[ad_1]

A Financial Times analysis of high-frequency data shows that the Omicron variant has done far less damage to the European economy than previous Covid-19 waves, thanks in large part to high vaccination rates and society’s response to the virus Increased survivability.

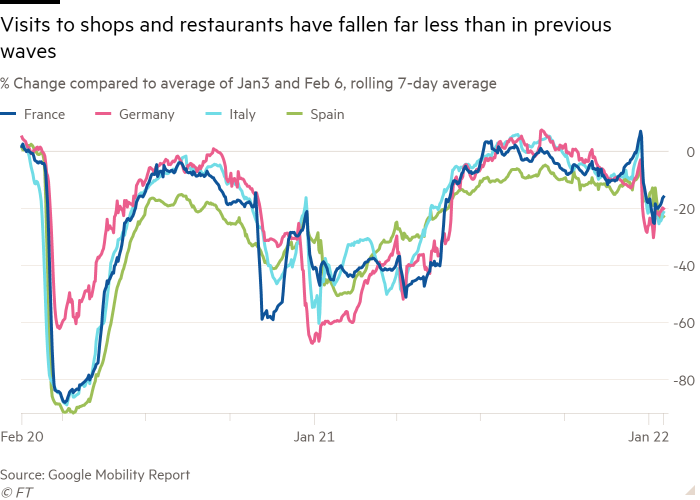

While infection rates across the euro zone have risen to their highest levels since the start of the pandemic, data on movie ticket sales, hotel bookings, job postings and mobility have fallen far less than previous surges caused by the coronavirus.

This time last year, visits to shops, bars and restaurants were down more than 40% from pre-pandemic levels. By contrast, visits have dropped by less than half this year, according to Google mobile data.

“The economic impact of the pandemic is fading with the flow,” said ING economist Bert Colijn. “The relatively high level of liquidity is good for economic activity.”

This is reflected in economists’ growth forecasts. Barclays economist Silvia Ardagna forecasts that despite Omicron, the EU economy will still grow by about 0.2% in the final quarter of 2021 and the first quarter of this year. She also expects “solid growth in 2022-23, driven by domestic demand”.

There is little sign that Omicron is seriously hurting the job market, according to job search site Indeed. Unemployment in the euro zone fell below the pre-pandemic average of 2019 in November.

Unemployment in the euro zone “will fall to unprecedented levels,” said Claus Vistesen, an economist at Pantheon Macroeconomics. a record The euro zone’s December high was 5%.

Even so, the exponential rise in infection rates has hurt economic activity as restrictions force people to self-isolate and limit public gatherings. This particularly hits consumer services.

In the first weekend of January, European film revenue in the EU’s four largest economies was about 20 percent lower than it was during the same period in 2020, according to Mojo, a U.S. website that tracks global box office sales. German restaurant reservations were also down 30 percent in mid-January compared to the same period in 2019.

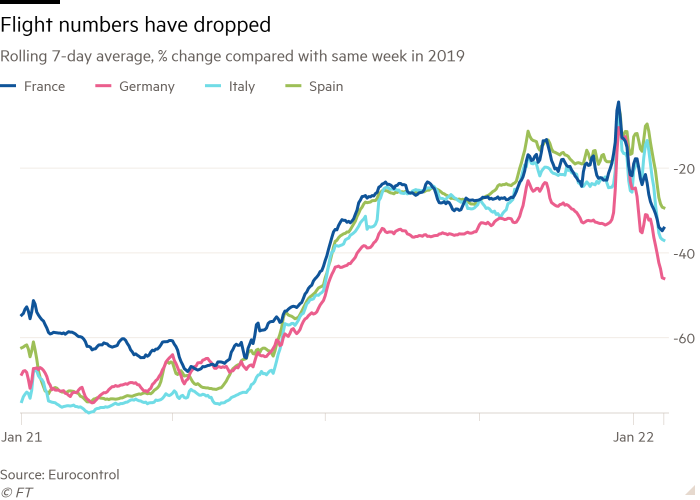

Likewise, tourism and international travel remained weak. The number of flights is down 35% compared to the number of flights in 2019 before the pandemic. Hotel bookings have also fallen back to spring 2021 levels, according to digital marketing platform Sojert.

Still, it’s a marked improvement from this time last year, when bookings fell even more.

One difference in this wave, analysts say, is that restrictions — such as the Covid-19 passes required to enter hotels and leisure venues in countries such as France and Italy — have largely targeted people who have not been vaccinated and are not yet sick. Since they are in the minority, the rest of the economy can remain open.

“There has been an increase in Covid-19 cases across Europe, restrictions have been put in place and liquidity has fallen,” said Nomura economist George Buckley. “However, there are reasons for optimism,” he added, predicting Spring will recover quickly.

Another reason for the smaller hit to economic activity this year is that hospitalizations and deaths have risen much less than infection rates, analysts said. In 2021, a much lower infection rate will drag the euro area into recession.

Jack Allen-Reynolds, an economist at Capital Economics, expects that “the current wave of infections caused by Omicron will subside faster than the previous wave, allowing restrictions to be eased in February”.

In fact, this week France said it would ease Covid-19 restrictions starting next month, as the wave of infections in the Paris region has peaked, and the rest of the country is expected to do the same soon.

Manufacturers are also expected to usher in better times.Daily data on German truck mileage, which represents industrial production, has surpassed November levels, suggesting that China’s Zero Outbreak Policy Global manufacturing supply chains have not been impacted.

Even with supply disruptions, higher inventory levels mean factories should be able to weather any shortages more easily than before, said Paul Donovan, chief economist at UBS Global Wealth Management.

“Overall, Omicron is likely to be much less disruptive than previous waves of pandemics,” he said. “People have learned to adapt, which minimizes losses.”

[ad_2]

Source link