[ad_1]

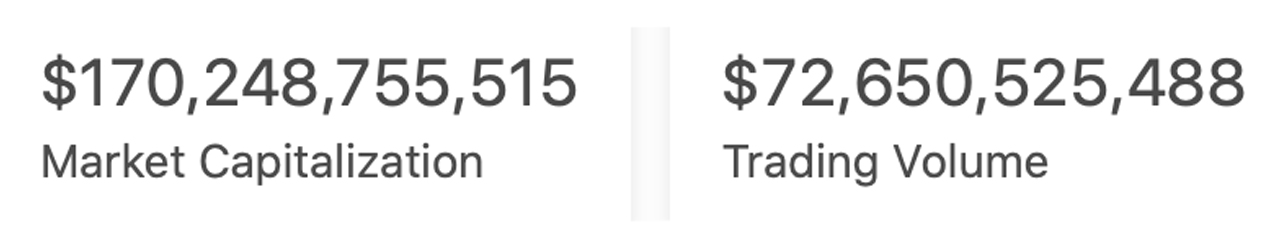

As the value of crypto assets has grown substantially over the past year, so has the growth of the stablecoin economy, with $170.24 billion worth of stablecoins in circulation today. Data shows that the valuation of a large number of stablecoins has grown exponentially over the past 12 months.

12-month statistics show substantial growth in stablecoin market valuations

Last year, many cryptoassets hit all-time high (ATH) prices as current data highlights the crypto-economy’s remarkable growth in 2021. Additionally, fiat-pegged tokens, commonly referred to as stablecoins, have also seen huge growth as centralized custodians and decentralized protocols have issued billions of tokens since last year.

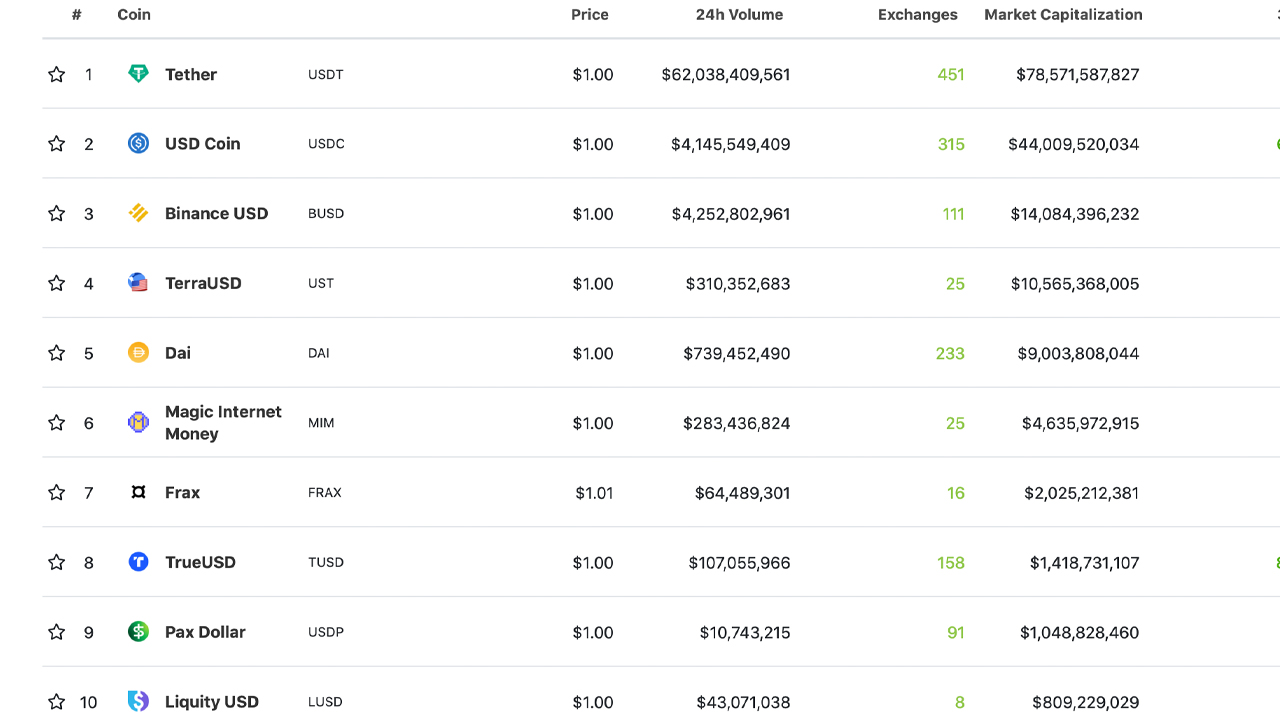

For example, on January 11, 2021, tether’s (USDT) has a market cap of $24.4 billion, up 221.31% since last year. The U.S. dollar coin (USDC) is the second-largest stablecoin asset by market capitalization, with a market cap of $4.4 billion on the same day last year. Today, USDC’s market cap is $43.9 billion, an increase of 897.72%.

The stablecoin issued by Binance (BUSD), which had a market cap of just $1 billion a year ago, is now at $14 billion, up 1,300% from last year. Terra’s stablecoin, UST, had a market cap of $138 million on January 11, 2021, and today has a market cap of $10.5 billion.

Fiat-pegged token market cap jumps above most crypto gains in past year

Makerdao’s DAI tokens increased from $1.3 billion to $9 billion today, a 592.30% increase over last year. MIM, also known as Magic Internet Money, is a stablecoin less than a year old, but the 6th largest stablecoin in existence.

MIM launched in September 2021 with $5.4 million, and today, MIM has a market cap of $4.6 billion. Also, the stablecoin frax (FRAX) currently has a market cap of $2 billion, but last year it was only $92 million.

It’s safe to say that some of the dollar-pegged tokens that have seen huge gains over the past year have grown more in market capitalization than traditional cryptoassets like Bitcoin or Ethereum.

Currently, stablecoins make up 8.24% of the entire crypto-economy and are worth just over $2 trillion. In the past 24 hours, stablecoin global trading volume was about $72.6 billion, accounting for 61.94% of the $117.2 billion trading volume in the entire crypto-economy today.

tags in this story

What do you think of the stablecoin market cap that grew by 500% to 1,300% last year? Let us know what you think about this topic in the comments section below.

Jamie Redman

Jamie Redman is Head of News at Bitcoin.com News and a fintech reporter living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He is passionate about Bitcoin, open source code and decentralized applications. Since September 2015, Redman has written over 5,000 articles for Bitcoin.com News on the disruptive protocols emerging today.

Image Source: Shutterstock, Pixabay, Wiki Commons, Coingecko, tradingview,

Disclaimer: This article is for reference only. It is not a direct offer or invitation to offer, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned herein.

[ad_2]

Source link