[ad_1]

This article is an on-site version of our The Road to Recovery newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Good evening

This morning’s news that UK inflation had hit its highest rate in 30 years is the latest setback for “team transitory” — those who argue that the current spike in prices is a one-off caused by the post-pandemic bounceback in demand and short-term disruptions to the supply chain .

The higher-than-expected rise in January CPI to 5.5 per cent compared with the previous year is well above the Bank of England’s 2 per cent target and could fuel, in the words of one economist, “the deepest squeeze on living standards in six decades”. The BoE expects inflation to peak above 7 per cent in April when the country faces a spike in energy bills.

Economists believe that today’s data, together with yesterday’s strong labour market reportmakes it likely the Bank will continue on its path of raising interest rates at its next monetary policy meeting.

Meanwhile signs of the cost-of-living crisis are cropping up everywhere, from increases in fares for commuters to the price of a pint.

Heineken chief Dolf van den Brink told the Financial Times that usual methods for predicting consumer behaviour were breaking down as companies grapped with how to pass on “crazy” increases in costs: “There’s no model that can handle this kind of inflation. It’s kind of off the charts. So it’s anybody’s guess . . . what the impact is going to be on volumes due to all these price increases.”

And good luck if you’re a first-time buyer trying to get on the property ladder: new data this morning showed house prices rose almost 11 per cent in 2021 to hit record highs, with the average price now £42,00 above pre-pandemic levels. The surge in house prices is also worrying policymakers in the EU.

The picture is similar across the Atlantic. The US yesterday reported that producer prices more than doubled in January from the previous month, putting more pressure on the Federal Reserve to speed up the withdrawal of its stimulus programme. Last year was the largest calendar year increase in wholesale inflation since the data were first compiled in 2010.

The White House, with an eye on this year’s midterm elections, is considering suspending federal gasoline taxes as pump prices soar to their highest levels in seven years, even at the expense of promises to lead the transition to clean energy.

The main exception to the drumbeat of negative news on inflation comes from China. New data from earlier today showed increases in factory gate prices slowing after government intervention in commodity markets and demand taking a hit from renewed lockdowns.

Browse our global inflation tracker to see how rising prices are affecting economies across the world.

Latest news

-

Singapore will open quarantine-free travel to Hong Kong residents, further widening the gap between the Asian financial centres in their approach to Covid-19 restrictions

-

The IMF published policy proposals for a ‘robust recovery‘

-

US retail sales rose at the highest rate for 10 months to hit 3.8 per cent in January as consumers splashed out on cars and furniture.

For up-to-the-minute news updates, visit our live blog

Need to know: the economy

Our Big Read examines the diminishing prospects for investment in emerging marketswhere the pandemic continues to rage and economies are burdened with emergency debt, spiralling inflation and slowing growth rates. Chief economics commentator Martin Wolf examines the looming threat of “long financial Covid”. The FT says better ways are needed to help indebted nations such as Sri Lanka, Zambia and others.

Latest for the UK and Europe

Falling birth rates and life expectancy coupled with rising immigration are likely to give the UK’s public finances an unexpected boostaccording to FT analysis. It means the government will have to find just £13bn in extra taxation to fund public services each year by the end of the decade instead of the £69bn implied by previous estimates. However, as the FT Editorial Board points out, Britain’s young face a poorer future.

In the event of conflict with Russia, Europe cannot expect much help with gas supplies from Australia’s biggest liquefied natural gas producer. The head of Santos told the FT most of his company’s output was earmarked for long-term contracts in Asia. In the UK, the phasing out of some nuclear stations and coal-fired plants has helped fuel a record high price for standby electricity generation.

Eurozone industrial output has returned to pre-Covid levels thanks to a recovery in carmaking and an easing of supply chain pressure. However, the bloc’s trade deficit hit a 13-year high in December because of surging energy costs. Post-Brexit trade disruption between the EU and the UK also continues as tariffs are applied to many goods for the first time after the end of the transition period.

Global latest

Chinese president Xi Jinping threatened to make tough Hong Kong restrictions“more draconian” to contain the surge in Omicron infections. Pernod Ricard became the latest international company to temporarily relocate staff from the city.

South Korea too is fighting an Omicron surge with a record number of new cases reported today, although in better news it has been successful in adding new jobs.

Japan annualised recorded growth of 5.4 per cent in the fourth quarter as Covid restrictions were eased and consumer spending rose. On a quarter-on-quarter basis, its economy rebounded 1.3 per cent after a fall of 0.7 per cent in the third quarter, but economists warn that rising Omicron cases and high oil prices will drag down the speed of recovery.

Need to know: business

Blackstone intensified its bet that the pandemic-fuelled boom in ecommerce would continue with a €21bn recapitalisation of its European logistics business in one of the largest-ever private real estate deals. Rents and valuations for warehouses have soared over the past year.

food company Kraft Heinz reported better than expected net sales of $6.67bn in the fourth quarter as it successfully offset rising costs by increasing prices by 3.8 percentage points from a year earlier.

One company that sees an opportunity in rising inflation is lodgings platform Airbnbwhich said the deterioration in household finances could drive more families to become hostsInvestors have voiced concerns over limited supplies of accommodation as international travel returns.

US banking regulators warned of the risks involved in the leveraged loan marketan activity that swelled during the pandemic as companies rushed to borrow emergency cash and investors clamoured for higher-yielding assets.

The World of Work

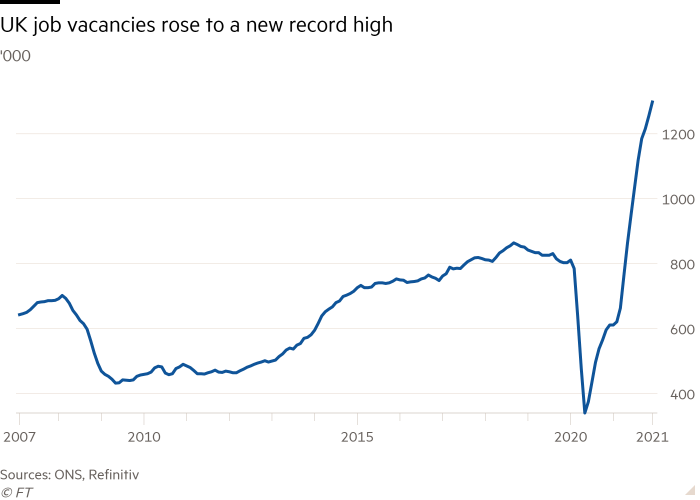

Although UK job vacancies have reached a record high and workers theoretically have more negotiating muscle, wages are failing to keep pace with inflation. “The reality for most people is a nasty squeeze on purchasing power,” says the FT’s Lex column.

New employees over the past two years have faced steeper-than-usual learning curves as they were forced to log on from home, rather than at the office. But companies are learning lessons from running remote programmes to develop new types of post-pandemic training.

The pandemic has ushered in a new wave of demand for MBA courses. Browse the world’s top courses and business schools in the annual FT rankingsget tips on crafting your application — and on funding your studies once you get accepted.

Covid cases and vaccinations

Total global cases: 414.7m

Total doses given: 10.5bn

Get the latest worldwide picture with our vaccine tracker

And finally.

“Mastery might be a long way off, but the flow state induced by floristry is profoundly rewarding, albeit with a few decapitations en route.” From meditative art to the joys of woodworking and the art of floristry, browse our new collection of hands- on hobbies to boost your mental health.

Thanks very much for reading The Road to Recovery. We’d love it if you shared this newsletter with friends and colleagues who might find it valuable, so please do forward it. And if this was forwarded to you, you are very welcome to sign up and enjoy it — and access to all of the FT — free for 30 days. Please sign up here.

Please also share your feedback with us at [email protected]. Thank you

[ad_2]

Source link