[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. The Federal Reserve minutes on Wednesday were boring, and hardly moved the bond market. But we are talking about inflation anyway. That, plus planes and cruise ships. Email us: [email protected] and [email protected].

A different kind of inflation debate

Today’s inflation is weird. It is high, which is bad. But it is coming with fast growth, which is good. Weirder still, it stems from pandemic disruptions to supply (bad) as well as surprisingly strong demand (good). It’s a mixed bag.

There are two popular takes on this. One is that central banks should damp demand to slow inflation, even at a cost to growth and employment. A second, espoused by Team Transitoryis that inflation is a function of temporary pandemic dislocations, so price growth will soon moderate and central banks should back off.

But there is a third option. From a January paper published by BlackRock’s in-house think-tank:

Central banks should live with supply-driven inflation, rather than destroy demand and economic activity — provided inflation expectations remain anchored. When inflation is the result of sectoral reallocation, accommodating it yields better outcomes.

Jean Boivin, one of the paper’s authors and a former Canadian central banker, told Unhedged many investors are getting inflation wrong by relying only on a macro lens. He emphasises a sectoral view. Two points stood out:

-

Covid is fuelling a long-term resource reallocation, creating inflationary bottlenecks in some sectors and slack in others;

-

Rising prices are how markets handle such a reallocation, and trying to crush them with rate rises will only prolong a painful but necessary process.

Unlike Team Transitory, Boivin expects pandemic dislocations will persist for years — so inflation will not subside soon. But unlike inflation hawks, he thinks the cost of curbing inflation is too high, so long as inflation expectations stay anchored. Central banks should accept elevated inflation as the least-worst alternative.

Rendering a verdict here is above our paygrade. But it’s not above that of Martin Wolfthe Financial Times’ chief economics commentator, who offered this bit of scepticism (emphasis Martin’s):

At some point, relative prices will peak. The question is when this happens — this year, next year or five years from now and what central banks should do in the meantime?

what [central bankers] have to do is prevent a wage-price spiral, which would certainly destabilise inflation expectations. Monetary policy must be tight enough to achieve this. In other words, it must create/preserve some slack in the labour market. What degree of policy tightness is needed to achieve this we don’t know. And it is certainly possible that headline and most measures of core inflation will continue to be high even if a degree of labour market slack does exist. But there is no point in permitting a level of aggregate demand that aggregate supply, given the pattern of demand, cannot meet. Central banks must tighten accordingly.

Responding to the italicised bit, Boivin reiterated why a sectoral view matters:

This is about a persistent reallocation, playing out over many years. This reallocation will create bouts of inflation, whether or not at full employment or if the aggregate output gap is closed. These bouts of inflation will be driven by sectors where supply is lagging demand (as it is now in goods sectors). Rising prices in these sectors are part of the mechanism that gets supply and demand in the same place. They reduce demand in areas with shortages and encourage supply capacity to move.

The price adjustments will, in fact, incentivise a quicker transition and central banks insisting on preventing these price adjustments will end up slowing the transition.

It strikes us that there are different risk assessments at play. Martin is worried about a wage-price spiral that hits inflation expectations. Boivin thinks that perception is itself the problem. From his paper:

The primary risk we see is that central banks hit the brakes if constraints persist and they perceive that higher inflation could feed into inflation expectations.

There is much more to say here, and readers are invited to send in thoughts. If inflation doesn’t subside this year, expect more of this debate. (Ethan Wu)

Is there value in the airline/cruise line junk pile?

Are we there yet? As a veteran of long car trips with children, I know there is only one answer to this question: we’ll get there when we get there, so quit asking. So it is with Covid. There is little value in speculating about when the economy will have recovered fully from the virus. It will happen when it happens.

That said, it feels like we are closer to the destination that we were even a month ago. Anthony Fauci, the chief medical adviser to US president Joe Biden, who is not known for his glib optimism, has said that the “full blown” stage of the pandemic is drawing to a close. The end of mask mandates is being debated. And most fundamentally, it is clear that the Omicron wave has crested. Here are new deaths and cases in the US:

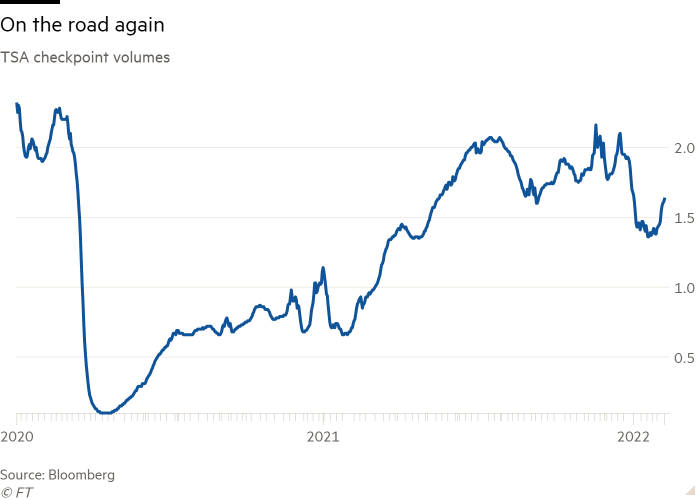

And here are US Transportation Security Administration airport checkpoint volumes. People are flying:

People may be acting like the pandemic is coming to an end. Shares in airlines and cruise lines are not. Here is the performance of the S&P 500 index against the airline and hotel/resort/cruise line sub-indices:

Hotel stocks have actually done fine. The drag is all cruise lines and airlines. Is there too much pessimism baked into those share prices? Consider the table below.

For the big cruise line and airline stocks, it shows both revenue and earnings per share for pre-pandemic 2019 and consensus estimates for this year. The declines in each show the damage the pandemic continues to inflict on these companies. The second-to- The last column expresses this year’s expected revenues as a percentage of 2019’s, a measure of how much demand has returned. It mostly has, but earnings are not bouncing back, likely reflecting reopening costs. The final column shows the current price divided by 2019 earnings, a measure of how much you are paying for the stock if earnings can return to pre-pandemic levels.

On the current price/2019 earnings metric, the stocks look very cheap — mid-single digit P/E multiples are low even by the standards of these two capital intensive, cyclical industries. What the prices seem to be saying is that the cruise business and the airline business are never returning to their old selves, or not for a very long time. Is that true? Some of these companies (Delta, Carnival, Royal Caribbean, United) took on a lot of debt to make it though the pandemic , which will depress their valuations. But that is unlikely to be the whole story here.

One good read

A lovely literary appraisal of PJ O’Rourke, who died on Tuesday, in The New York Times.

[ad_2]

Source link