[ad_1]

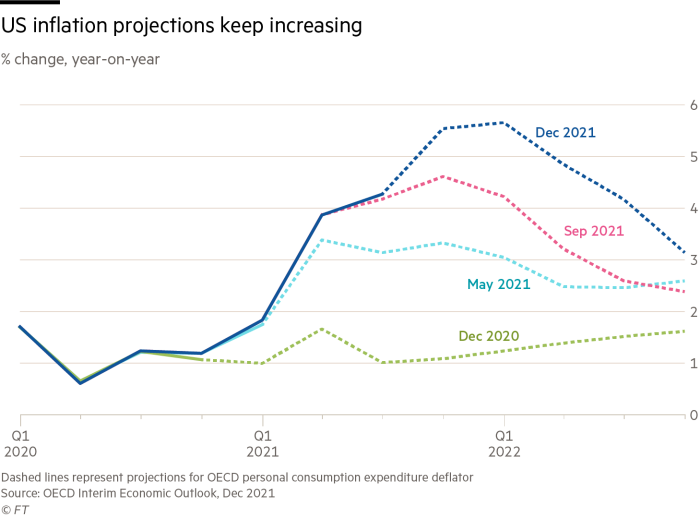

The biggest economic surprise in 2021 is the strength of the economic recovery. Another is the spike in inflation that has accompanied this recovery, especially in the United States. After the shock of Covid-19 in 2020 and a surprisingly strong recovery and inflation surprise in 2021, what might 2022 bring us?

recent OECD The global economy is expected to grow at 4.5% in 2022, just slightly below the recovery-fueled 5.6% growth in the previous year. The OECD also forecasts that the euro area will grow by 4.3% in 2022, compared with 3.7% in the United States, but inflation in the United States will be 4.4% in 2022, compared with 2.7% in the euro area.

Even relative to this rather attractive scenario, one can imagine upside risks.

For example, if the supply shortages accompanying the recovery are remedied, inflation could disappear sooner than expected. This would allow the central bank to stick to monetary easing.

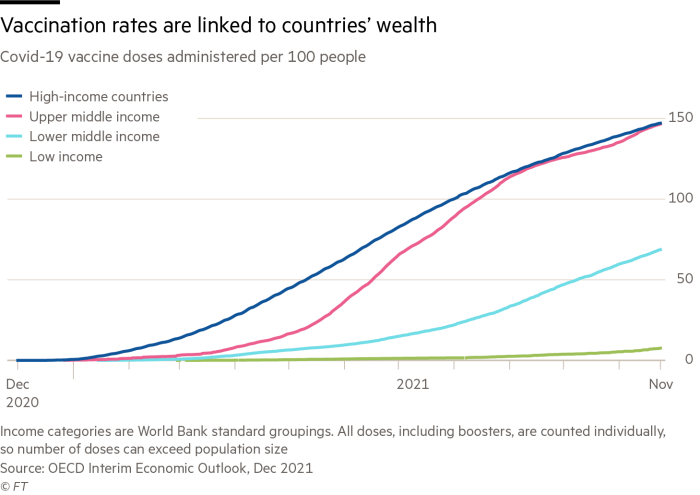

In addition, further coronavirus variants, beyond Omicron, may gradually reduce the harm. Alternatively, a global vaccination program could bring lasting relief to the pandemic. If so, a quicker reopening of the world economy could support a stronger and more broadly shared recovery, especially in severely devastated emerging and developing economies.

However, there are also downside risks on the economic and non-economic fronts.The former possibility is Soaring inflation continues to surprise, Wage price spirals can arise as workers deal with the damaging effects of high inflation on real wages. That could uproot the anchor for inflation expectations.

Central banks will be forced to tighten monetary policy far more than currently expected. It will almost certainly also have a negative reaction in today’s frothy asset markets, possibly triggering a wave of bankruptcies.

One of the non-economic downside risks is the emergence of variants of the coronavirus for which current vaccines are ineffective. There are also geopolitical risks, most notably tensions between the United States, China and Russia. Such tensions are often seen as war.

Other risks lie at the junction between economic and non-economic. One is that as frictions between China and the West continue to worsen, this has done significant damage to global economic relations, which now seems likely.

Then there is the long-term danger of destabilizing climate change. Despite growing awareness of this threat, action remains far behind what is needed to avoid potentially catastrophic climate change. The recent COP26 climate conference in Glasgow was not a complete failure.but this is also far from successful. If Donald Trump or someone like him becomes the next U.S. president, the chances of successfully addressing this threat will be slim.

An important lesson we have learned over the past year and a half is the uncertainty of the world economy. We can recognize some predictable forces: the inherent trend of market-driven economic growth, the continuation of technological progress, and the population forces of fertility and aging. But there are also unpredictable and disorderly drivers: financial crises, political turmoil, geopolitical pressures, pandemics, and behind them, climate change.

Covid-19 is a powerful reminder of this uncertainty. It also brings some powerful lessons. Among them, two stand out.

The first is that, in the context of this pervasive uncertainty, our systems must Robust, or resilient, or both.

Robust systems can function throughout the impact, while elastic systems quickly return to normal function after impact. Which one we need depends on the importance of continuing operations. Generally speaking, systems that provide essential goods and services such as basic food, medical supplies, energy or everyday financial services need to be robust. But users of many other goods and services can cope with some disruption. What matters in this case is resilience.

Businesses and policymakers alike need to decide where they need robustness and where they need resilience – and how much and how they are prepared to pay. But they should also avoid the obviously false idea that “native” is synonymous with “robust” or “resilient”. Putting all your eggs in a basket called “local” guarantees neither robustness nor resilience.

The second and more important lesson is that the contradiction between our present species and the world we have created is becoming more and more dangerous. Although an intensely tribal species, we have created a global world.

Covid has been a global shock Outstanding. However, it has proven impossible to mount a coherent global response, especially when it comes to vaccine supply and delivery. This tribalism ultimately increases everyone’s vulnerability. Likewise, geopolitics is pulling the world apart, even though it is more integrated than ever on multiple fronts, especially economics.

This contradiction between who we are and what we build is the dominant contradiction of our time. These pressures may not shake the foundations of our world in any given year. But they create background risks that should not be ignored.

[ad_2]

Source link