[ad_1]

last year, i took the question It is generally believed that there is a lack of innovation in financial terms.

This is not just my assumption about technology – RWM manages about $2.8B in assets and serves over 1600 households. We can’t do everything we do — asset management, financial planning, tax and estate planning, 401ks and tax-qualified accounts, and all the research, writing, and publishing we do — unless we have a strong, cutting-edge technology stack.

We live this life every day.

We are very familiar with the field and my first hand experience is that financial technology (aka FinTech) has made us more efficient, productive and capable, despite the fact that fintech continues to reduce costs and lower investment/financing costs.

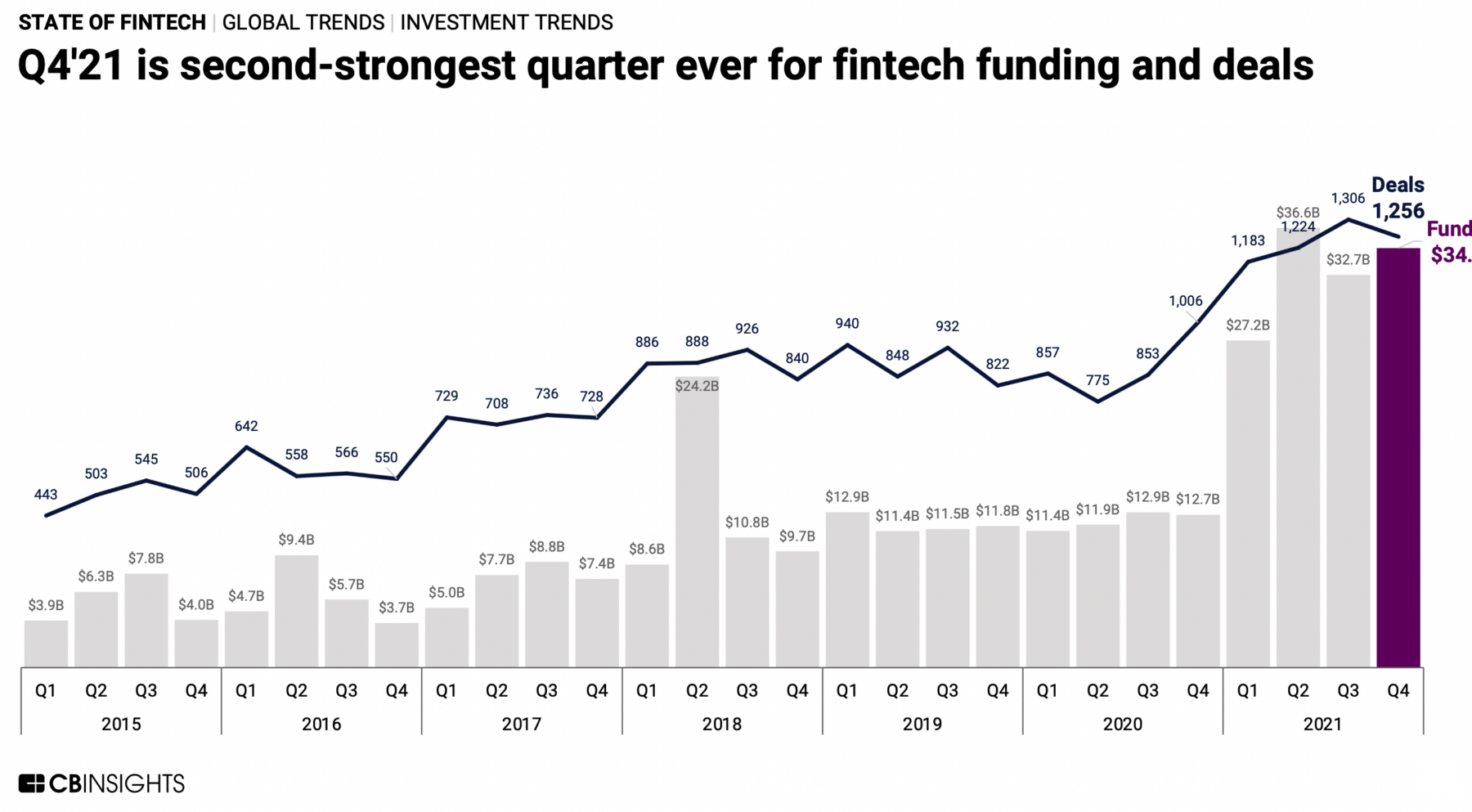

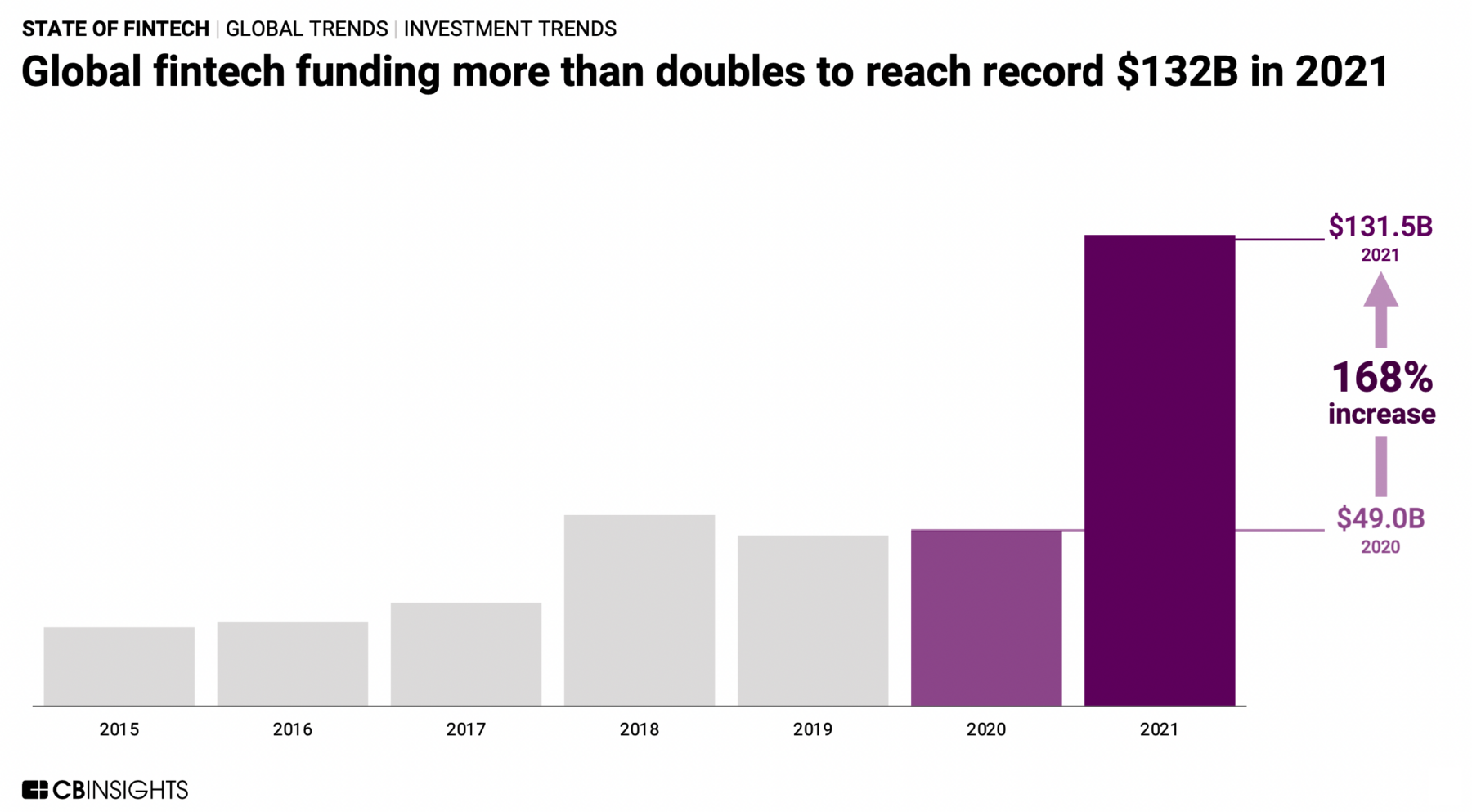

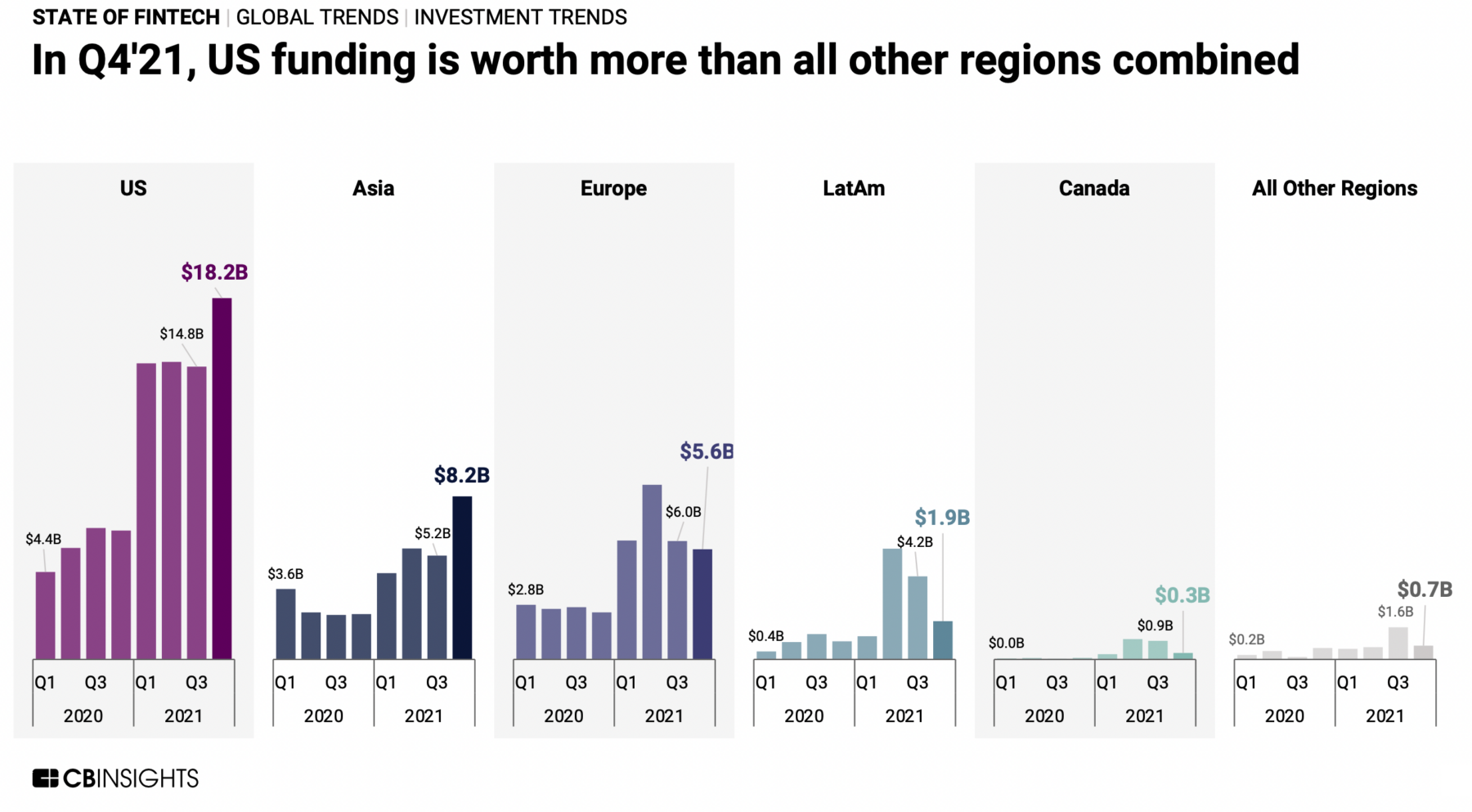

This Graphics I show Last time I mentioned that there is a lot of venture capital in this area, but you may not have imagined how big this area is relative to other venture capital: For every $5 in global venture capital, fintech accounts for $1. Fintech funding more than doubled to $132 billion in 2021, accounting for 21% of total global venture capital. (Look Graph after jump)

I don’t really care about the number of big rounds or unicorns around the world or M&A deals in the space. This is what bankers have to worry about. What interests me is the direction and magnitude of the overall trend. The field is rapidly growing and filled with entrepreneurs, including technologists and investors working in (or adjacent) the financial sector.This bodes well for more innovations to come my way, and our ability to continuously develop the way we do things and work for our clients.Anytime we have a chance faster, better and cheaper, we are all there.

The pace of innovation is accelerating, limited only by how fast we can get the job done with the best technology.

Decades ago, the only innovations in finance might have been ETFs and ATMs, but if you believe this is still the case today, prepare to be left behind. . .

source:

2021 State of Fintech Report

Anisha Cotapa

CB InsightsJanuary 25, 2022

https://bit.ly/3r8gni0

Before:

faster/better/cheaper (November 11, 2021)

The State of Venture Capital in 2021 (January 13, 2022)

Venture capital money is everywhere (September 15, 2021)

[ad_2]

Source link