[ad_1]

Euro zone companies reported a weaker-than-expected start to the year, with activity growing at the slowest pace in 11 months, a closely watched survey showed, despite easing supply bottlenecks hindering manufacturers.

The IHS Markit Rapid Eurozone Composite Purchasing Managers’ Index, a monthly survey that takes the pulse of business activity, fell to 52.4 from 53.3 the previous month, slightly below most economists’ expectations.

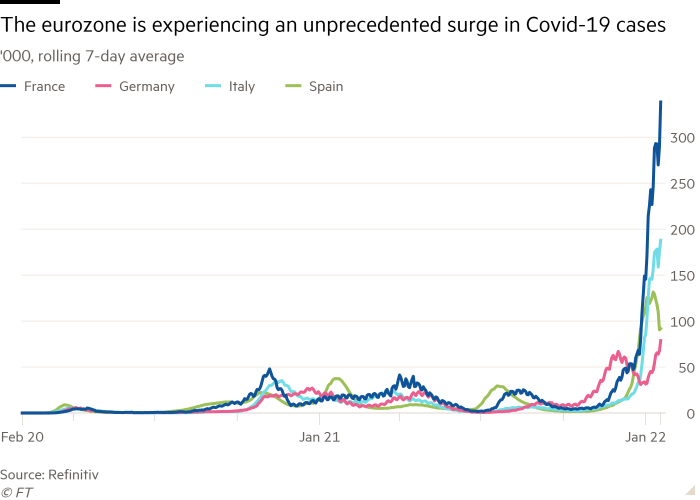

A PMI score above 50 indicates that most businesses are reporting higher levels of activity than a month ago. But the findings suggest that the euro zone may be in worse shape than expected due to a surge in infections with the latest Omicron coronavirus variant.

“While the Omicron wave has dented the outlook for the services sector, the impact so far appears to have been less severe than previous waves,” said Chris Williamson, chief business economist at IHS Markit. “Meanwhile, manufacturers’ expected outlook has improved, with This is associated with a reduction in supply shortages, adding to the brighter outlook.”

Businesses also reported that the average price of goods and services rose at the fastest pace since the survey began in 2002, a sign that inflation is likely to remain high at the start of the year. hit A record 5% for the euro zone in December.

While infection rates in the 19 countries that use the euro have risen to their highest levels since the pandemic began, data on movie ticket sales, hotel bookings, job postings and mobility has fall much less Compared to previous surges caused by the coronavirus.

However, the group’s services businesses said tightening coronavirus restrictions had weighed on demand – particularly in the consumer-facing and hospitality sectors – while staff absences due to Covid-19 had also dampened activity. The services PMI fell to a nine-month low of 51.2.

Euro zone manufacturers reported an easing of supply chain issues that have led to record backlogs of factory orders, port congestion and material shortages, helping the sector’s PMI score rise to a five-month high of 59.

“Suppliers have seen their lowest average delivery delays since January last year, with fewer reported items in short supply and shipping delays showing signs of easing,” IHS Markit said.

German companies – especially its sprawling manufacturing sector – reported “surprisingly resilient performance”, with the country’s PMI reading rising to 54.3, the highest since September.

Survey questions predictions that Germany could slip in economic recession – Defined as two consecutive quarters of negative growth – this winter. But Michael Holstein, chief economist at Germany’s DZ Bank, said: “We continue to assume that the German economy will be difficult in the first quarter and we don’t expect a full recovery until spring.”

In France, the government plan to relax Business activity slowed to its slowest pace in nine months as coronavirus restrictions were tightened last month. The country’s PMI score fell to a nine-month low of 52.7, hit by weak growth in services and manufacturing.

Andrew Kenningham, chief European economist at Capital Economics, said: “Euro zone economic activity should pick up in February and March as some countries have peaked in the number of new Covid-19 cases and some governments have drawn up plans to ease restrictions. Pick up.” .

Growth in the euro zone was “likely to be close to stagnation” in the fourth quarter, he said, and expected a rebound of 0.5 percent in the first three months of 2022.

[ad_2]

Source link