[ad_1]

The value of the crypto economy has been declining this week. In the past 24 hours, it has lost 2.5% to $2.3 trillion. Bitcoin, the leading crypto asset, has fallen 4.8% in the past 7 days, and Ethereum has fallen 11.7% last week. The downward spiral has made cryptocurrency advocates question whether the bull market is over and whether the bear market has already begun.

The bear market continues to depress the crypto economy

After hitting a record high on November 10, the crypto-asset economy has depreciated sharply and will continue to decline every few days. After reaching $69,000 per unit on November 10, Bitcoin (BTC) In the six days and more than two weeks after that, I managed to stay above the $60,000 area, Bitcoin Try to stay in the area above $50,000. After falling below US$50,000 on December 4, it hit a low of US$43,972 per unit on the same day, but it has managed to rise above the US$47,000 area.

still, Bitcoin (BTC) It was 149% higher than this day last year. However, monthly statistics show that Bitcoin has fallen by 26.1% and more than 30% from its all-time high. The second largest crypto asset, Ethereum (ETH), Fell 11.7% this week, 30 days statistics show Ethereum It fell by 17.5%.Similarly, Ether is still rising year-to-date because the price per person Ethereum It is more than 550% higher than the same period last year. Crypto assets are below the $4,000 area and are currently changing hands at a price of $3,845 per ether.

Bitcoin fell below the 200-day moving average, analysts say it will fall further

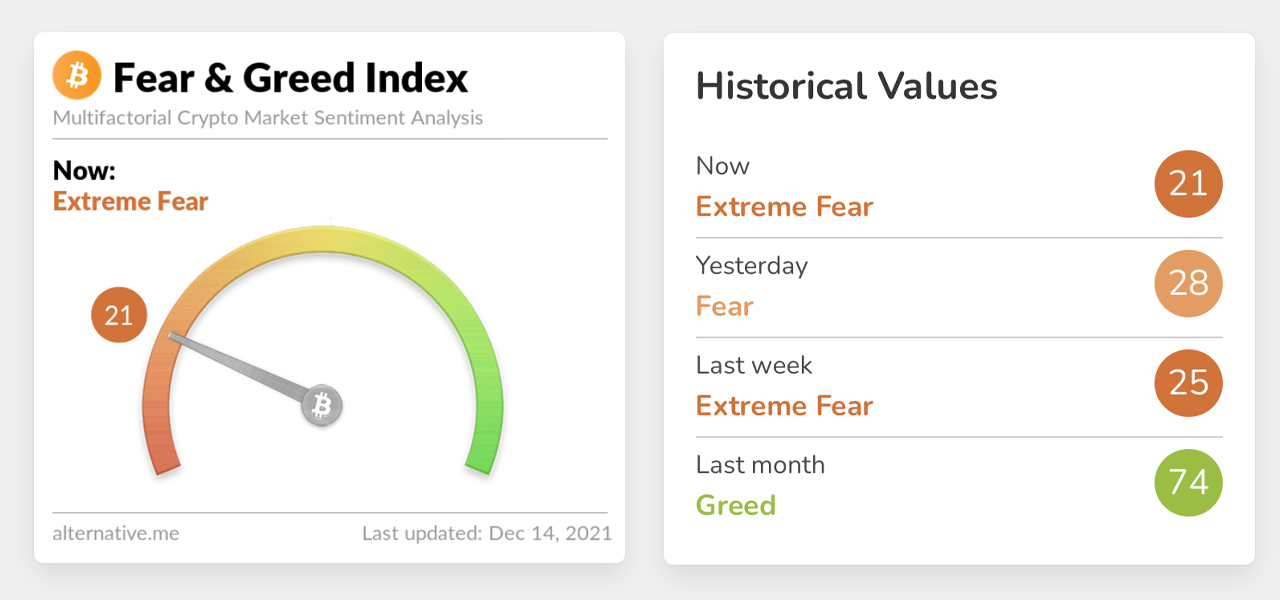

In a conversation with Alex Kuptsikevich, Fxpro’s senior market analyst, Kuptsikevich told Bitcoin.com News that the cryptocurrency market “was under tremendous pressure on Monday afternoon.”In addition, the Crypto Fear and Greed Index Kuptsikevich said: “It is not easy to determine the trigger point of the new wave, but after the two major cryptocurrencies gave up their key positions, it intensified and expanded.”

“At the time of writing, Bitcoin has fallen below its 200-day average and traded at less than $47,000. Excluding the intraday drop on December 6, this is the lowest value since the beginning of October. The peak level more than a few months ago fell by a third,” the analyst further added. “In general, the 69k high is the starting point of the pressure on BTCUSD. If the decline develops, it is worth paying more attention to the 40k and 30k levels, which are important levels for Bitcoin before it turned upward.”

Fxpro’s senior market analyst continued:

The entire crypto space is in a bear market. Their total capital is already more than 30% below the peak, and attempts to integrate beyond the critical level have failed. Last summer, the interest of cryptocurrency investors returned after capitalization fell by more than half. This indicates that it is possible to further decrease by 30% from the current level.

Co-founder of Huobi Group: “Bitcoin needs to break through the downward trend line”

The analyst said in a conversation with Du Jun, co-founder of Huobi Group Bitcoin After falling, it began to stabilize, focusing on the support of 47,000 US dollars.

“According to data from Huobi Global, Bitcoin At noon, it maintained a sideways shock. The upper edge of the shock range was $47,500 and the lower edge was $46,200,” Du Jun told Bitcoin.com News. “From the 4-hour horizontal candlestick chart, the price started to stabilize after last night’s decline. , The fulcrum of the current shock is near the price low on December 11, which can be seen as a short-term test support level. “

The co-founder of Huobi Group concluded:

At the daily level, today is a longer solid cross negative, and the price low has a clear downward trend. The price is currently in a weak position. Stabilizing 47,000 can only make the downtrend temporarily. To counterattack, you need to break the downtrend line and the 50800 gear.

Tags in this story

What do you think of Kuptsikevich’s assessment of the crypto economy and calling it a bear market? Do you think the crypto economy is in a bear market? Please tell us your thoughts on this topic in the comments section below.

Jamie Redman

Jamie Redman is the head of news at Bitcoin.com News and a fintech reporter living in Florida. Since 2011, Redman has been an active member of the cryptocurrency community. He is passionate about Bitcoin, open source code and decentralized applications. Since September 2015, Redman has written more than 4,900 articles about destructive protocols emerging today for Bitcoin.com News.

Image Source: Shutterstock, Pixabay, Wikimedia Commons

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link