[ad_1]

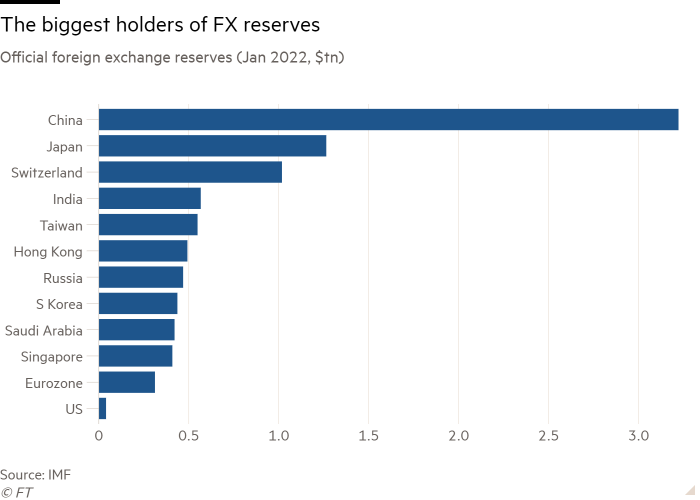

At the end of January, Russia held foreign reserves worth $469 billion.This treasure was born from the prudence it teaches 1998 Default And, Vladimir Putin hopes, it is also a guarantee of his financial independence. However, as his “special military operations“Starting in Ukraine, He learned that more than half of his reserves were frozen. His enemy’s currency is no longer usable currency. This action is not only significant for Russia. Targeted demonetization of the world’s most globalized currency is significant.

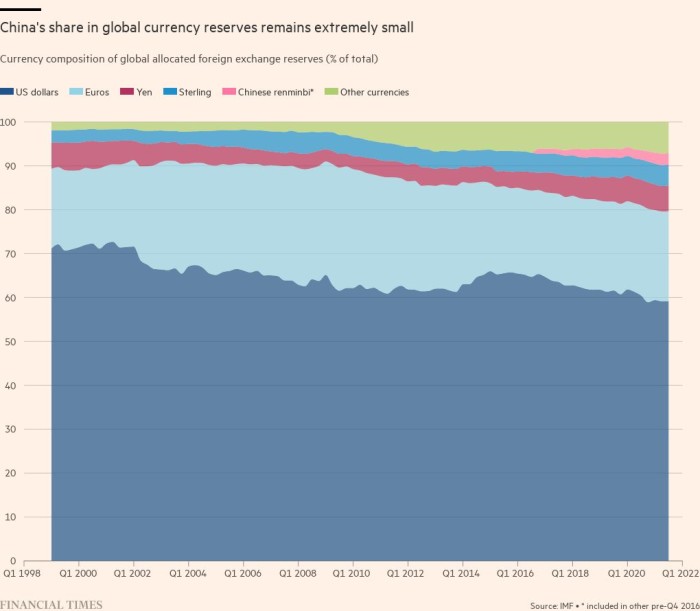

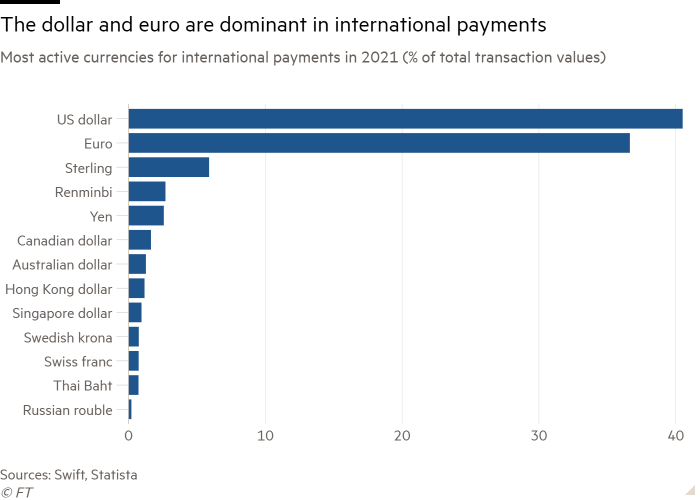

Money is a public good. A global currency — the currency people rely on for cross-border transactions and investment decisions — is a global public good. But the provider of public goods is the national government.Even though old gold exchange standard,That’s it.in our time decree (government-made) currency, since 1971 The situation is more obvious. In the third quarter of 2021, 59% of global foreign exchange reserves were denominated in USD, another 20% were denominated in euros, 6% were denominated in Japanese yen, and 5% were denominated in British pounds. China’s yuan still accounts for less than 3 percent of global reserves.Today, global currencies are issued by the United States and its allies, including small. (See diagram.)

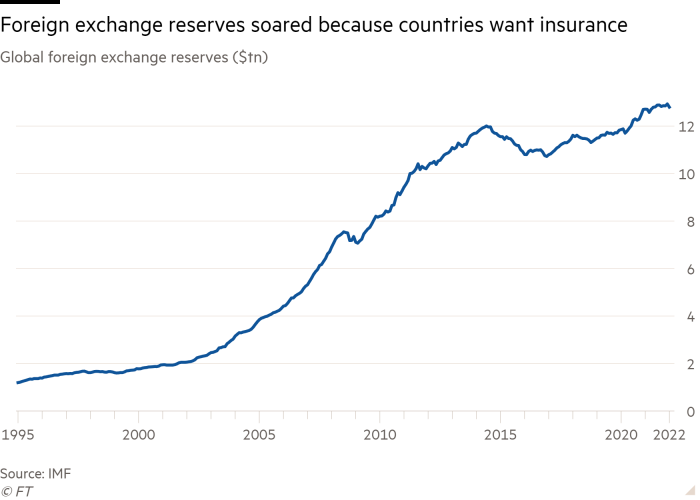

This is not the result of a conspiracy. Useful currencies are those of open economies with liquid financial markets, monetary stability, and the rule of law. However, the weaponization of these currencies and the financial systems that handle them would destroy these possessions for any feared target holder. Sanctions on Russia’s central bank are appalling. The government asks, who is next? What does this mean for our sovereignty?

One can object to Western actions on narrow economic grounds: the weaponization of money will divide the world economy and reduce its efficiency. One might respond that this is true, but in a world of high international tensions, this is becoming increasingly irrelevant. Yes, this is another force of deglobalization, but many will ask “so what?”. A more worrying objection to Western policymakers is that the use of these weapons could harm them. Will the rest of the world rush to find ways to trade and store value around the currency and financial markets of the United States and its allies? Isn’t that exactly what China wants to do now?

it is. In principle, four alternatives to today’s globalized national currencies can be envisaged: private currencies (such as Bitcoin); commodity currencies (such as gold); global fiat currencies (such as the International Monetary Fund’s Special Drawing Rights); or other national currencies Currency, most notably Chinese. The first one is incredible: The current market cap of all cryptocurrencies is $2 trillion, accounting for only 16% of the world’s foreign exchange reserves, and trading directly in cryptocurrencies is impossible trouble. Gold can be used as a reserve asset, but it is hopeless when it comes to trading. There’s not even a chance to agree on a global currency that’s good enough to replace reserves, let alone become a global transaction tool.

This leaves another national currency.An excellent recent booklet by Graham Allison and colleagues at Harvard University huge economic competition The conclusion is that China is already a formidable competitor to the United States. History has shown that the currency of an economy of its size, complexity and level of integration will become the global currency.

However, so far, this has not happened. That’s because China’s financial system is relatively underdeveloped, the currency is not fully convertible, and it lacks true rule of law. China is far from offering what the pound and dollar offered in their heydays. While holders of the U.S. dollar and other major Western currencies may fear sanctions, they certainly know what the Chinese government might do to them if they are not happy. Equally important, the Chinese government knows that internationalizing a currency requires open financial markets, but this would fundamentally weaken its control over the Chinese economy and society.

The lack of a truly reliable alternative suggests the dollar will remain the world’s dominant currency.However, there is an argument against this complacency, in digital currency, An uplifting brochure from the Hoover Institution. Essentially, this is China’s cross-border interbank payment system (Cips — fast system) and digital currency (e-CNY) may respectively become the main payment system and carrier currency for trade between China and its many trading partners. The e-renminbi could also become an important reserve currency in the long run. In addition, the booklet argues, this will give the Chinese government a detailed look at the transactions of every entity within its system. That would be an additional source of power.

Today, the overwhelming dominance of the United States and its allies in global finance is a product of their total economic size and open financial markets, giving it currency dominance. Today, there are no reliable alternatives to most global monetary functions.Today, high inflation The threat to trust in the dollar may be greater than the weaponization of rogue states. In the long run, however, China may be able to build a walled garden for those closest to it to use its currency. Even so, those wishing to transact with Western countries still need Western currencies. What may emerge is that the two monetary systems – Western and Chinese – function differently and overlap disturbingly.

As elsewhere, the future promises more chaos than a new global order around China. Future historians may see today’s sanctions as yet another step on that journey.

[ad_2]

Source link