[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Markets sniffed peace in the Ukraine today, and rose. We hope they are right, but we suspect the rollercoaster ride ain’t over yet. Email us: [email protected] and [email protected].

Rent inflation is not going away soon

Yesterday we discussed house price inflation and, tangentially, whether it is a leading indicator for rent inflation. This is important just now because rent, broadly construed, makes up about a third of the CPI inflation calculation. And CPI inflation is making markets go bananas.

Yesterday’s conclusions, roughly, were that it is unclear how much house price inflation contributes to rent inflation; that house prices have risen by a huge amount in the last two years; but that the increases appear to be over for now, and could reverse at the end of this year.

That does not imply rent inflation has plateaued, as well. Start with some basic data. Here is annual change in asking rents for new leases, as reported by the online brokerage sites Zillow and Apartment List:

This looks awful. The CPI measures of rent and owners’ equivalent rent were up just 3.8 and 4.1 per cent year over year in January. The CPI measures lag, both because they include slower-moving renewing leases and because the survey-based owners’ equivalent reading tracks slow-moving expectations. But if the double-digit broker numbers are indicative, the official figures are going to rise a lot in coming months.

Things look a little different when you look at the same data on a month-over-month basis:

Here you see that the normal seasonal decline in rents has happened this winter. This is a relief. But look closely. The decline has not been as steep as in previous years. Seasonally adjusted, rent is not on fire, but still looks unusually warm . The big question is whether this will continue through this year and beyond.

The Zillow and Apartment List data may understate how warm rent inflation it is. RealPage, which makes software for property companies, has data on actual closed leases. This is better, because rental unit occupancy rates are historically high right now, so renters often pay over the ask price to secure an apartment, as RealPage economist Jay Parsons pointed out to me. The RealPage closed leases data show a 0.6 per cent month over month increase for new renters in January, very high for winter, and higher than the Zillow and Apartment List figures.

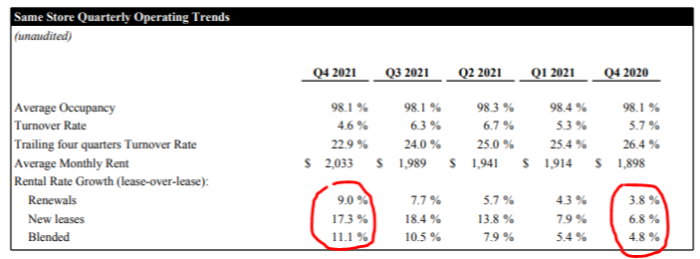

Another eye opening set of data comes from Invitation Homes, which is a real estate company that rents more than 70,000 single-family homes across the US. Its fourth-quarter numbers include a 17 per cent rise in rents on new leases, and a staggering 9 per cent on renewals. Look at the acceleration from a year ago:

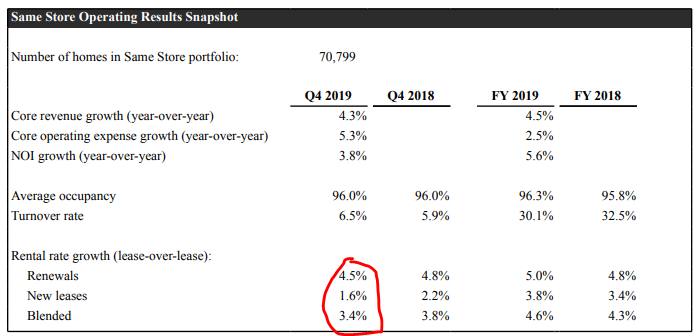

Here, for contrast, are the results from the fourth quarter of pre-Covid 2019:

Things are really, really different now. What explains this? The housing economists I spoke to all tell the same story. There appears to have been a spike in household formation, which has not yet been captured in the official numbers. This has run up against a national housing shortage. The very large millennial generation is hitting the age where they dump their roommates and move into their own homes, and the housing bust following the great financial crisis led to years of slow new construction, a trend that is only ending now. Add pent-up demand to this picture, after new household formation paused in the first year of the pandemic. Layer on top of that stimulus programmes that padded millennials bank accounts, and you get the rent increases you are seeing now.

The pandemic “slowed down household formation and now we are seeing that release . . . but the inflation will continue after the burst ends”, said Daryl Fairweather, chief economist at Redfin, another brokerage. Parsons of RealPage wrote that he expected “rent growth to remain significant throughout 2022 in essentially all markets and all price points”.

Economists at the San Francisco Fed agreed. Earlier this week they published a study that used asking rents — that same Zillow data we saw above, in fact — and house prices in major US cities to project future increases in CPI and PCE (personal consumption expenditure) rent inflation. They note that Zillow asking rent inflation is a decent predictor of CPI rent inflation a year later. Here is their chart of the relationship:

Combining this with house price data:

Our panel model predicts that future rent inflation could increase by about 3.4 percentage points in both 2022 and 2023 relative to the pre-pandemic five-year average. This prediction translates into an additional 1.1pp increase in overall CPI inflation for both 2022 and 2023. In terms of overall PCE inflation, the measure used by the Federal Reserve to assess price stability, our prediction translates into an additional 0.5pp increase for both 2022 and 2023.

A percentage point more CPI inflation over the next two years is a lot. What’s more, the model makes sense, given the demographic and housing supply issues, low unemployment, strong household balance sheets and wage growth we are seeing.

It is, as we keep repeating, very hard to predict things right now. Rent inflation is highly cyclical. A significant economic slowdown could change things fast. And the rent inflation story has special characteristics that will not apply to other goods and services — Unhedged has not given up its neutral status in the transitory/permanent debate. But with those provisions, the idea that rent inflation will stay high though 2023, and push up CPI meaningfully, is strong.

Gold is bugging out

“Gold is a hedge against real rates” is a piece of conventional wisdom we basically agree with. Since the late 1970s, the link has stayed tight. Real rates up, gold down. The data is clear, and the reasoning is simple: real rates are the opportunity cost of holding yield-free gold.

But things have been weird lately, and gold is no exception. The metal has been moving up right alongside real rates:

(The chart above uses two-year Treasury yields to capture the impact of recent Fed action on real rates, but 10-year inflation-linked Treasuries offer the same picture.)

Perhaps, with real rates below zero, moving from very negative to somewhat negative just doesn’t matter. That’s what occurred to us, at least, but we don’t know much about gold. So we asked someone who does, John Hartsel at Donald Smith & Co, a longtime gold stocks investor, who added:

I think people are starting to look more towards protection against dollar devaluation and wealth preservation and those other aspects of gold.

But the real rates thing — it has been a very tight relationship obviously. But it is kind of odd: real rates are derived from the difference in pricing of two securities where the government is massively involved in price determination . . . It depends on how you measure real rates.

This last point is important. For as neat as the “real rates are the opportunity cost of gold” theory is, the mechanism keeping gold linked to rates is harder to see. The “true” real rate is more a concept than a measurable variable . How much does quantitative easing distort real rates, for instance? There are estimates, but they are ultimately just guesses. And what if one-month T-bills minus inflation is closer to the true real rate? By that measure, real rates have been falling, not rising.

The vagueness here could explain why gold has gone on extended run-ups with real rates, like in 2005-06 (credit to Strategas for noting this), before reverting back to trend. Real rates and gold head in opposite directions over the long term . But that leaves room for some fun in the here and now. (Ethan Wu)

One good read

The FT’s Jonathan Wheatley lays out the bear case on emerging markets in 2022. Are any brave Unhedged readers willing to take the other side of the argument?

[ad_2]

Source link