[ad_1]

Ive here. Wolff did not set when more shale gas production and LNG shipping and port facilities could be built to fill Europe’s energy gap. However, some readers have raised another potential choke point that I would be interested in sanity checks: those ships carrying LNG. Obviously, the construction of the large spherical storage room is particularly cumbersome. Note that Wolf doesn’t show that type of tanker, so I wonder if the low-hanging design will prevail.

From Wolfricht, Wolf StreetEdit. Originally published on wolf street

There has been a lot of talk about the US supplying more liquefied natural gas (LNG) to Europe to replace a portion (a small portion) of pipeline gas from Russia. Tankers loaded with U.S.-produced LNG are already on the route. But LNG export terminals on the Gulf Coast are nearing capacity, and it will take time to build new liquefaction trains at existing export terminals, build new export terminals and supply pipeline infrastructure. So these ideas, as good as they may be, get complicated very quickly.

The current state of natural gas in the United States.

The United States is the world’s largest consumer of natural gas. For decades, the U.S. didn’t produce enough natural gas to meet demand, so the U.S. imported gas from Canada via pipeline and LNG from other countries. Fracking changed the equation, natural gas production began to soar, and along the way, the United States became the world’s largest producer of natural gas. According to EIA data, U.S. natural gas production hit a record 118.8 billion cubic feet per day in December:

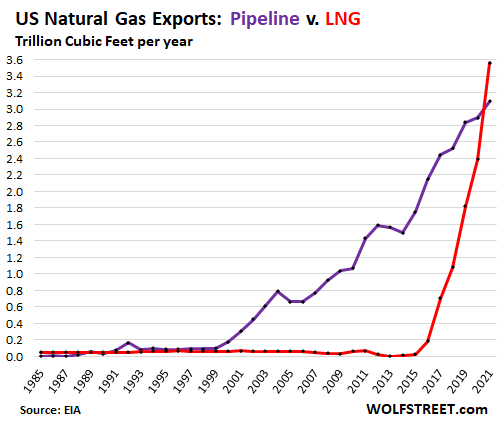

In 2008, the industry tried to find a way out as U.S. natural gas prices plummeted as fracking production surged. The company invested in more pipelines to Mexico, and pipeline gas exports to Mexico increased. The company has invested in large LNG export terminals on the Gulf Coast, the first of which took off in 2016.

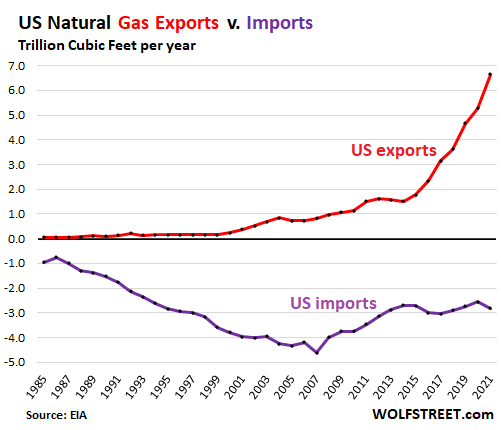

Total natural gas exports via pipeline and LNG (red line) surged 26% in 2021 to a new record of 6.65 trillion cubic feet this year. Since 2013, total natural gas imports, represented by a negative number (purple line), have remained within the same range.

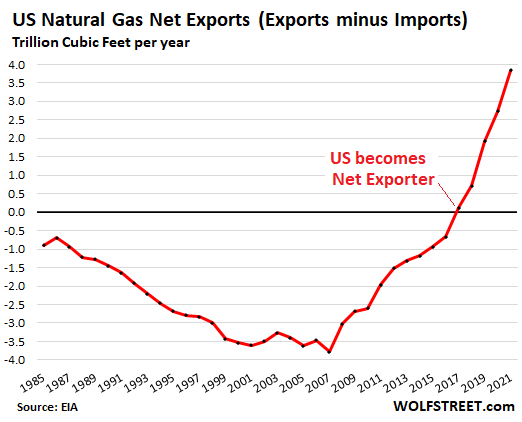

In 2017, the United States became a “net exporter” of natural gas, exporting more gas to the rest of the world than it imported:

LNG imports have largely stopped, except for some of New England’s coldest winter months, which are not well connected by pipeline to U.S. production areas.

Canadian Trade: The U.S. exports natural gas to and imports natural gas from Canada as regional pipeline infrastructure is in place. About 30% of U.S. pipeline exports go to Canada. On a net basis, the U.S. imports more from Canada than it exports to Canada.

Mexico Trade: The U.S. does not import natural gas from Mexico; this is a one-way trade, with the U.S. supplying Mexico with an increasing amount of pipeline gas. About 70 percent of U.S. natural gas pipeline exports go to Mexico.

For the first time in 2021, exports via LNG (red line) surpassed pipeline exports (purple line):

This is our view The giant ship of the booming LNG trade: Design, technology and challenges of LNG carriers.

U.S. LNG export countries.

The table below shows the top 25 recipients in 2021, measured in billion cubic feet per year, according to EIA data. South Korea has been the largest buyer of U.S. natural gas. China has now surpassed Japan as the second largest buyer. China, a big buyer, largely stopped in 2019 as part of the trade war, but restarted in 2020. Brazil has become the fourth largest buyer in 2021.

By comparison, in 2021, the U.S. exported 2.16 trillion cubic feet of natural gas to Mexico via pipeline. That’s roughly the equivalent of U.S. LNG exports to the top eight countries on the list combined.

Also note the European countries buying U.S. LNG in 2021.

| U.S. exports, by top recipient country in 2021, billion cubic feet per year | ||||

| 2019 | 2020 | 2021 | ||

| 1 | South Korea | 270 | 316 | 453 |

| 2 | China | 7 | 214 | 450 |

| 3 | Japan | 201 | 288 | 355 |

| 4 | Brazil | 54 | 112 | 308 |

| 5 | Spain | 167 | 200 | 215 |

| 6 | India | 91 | 124 | 196 |

| 7 | U.K | 118 | 160 | 195 |

| 8 | Turkey | 31 | 124 | 189 |

| 9 | Netherlands | 81 | 86 | 174 |

| 10 | France | 118 | 90 | 171 |

| 11 | Chile | 90 | 81 | 122 |

| 12 | Taiwan | 27 | 64 | 99 |

| 13 | Argentina | 39 | 15 | 83 |

| 14 | Portugal | 53 | 37 | 66 |

| 15 | Poland | 38 | 37 | 56 |

| 16 | Dominican Republic | 10 | 26 | 53 |

| 17 | Pakistan | 27 | 37 | 46 |

| 18 | Greece | 15 | 48 | 40 |

| 19 | Bangladesh | 3 | 11 | 38 |

| 20 | Croatia | 0 | 3 | 36 |

| twenty one | Kuwait | 10 | 17 | 34 |

| twenty two | Italy | 69 | 68 | 34 |

| twenty three | Lithuania | 3 | 29 | 31 |

| twenty four | Jamaica | 14 | 17 | 25 |

| 25 | Singapore | 31 | 28 | 25 |

As far as the U.S. is Europe’s largest supplier of LNG, right now, the U.S. doesn’t have much excess capacity to export more LNG anywhere. Major additional LNG shipments from the U.S. to Europe are primarily diverted from other customers. U.S. LNG export capacity continues to increase, and while it is already underway, it will take time. Increasing export capacity further than planned will take more time.

[ad_2]

Source link