[ad_1]

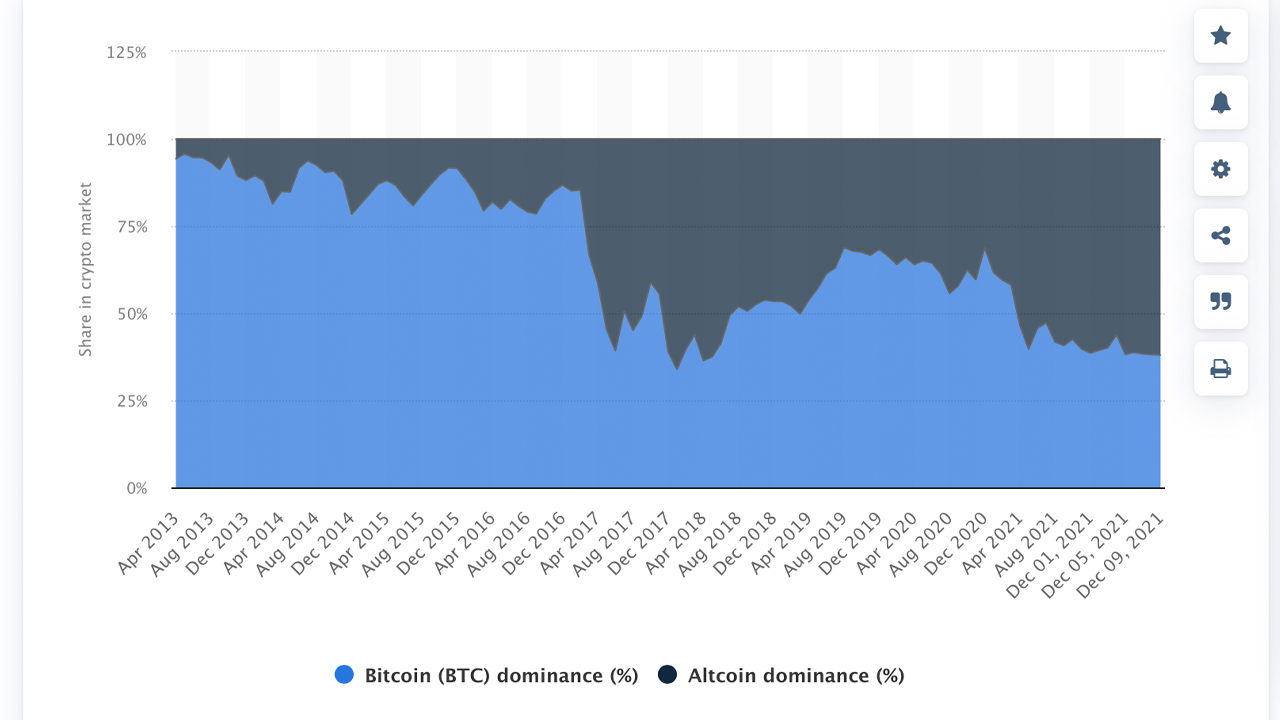

Since June 3, 2018, Bitcoin’s dominance has fallen to its lowest level in three and a half years, at 37%. At the end of March last year, Bitcoin’s dominance hovered in an area slightly higher than 60%, but since then, the market value of many digital assets has swelled and has taken a prominent position in the market ranking in the process.

Bitcoin dominance drops below 38%

The crypto economy currently has approximately 12,247 crypto assets traded on 542 exchanges around the world. The crypto market has fallen by more than 7% in the past 24 hours, falling to a low of $2.16 trillion by 8 am (Eastern Time).

Although people regularly measure the market value of a single crypto market, Bitcoin’s market valuation advantage compared to other market values ??has been measured since the existence of multiple crypto markets.

In the first few years, Bitcoin In terms of market value advantage, the advantage is much higher than the 90% range. The dominance recorded during May 2013 was even more so, when Bitcoin The dominance rate is 94%.

This is measured against crypto assets such as namecoin, novacoin, litecoin, terracoin, feathercoin, and freicoin. From May 2013 to February 2017, Bitcoin’s market dominance remained above 80%.

However, since February 26, 2017, Bitcoin has not been able to recover above 80% of the region. Only a year ago, in January last year, it managed to reach 70%.

11 tokens other than Bitcoin and Ethereum control more than 20% of the crypto economy

BitcoinThe dominance of is currently declining at a rate of 37.7%, while Ethereum (Ethereum) Accounted for 18.6%. Although Ethereum is a powerful enemy, many other cryptocurrency caps have entered Bitcoin’s dominance.

Tether, Binance Coin, solana, USD, cardano, and xrp account for more than 15% of the $2.18 trillion crypto economy. The above coins, plus terra, polkadot, avalanche, dogecoin and shiba inu, are equivalent to 20.63% of the crypto economy.

All of these tokens, including Ethereum and the removal of SHIB, account for more than 1% or more of the dominance of the crypto market’s valuation.From January 2021, when BitcoinThe dominant position is 70%, and countless altcoins have been closely following the market value of Bitcoin.

Tags in this story

What do you think of Bitcoin’s low dominance today? Please tell us your thoughts on this topic in the comments section below.

Jamie Redman

Jamie Redman is the head of news at Bitcoin.com News and a fintech reporter living in Florida. Since 2011, Redman has been an active member of the cryptocurrency community. He is passionate about Bitcoin, open source code and decentralized applications. Since September 2015, Redman has written more than 5,000 articles for Bitcoin.com News about destructive protocols emerging today.

Image Source: Shutterstock, Pixabay, Wiki Commons, Statista,

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link