[ad_1]

Economists said that the Bank of England will need to show its plan to control inflation at this week’s monetary policy meeting, after the central bank failed to predict the strength of the rebound in prices and economic growth this year.

Following last week mobile Since the Fed’s forecasts indicate that it may raise interest rates at least a year earlier than previously expected, all eyes this week will be on the Bank of England to see if it will follow suit.

There is increasing pressure from central bank observers and internal requirements for the Bank of England to take a more proactive stance.

George Barkley, chief British economist at Nomura Securities, said that although he does not expect the central bank to take action on Thursday, “the continued sharp rebound in gross domestic product and the unexpected rise in inflation cannot be ignored.”

Philip Shaw, head of Investec’s economic team, said that “the American-style situation may be developing, with inflation rising faster than the central bank predicted.”

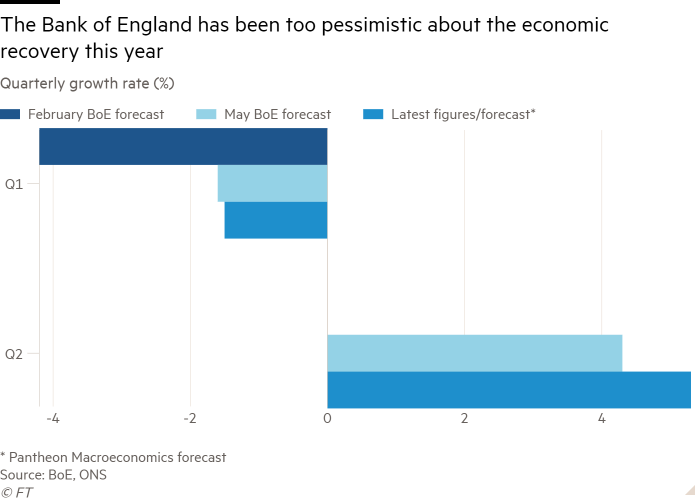

Since the beginning of the pandemic, the Bank of England has not encountered a situation where its assessment of the economy seems to be seriously wrong, but now people are generally aware of the need to revise its views, including within Threadneedle Street.

Andy Haldane, the bank’s outgoing chief economist, wrote an article on The New Statesman earlier this month caveat The inflation outlook is the most dangerous in the past 30 years.

Britain’s inflation rate has jumped from 0.4% in February to 2.1% in May, an increase much higher than the Bank of England’s expectations.bank February forecast It shows that the Monetary Policy Committee expects that the inflation rate will reach around 1.6% by May, and these forecasts were revised up to 1.8% last month. freed Official data from last week.

The Bank of England has repeatedly underestimated inflation, causing financial markets to price medium-term inflation at the highest level since the financial crisis 13 years ago.

UBS’s calculations take into account changes in retail price index measurement in 2030, indicating that financial markets expect the Bank of England’s mid-term inflation target to be more than 1 percentage point higher than its 2% target.

“If it rises further as the economic recovery unfolds, the Monetary Policy Committee will face increasing pressure to persuade the market to firmly control future inflationary pressures,” said John Rice, a strategist at UBS.

However, few people expect the Monetary Policy Committee to make a decisive move at the June meeting that ends on Thursday. Economists almost unanimously predict that the bank will continue its latest round of quantitative easing of 150 billion pounds by the end of 2021, and maintain interest rates at a historically low 0.1%.

The question for many people is whether the Monetary Policy Committee chose to talk about the increasing inflationary pressures it faces this month, or whether it will continue to stick to it.

Deutsche Bank economist Sanjay Raja said that the Bank of England is facing “challenges” from rising inflation, but it is unlikely to change its view that these are “temporary” at the meeting. However, he believes that changes in the outlook should “tilt the policy statement in a slightly stronger hawkish direction than in May”.

Citi’s Christian Schultz added that policymakers need to show some concern so as not to appear complacent. “We expect some other signs of vigilance may appear in the meeting minutes, but the guidance will remain unchanged,” he said.

Most economists now expect a significant overshoot of inflation later this year. But many people agree with the Bank of England officials that prices will be automatically controlled again in 2022, because once the coronavirus vacation program ends, the unemployment rate will rise and spending growth will soon slow down.

Capital Investment’s Thomas Pugh stated that “there is enough spare capacity in the economy to reduce the inflation rate”. Samuel Tombs, a British economist at Pantheon Macroeconomics, said the delay in the eventual reopening of the economy will mean that the recent rapid spending growth will “slow significantly in the summer.”

But the Bank of England will find it difficult to ignore the growing rhetoric about tightening monetary policy, especially as it is examining whether it will seek to raise interest rates or reverse its quantitative easing policy. The Governor of the Bank of England, Andrew Bailey, hinted that he hopes to sell some of the bonds held by banks as soon as possible to reverse the quantitative easing policy.

This has caused financial markets and economists to be uncertain about what will happen to interest rates. Economists expect to raise interest rates for the first time sometime between early 2022 and 2024. Financial markets are betting on the second half of 2022.

BNP Paribas’ Macro Research Manager Chad Barwell said that the unclear intentions of the Bank of England were counterproductive and led to financial markets taking a tougher stance than the central bank might hope. “It is unclear what they want to do and how they will do it. MPC should worry that the market will absorb more interest rate hikes,” he said.

[ad_2]

Source link