[ad_1]

Daunt Books on Marylebone Street, with its glass ceiling and oak paneled galleries, is one of the most beautiful shops in London. However, during this holiday season, the Edwardian environment is a little less elegant than usual. In some parts of the store, cardboard boxes and piles of unorganized books are placed between the aisles and above the shelves.

Like booksellers all over the UK, Daunt is worried Tighten In the global supply chain, it will not be able to meet customer needs on Christmas Eve. In order to reduce the possibility of shortages, it ordered much more inventory than usual. The storerooms of the chain stores are almost full, and there is nowhere to store inventory.

General Manager Rose Cole warned that by the end of this month, the supply of some of its books may still start to decrease. “More games will not be launched on time,” she said. “this will [get] getting more serious. “

Her worry is right. Further upstream in the supply chain, the bottleneck has developed for several months. Fabrice Holler, chief operating officer of CPI Books, the largest printing company in Europe, said that “the system is under very heavy pressure.”

The problem started near the top of the supply chain, where the supply of raw materials was tight. The paper industry has been in decline for many years, especially because the digitization of books and other widespread media forced factories to close.

According to data from commodity data provider Fastmarkets, in the past five years, the European industry has lost 1.3 million tons or about 20% of its capacity in so-called mechanical grinding, a major production technology.

During the pandemic, the demand for raw materials unexpectedly surged. The e-commerce boom has caused retailers to scramble to buy cardboard, and as people restricted by the lockdown begin to read again, book sales have risen.

Holmen is one of Europe’s largest book paper producers. Its CEO Lars Lundin said that it is still fulfilling its supply agreement, but acknowledged that the Stockholm-based group is taking longer to deliver the paper than earlier this year.

This delay caused problems for the printer. CPI, which accounts for about 40% of the European trade printing market, said that supply difficulties mean that the company now needs three weeks to produce books—much longer than the usual seven days.

Holler said costs have also increased dramatically in the past 6 to 12 months: paper has increased by about 20% to 30%, energy has increased by about 25%, and transportation, glue and plastic packaging have increased by 15%.

He said: “We must pass on the price increase as much as possible,” adding that the printing company has increased the publisher’s price by an average of 5%.

Holler said the demand for paper was so strong that CPI had to limit sales to some customers. He added that Amazon is particularly active in building packaging and book inventories.

The shutdown of paper mills and printing plants is only the beginning. Publishers also need to deal with container shortages, port congestion and lack of truck drivers, which have affected a wide range of consumer industries.

British factories can print ordinary black and white texts, but the country lacks the facilities to import color publications. Therefore, according to publishers and retailers, the risk of shortages is most serious for children, cooking, and gardening products: these products are often popular Christmas gifts.

Karina Stevens, head of operations for children’s publisher Nosy Crow, said that delivery delays are “increasing day by day.” She added that the delivery time from Hong Kong has approximately doubled from the usual five to six weeks.

Smaller publishers especially lack the bargaining power to ensure space on board. Larger companies, especially those with higher stock value, can pay more for these slots.

Stevens said that recently a ship unloaded a container full of Nosy Crow products and headed for Southampton, Singapore. “They actually just unloaded our containers at the Singapore port. We have to wait for the next ship, which is a week later.”

“We tried to advance the date and allow more time. But what we can do is limited… There are some things, such as the closing of the port at the last minute, that you cannot plan.”

Andrew Franklin, the co-founder of Profile Books and publisher of authors such as Francis Fukuyama and Jonathan Dimberby, said: “We currently have some big books on the market. Can we print them out? We don’t know.”

Has had to postpone the release and signing of the new book.

Franklin said that complications related to Brexit have caused problems for both exports and imports. “In the past, it took us a day and a half to ship our books to Ireland. It currently takes 6 to 10 days.”

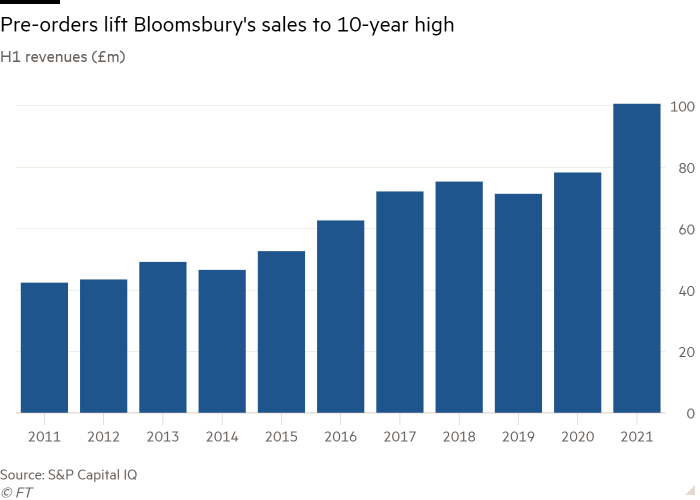

In recent months, retailers such as Daunt are eager to order in advance to boost publishers’ sales: For example, Bloomsbury, which is listed in London, had revenue in the first half of the year. Soar This was an increase of 29% year-on-year, reaching a record 101 million pounds.

However, given the difficulty of balancing supply and demand, the publisher warned that after the holiday season, retailers may return more unsold books than usual. “We see a big gap in the items ordered [by retailers] And things that have been selling,” Franklin added.

At the same time, if consumers want to ensure that they receive the products of their choice in time before Christmas, they are urged to place orders now.

Cole said that so far, Daunt’s customers have not encountered unexpected shortages. But she added: “If you ask me the same question a month later, the situation will be different.”

[ad_2]

Source link