costing publishers real money, as Google employees have admitted internally. With the rise of Header Bidding, Googlers discussed “Options to Mitigate Header Tender Infrastructure Growth. ” When one Google employee proposed the “nuclear option” of reducing Google transaction fees to zero, another employee responded that the problem with price competition is that it’s just “won’t kill HB [header bidding]. ” In response, Google developed its own Header Bidding-like solution, now called Open Bidding (codenamed “Jedi”), which measures its success not by financial goals or increased output, but by preventing publishers from using headers The extent of the bid. However, a senior Google employee commented that Jedi “Serious risk of sub-optimal earnings and negative media coverage for publishers if exposed externally. “

At the same time, Google is wary of the risks of large entrants supporting header bidding…. In response to Facebook’s support for Header Bidding, a Google executive was impressed in the company’s promotional video: “The existential threat posed by Header Bidding and FAN needs to be countered. This is my personal number one priority.If we do nothing, this requires[s] arrive [be] go all out[s] deck approach. “

Google eventually invited Facebook to the negotiating table. According to the lawsuit, Google promised Facebook a set of advantages when bidding in the open (Google would still retain control and charge competitors) in exchange for Facebook scaling back its Header Bidding program. These special terms include speed advantages and helping identify users (which is essential for online ad auctions). Google wrote in an internal document: “FAN needs special deal terms, but it’s worth cementing our value. ” (At the same time, in its web support manager Google states that all auction participants compete “equally”). Any doubts about Google and Facebook’s understanding when they entered into the Jedi Blue agreement (signed by Google’s senior executives Philipp Schindler and Facebook’s Sheryl Sandberg) are dispelled by the internal evidence cited in the complaint. In internal communications, Facebook executives noted that “them [Google] Hope this deal kills header bidding. “

Honestly, I’m not surprised. Online advertising is a cesspool that makes gig economy platforms look good.When Uber caught cheating by showing drivers less total fares than passengers actually paid, it becomes “mumble mumble”, barely correcting this bad practice. By contrast, as a small publisher, I can’t verify anything my ad serving is telling me because I don’t have audit rights. I don’t know how much they looted on top of what I agreed to pay them.

So I was hoping to clean these areas, but I wasn’t holding my breath.

[pdf-embedderurl=”https://wwwnakedcapitalismcom/wp-content/uploads/2022/01/00-20220114_195_0_States-Third-Amended-Complaintpdf”title=”0020220114_195_0_StatesThirdAmendedComplaint”[pdf-embedderurl=”https:https://wwwnakedcapitalismcom/wp-content/uploads/2022/01/00-20220114_195_0_States-Third-Amended-Complaintpdf”title=”0020220114_195_0_StatesThirdAmendedComplaint”[pdf-embedderurl=”https://wwwnakedcapitalismcom/wp-content/uploads/2022/01/00-20220114_195_0_States-Third-Amended-Complaintpdf”title=”0020220114_195_0_States???????”[pdf-embedderurl=”https://wwwnakedcapitalismcom/wp-content/uploads/2022/01/00-20220114_195_0_States-Third-Amended-Complaintpdf”title=”0020220114_195_0_StatesThirdAmendedComplaint”

[ad_2]

Source link