[ad_1]

SBI Group, a financial services company group headquartered in Tokyo, Japan, announced the launch of an encrypted asset fund composed of seven different digital currencies. The crypto funds launched by the Japanese company include Bitcoin, Ethereum, XRP, Litecoin, Bitcoin Cash, chainlink and polkadot.

SBI Group’s new crypto fund utilizes 7 different digital assets

Three months ago, SBI Holdings, commonly known as SBI Group disclose The company is planning to launch a crypto asset fund.At that time, SBI stated that the new fund will be launched at the end of November, but the official press release Publish December 17.In addition to press announcements, SBI also released more Detailed summary Digital currency fund.

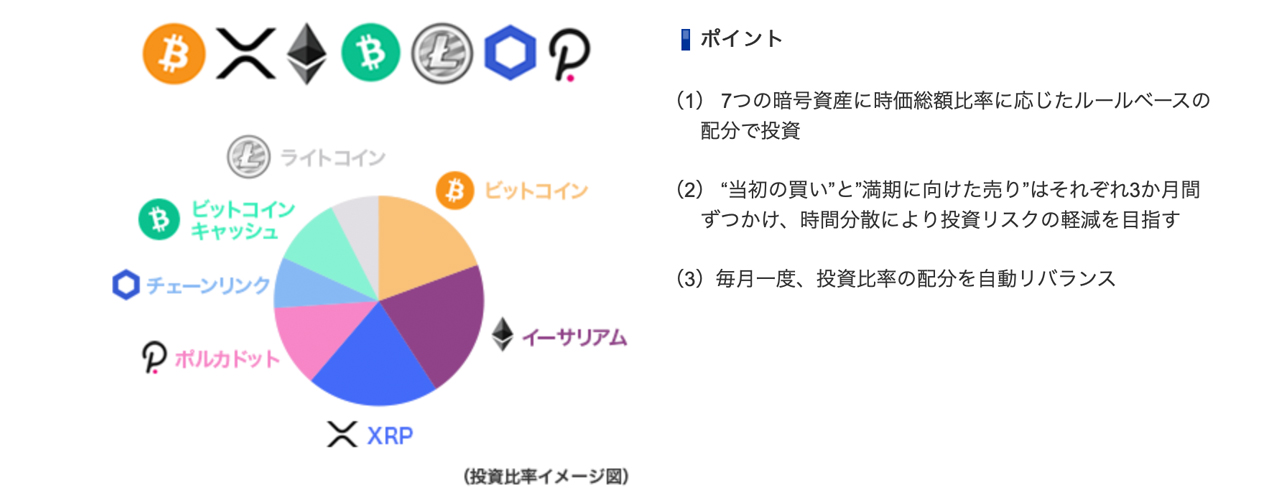

SBI’s crypto funds include Bitcoin (BTC), Ethereum (ETH), Polka (point), Link (LINK), Litecoin (LTC), Ripple (Ripple), and Bitcoin Cash (BCH)The financial services company called it “Japan’s first cryptocurrency fund for ordinary investors.” The press release explained that Japanese investors need to “fully understand the nature of crypto assets and the risks associated with crypto asset investments.”

The application period for investing in SBI’s new crypto fund is from December 17, 2022 to January 31, 2022. The fund will be managed in the name of SBI alternative fund GK. The press release further explained that assets can be rebalanced after maturity in the future, but for now, the ratio of each cryptocurrency in the fund is about 20% or less . The SBI Group’s new crypto fund contract is valid from February 1, 2022 to January 31, 2023.

SBI Alternative Fund “Aims to reduce investment risk through time diversification”

SBI has been involved in the cryptocurrency field for many years developing All types of products.Company owned cooperate With Ripple, it get UK-based crypto services companies B2c2 and SBI cooperating Cooperated with Boerse Stuttgart in 2019 to provide encryption services in Europe and Asia.Compared with earlier cryptocurrencies, Japan’s Encryption regulations Becoming stricter, greatly slowing down the launch of SBI’s crypto fund.

SBI’s press release explained: “It takes 3 months for’initial buying’ and’sell at expiration’ to each.” “It aims to reduce investment risk through time diversification. Automatic rebalancing of investment ratio allocation once a month ,” the financial institution’s announcement added.

SBI’s new crypto fund has its own Web portal According to reports, the fund was established on December 2, 2021. Interestingly, the SBI press release issued on Friday mentioned the possibility of SBI Group dealing with the “Bitcoin Futures ETF” and further mentioned the “widespread use of NFTs (non-fungible tokens)” using blockchain technology. “

Tags in this story

What do you think of SBI’s new crypto fund? Please tell us your thoughts on this topic in the comments section below.

Jamie Redman

Jamie Redman is the head of news at Bitcoin.com News and a fintech reporter living in Florida. Since 2011, Redman has been an active member of the cryptocurrency community. He is passionate about Bitcoin, open source code and decentralized applications. Since September 2015, Redman has written more than 4,900 articles about destructive protocols emerging today for Bitcoin.com News.

Image Source: Shutterstock, Pixabay, Wikimedia Commons

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link