[ad_1]

Since mid-November, the total locked-in value (TVL) of decentralized finance (defi) has fallen from US$257 billion to US$250.55 billion, and has lost more than 5% in the past 24 hours. In the past 7 days, defi tokens like uniswap, pancakeswap, curve dao tokens, 1inch and Sushi have lost value between 15% and 23.9%.

Defi TVL drop — Curve, Makerdao and Convex Finance dominate

At the time of writing, the TVL in the defi protocol in countless blockchains is $250.55 billion. index From defillama.com. The total defined value locked in the last day lost 5.08%, and the agreement curve dominated most of the listed TVLs with an advantage of 8.07%.

The total value of Automated Market Maker (AMM) Curve was US$20.23 billion, up 1.13% last week. At the time of writing, Makerdao is the second largest defi protocol TVL, valued at $18.56 billion. Currently the third largest defi agreement, TVL, belongs to Convex Finance, valued at US$15.14 billion.

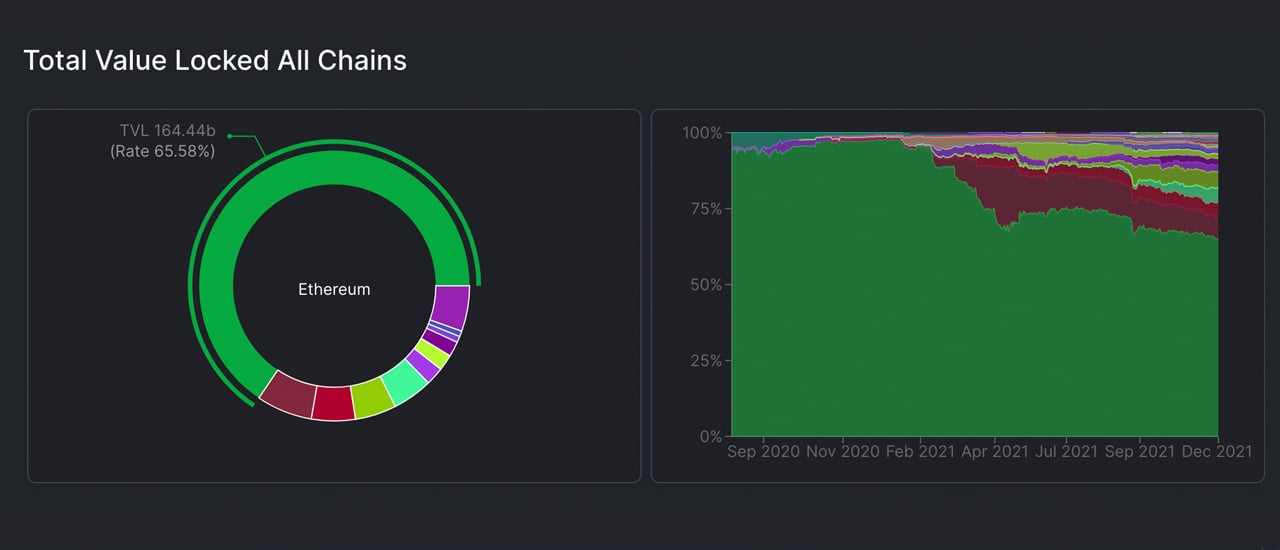

Ethereum Defi TVL Dominance 65%, Binance Smart Chain 6%, Terra 5%

TVL for each blockchain It shows that Ethereum accounted for $164.36 billion in the defi of $250.55 billion on Sunday. Binance Smart Chain (BSC) has revenues of USD 16.61 billion, which is the second largest chain in terms of defi protocol TVL.

The BSC is followed by Terra ($13.29B), Avalanche ($12.03B), Solana ($12.46B) and Tron ($5.48B). At the time of writing, Ethereum accounts for 65.58% of the value of $250.55 billion locked in defi. Although BSC has an advantage of 6.62%, TVL in Terra occupies 5.30%.

Rebase and AMM Defi token slides ——Crosschain Bridge TVL fell by 26% in 30 days

Statistical data According to data from coingecko.com, the total market value of top automatic market maker (AMM) defi tokens dropped by 13.6% to $17.2 billion. also, index Shows that the rebase token fell 5.1% on Sunday to a low of $6.09 billion.

In the past 7 days, the top AMM crypto asset Uniswap (UNI) has fallen by 15%. Uniswap is followed closely by pancakeswap (16.7%), curve dao token (27.2), 1inch (26.3%), sushi (23.9%) and bancor token (10.1%).

Last week, Rebase tokens such as Olympus (OHM) fell 17.1%, while Wonderland (TIME) fell 18.5%. Klima dao (KLIMA) has fallen by 50.6% in the past 7 days, and ampleforth (AMPL) has fallen by 17.7%.

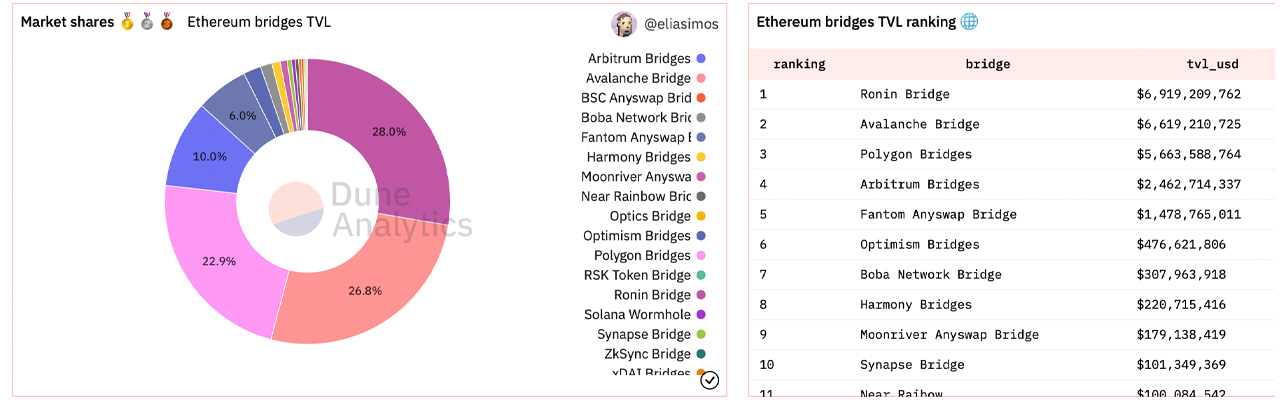

According to data from Dune Analytics, monthly statistics show that cross-chain bridge TVL has fallen by 26.9%, and today, the bridge TVL of Ethereum has reached 24.4 billion U.S. dollars. The leader is Ronin Bridge with US$6.9 billion, Avalanche with US$6.6 billion, and Polygon with US$5.6 billion.

Tags in this story

What do you think of the state of decentralized finance (defi) today? Please tell us your thoughts on this topic in the comments section below.

Image Source: Shutterstock, Pixabay, Wikimedia Commons

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link