[ad_1]

This article is a live version of our Trade Secrets newsletter.register here Get the newsletter straight to your inbox every Monday

Hello and welcome to Trade Secrets.The new year is a quiet start in terms of trade war renewal or building lasting peace, only they will – they – won’t – their bellicose response to the EU’s trade war China – Lithuania A situation that makes us happy. (Answer: They won’t.) India tried and predictably — you might say intentionally — failed trick Calling for a virtual ministerial meeting on the topic of Covid-19 patents at the World Trade Organization is an attempt to give a little boost to the fading issue. A major segment today looks at supply chain issues, where the return to normalcy has been delayed, and how difficult it is to figure out what’s going on. Chartered Waters Focus this week on China’s record trade surplus.

We would love to hear from you.Send any ideas to [email protected] or email me [email protected]

Bottleneck Barometer

As the Old Testament book of Proverbs says, delays in restoring supply chains to normal can make people sick have, almost. As we pointed out last week, the chaos in ports and logistics around the world appeared to have eased by the end of last year. Shipping rates are dropping and delays seem to have peaked.

Then there’s Omicron. China’s minimal tolerance for Covid has magnified the new variant into severe labor shortages in manufacturing, distribution and ports.This is clearly a negative supply shock, not a demand excess issue as we think it is keep counting has been the main problem. If we’re right – assuming the Omicron wave subsides – the variant will delay and complicate, but not shorten the improvement. But it’s still possible that we’re wrong and that indefinite supply problems will kill world merchandise trade.

For those without the luxury of journalists to watch and wait (exporters and importers, shipping companies, investors), how do they know where we’re going? As usual, economists at investment banks and consulting firms are quick to escape the trap of metrics and indices. The tricky part is that none of these have been tested against early supply chain seizures in similar circumstances, because without any events, while you can observe the results, it’s hard to figure out the exact cause.

The general implication of most indicators is that stress and shortages look like they peaked at the end of last year and then declines, but in fact have stagnated.One of the most complex measures comes from the Federal Reserve Bank of New York, described in this blog post, which combines the cost of goods (air, container, and bulk) with the manufacturer’s lead time, backlog, and inventory.

Importantly to us, the Fed’s measures also attempt to correct the effects of increased demand in order to isolate only the supply side. On the other hand, it is as good as the data you plugged in, and using the Baltic Dry Index as an indicator of bulk shipping costs will be of concern to the shipping industry. long term warning It will rebound sharply due to short-term factors.

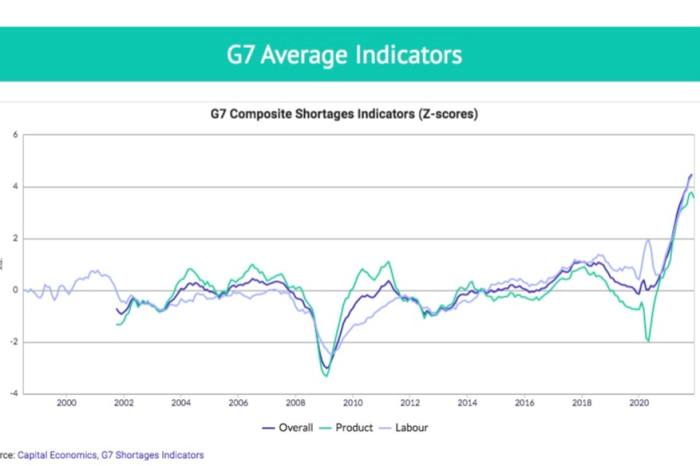

Consultancy Capital Economics created a measure for G7 economies that also includes labor market shortages that, by their measure, are more worrisome than product market shortages late last year.

In November, the White House created its own “Dashboard” indicator, but it seems to be mainly for supporting narrative President Joe Biden saves Christmas by keeping the ports running. (Scott Lincicome of the Cato Institute provides a detailed rebuttal to the case here.)

The correlation between these indices and actual movements in trade volumes and prices remains unproven. We’ll be interested in a future article linking the index to changes in inflation, promised by economists at the New York Fed. However, the data on trade in goods is lagging and fluctuating, which is easy to correct. Global trade contracted in the third quarter of last year, but a useful monthly index from Dutch research institute CPB showed that Restoration in October Calculated on monthly and three-month moving averages.

You also need to be very careful when looking at narrow range of high frequency data points. As you can see from the White House dashboard, to the untrained eye, the notorious West Coast port chaos was resolved in December due to a sudden plunge in container volumes at the port. In fact, it’s a new system that charges carriers for containers that stay at the terminal for more than 8 days: the port is still congested. The number of ships parked near these ports has similarly dropped, but only because the new queuing system requires them to wait 150 miles at sea. (you can go facebook page If you have time, try to understand a diagram like this. )

We will continue to monitor all of these supply chain metrics, and hat To all economists trying to understand this. But we must remember that we are trying to set a course in uncharted territory that we are charting.

Chartered Waters

China’s trade surplus soars to highest level on record Last year, a continued boom in exports helped offset the loss of momentum in the country’s broader economy.

Data released on Friday underscored China’s dominance of global trade in the era of the coronavirus, during which it has manufacturing Benefit from the shift from service to commodity consumption around the world.

trade link

Lockdowns and restrictions imposed by China’s zero-tolerance policy on the new coronavirus may pose a greater risk of disruption than in the early days of the pandemic, British “Financial Times” report.

Claire Jones of the Financial Times explain how Germany’s reliance on manufacturing makes it particularly vulnerable to supply chain disruptions.

China’s trade surplus soared last year As global commodity demand recovers.

Trade Specialist Podcast from the Center for Strategic and International Studies look at Recent developments on climate and trade, including proposed changes to the EU carbon boundary adjustment mechanism.

an unusual Covid-related border dispute English football club Chester FC has been threatened with legal action for allowing fans to watch matches. Its stadium straddles the England-Wales border, where lockdown restrictions are tighter.

[ad_2]

Source link