[ad_1]

David Splinter (David Splinter) and Gerald Auten (Gerald Auten) made a summary at the Hoover Economic Policy Working Group seminar last week, summarizing their past and income distribution Some work in progress. Associate If the above embedding is invalid.recent paper.Lobes Web page.

Splinter and Auten are both pragmatic economists. I will pass on their facts. The explanation for the grumpy is my own.

A generally accepted fact is that the recent phenomenon of income inequality has greatly increased, and this is a “problem” that needs to be “solved”. So, what if the huge inequality crisis is not established at all? Let us set aside whether income is a good way (no), let us look at the fact that income inequality has increased significantly?

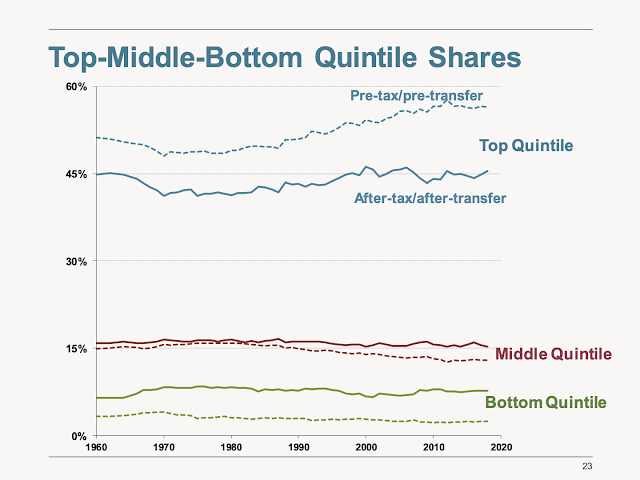

no. This is the title result. Since the 1970s, they have carefully recalculated the figures, and the top 1% share of income has hardly wavered. (By the way, if you think that the economy of the mid-1970s was a great happiness and prosperity that we should strive to rebuild, then you are too young to remember the 1970s.)

Now, we have a deep understanding of how to increase revenue and where Piketty and Saez went wrong. There are some in the video. These papers have more content and are very long back and forth, including comparisons with many other studies. I will give just a few examples.

Ignored income. Piketty Saez missed a lot of income. Auten Splinter attributes all national income to someone. Before 1986, many wealthy people were merged. Ignoring the company’s revenue will cause early stocks to fall. Auten Splinter fixed the problem. Pre-tax and transfer income! Who cares about pre-tax income! Auten Splinter calculates the highest after-tax income-the lower-including the lowest transfer income-income. Demographics. The marriage rate has dropped, so Auten Splinter (Auten Splinter) calculates income on an individual basis. benefit! This includes benefits such as health insurance provided by the employer.

One person can speak, but one person can speak. At the very least, the “facts” that are the cornerstone of political debate are much more uncertain than they seem.

If the rich have not become richer, then the poor have not become poorer:

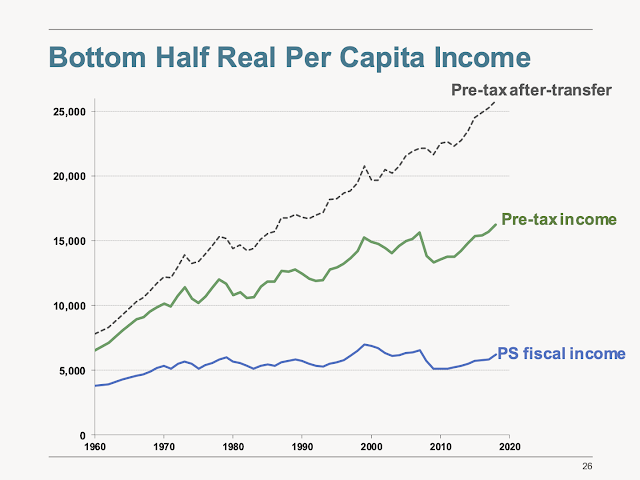

What’s more interesting is let’s go share it Take a look at the second great article of contemporary faith: In the past few decades, has the situation of low-income people really not improved? What are they actual income, Not just their share?

Real income, including everything that Piketty and Saez missed, is increasing. Actual income, including transfer payments, has greatly increased.

Even this can cause misunderstandings, because actual people are different. Today’s low-income earners are different from the low-income earners of 1970. Even if the PS chart is correct, it is wrong to say “the poor become poorer” because they are different people. For example, suppose everyone stays the same throughout their lives, but wages increase faster over time. The poor (young) will become poorer, and the rich (old) will become richer, but yesterday’s poor are today’s rich, and there is no change in the distribution of income throughout the life.That’s not what happened, it’s just a story that explains the confusion

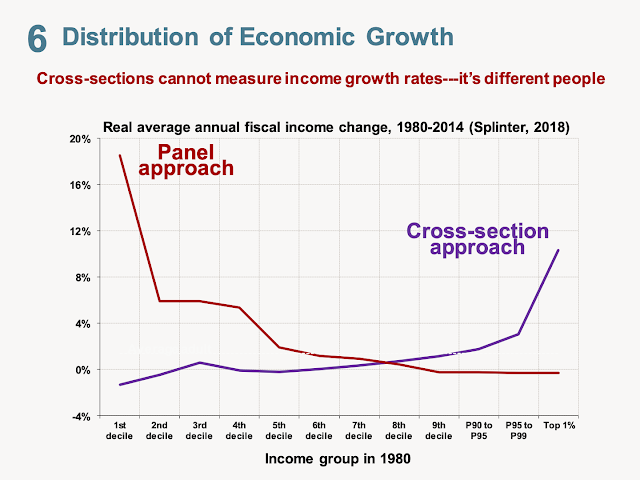

The “cross-section” approach looks at the income growth of each percentile, that is, how far the top 1% of income today differs from the 1% of the highest income in the 1980s. It does look like “the rich get all the benefits.”

But the “panel method” focuses on actual human experience. If you look at the deciles in 1980, how much has their personal income increased over time? We see the opposite pattern. People with very low incomes have seen more growth.

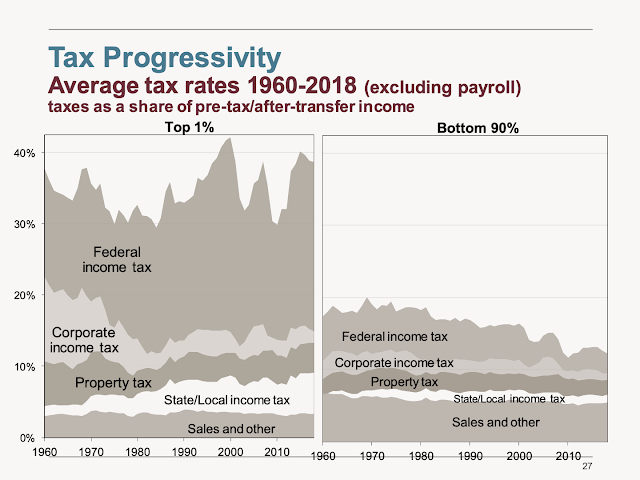

The third article of the current belief, “The rich do not pay their due share, and the taxes they pay are reduced.” In fact, the US tax and transfer system is one of the most advanced in the world.

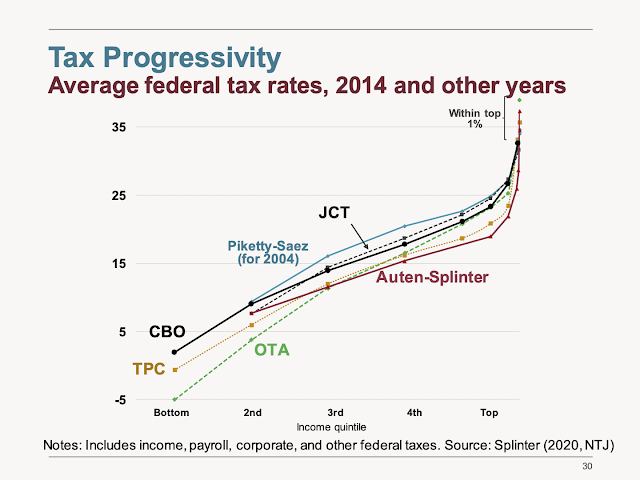

This is a beautiful chart because it correctly includes all taxes, not just the federal income tax.

These are just taxes, including tax credits that generate negative numbers at the bottom. They do not include transfers, which are negative taxes.

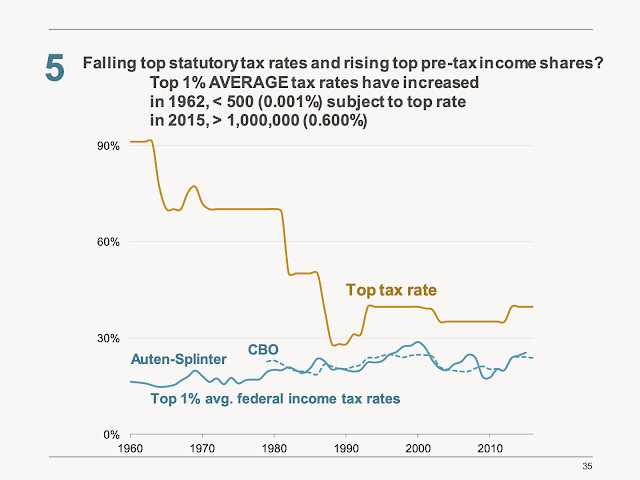

It’s the old days of the 1950s, when we really put it on the rich? It’s also fake.

Even in events such as Hoover donor gatherings, I will be asked “What is the conservative answer to inequality?” My basic answer is that inequality is not a problem. If you think that inequality is a problem, then you think that if Bill Gates is poor by $1,000 and poor by $10, the world will be better. A good explanation for the feeling that “inequality is a problem” is not the unbearable jealousy of the super-rich, but the opportunity barriers faced by low-income people in the United States. Now, we have some issues to discuss and one solvable issue. Let’s start with the cruel public schools among the numerous unions.

But even if you don’t buy every number of Auten and Splinter, you don’t find that the “problem” of increasing inequality is real at the beginning.

Lack of opportunities and obstacles to progress still exist. Even if the situation did not get worse, it was bad enough in the 1970s. Let us begin to study the real problem.

[ad_2]

Source link