[ad_1]

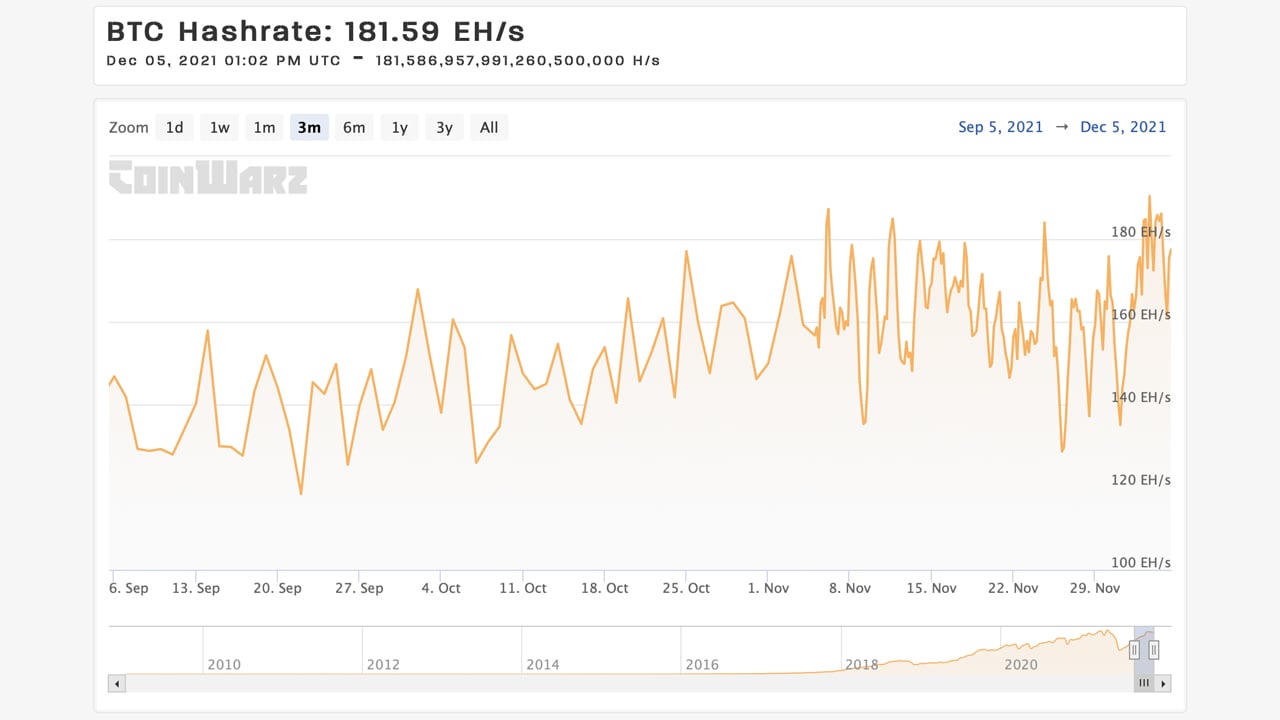

Even if the price of leading crypto assets fell below the $50,000 price range, Bitcoin’s hash rate increased significantly. Eight days ago, the network hash rate was sliding at a rate of 168 exahash (EH/s) per second, an increase of 7.73% last week, reaching today’s 181 EH/s.

Bitcoin’s hash rate climbs after difficulty decreases

As the price fell below the $50,000 area, Bitcoin (Bitcoin) The computing power remains strong and has increased by more than 7% in the last week. At the time of writing, BitcoinThe hashrate on Sunday is 181.59 EH/s Because the processing power of the network has reached a daily high.

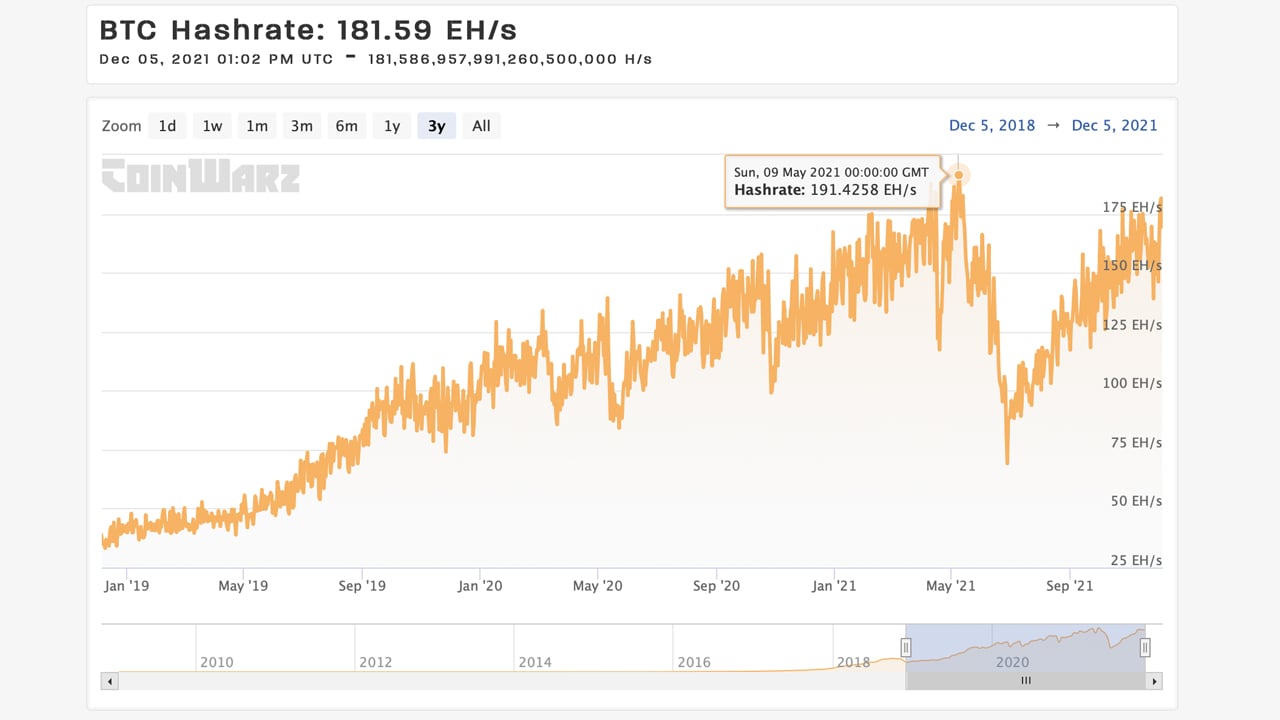

The three-month statistics show BitcoinOn Friday, December 3, its computing power reached 190 EH/s. Indicators show that the computing power of the network reached a record high of 191.42 EH/s on May 9, 2021. Despite the recent price drop, one reason the hash rate is still high is that during the last difficulty change on November 28, the mining difficulty of the network has dropped.

The changes seen that day BitcoinFirst Difficulty of mining Decline since July 17. The difficulty dropped 7 days ago, reducing the mining difficulty by 1.49% BitcoinThe current difficulty is 22.34 trillion. According to the current processing capacity, the next difficulty is estimated to increase by 1.17%, reaching the possible 22.6 trillion.

Nearly 20 Exahash’s invisible miners consume a large number of blocks for 50 consecutive days

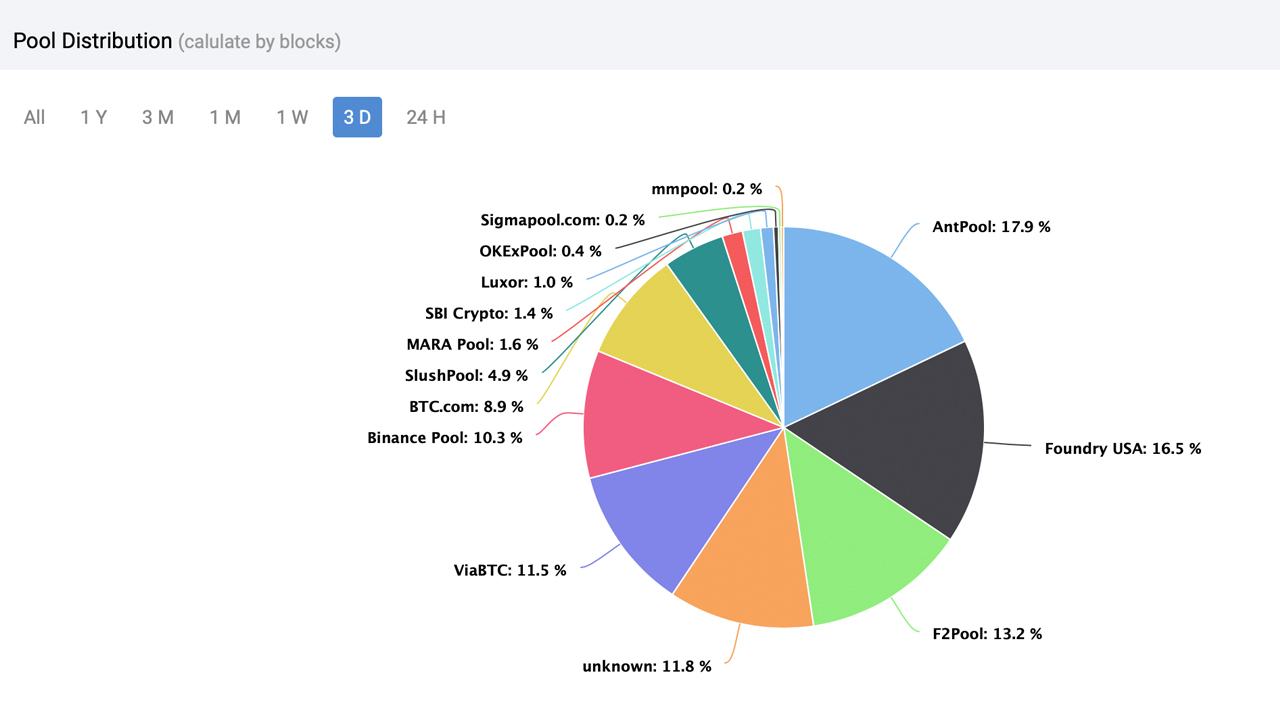

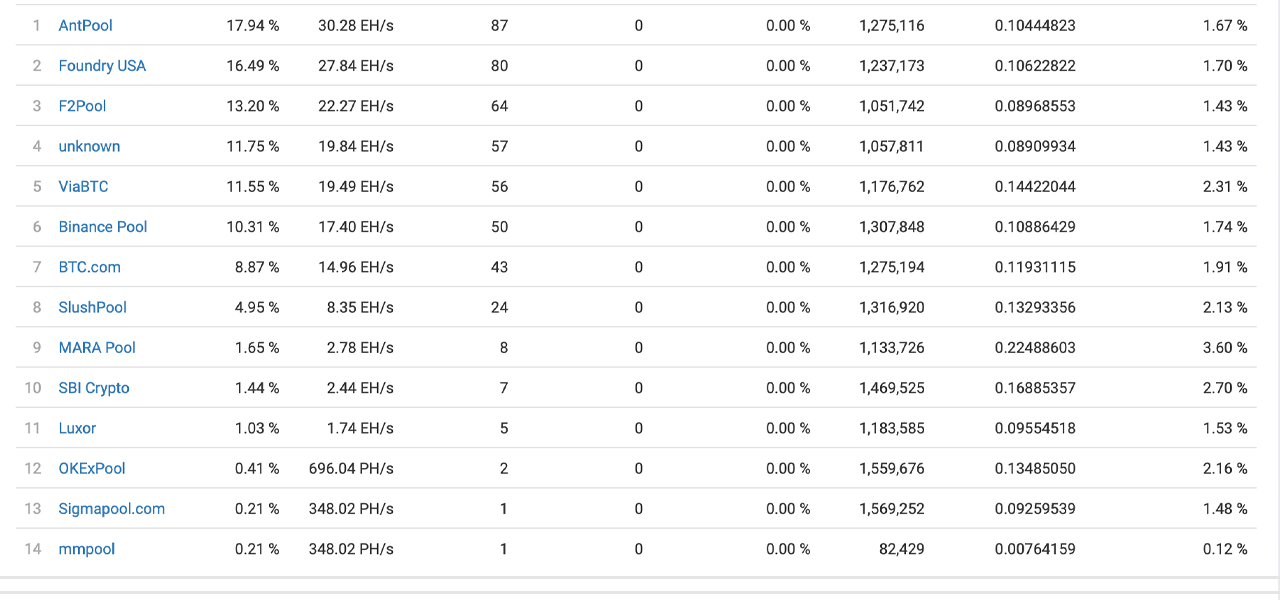

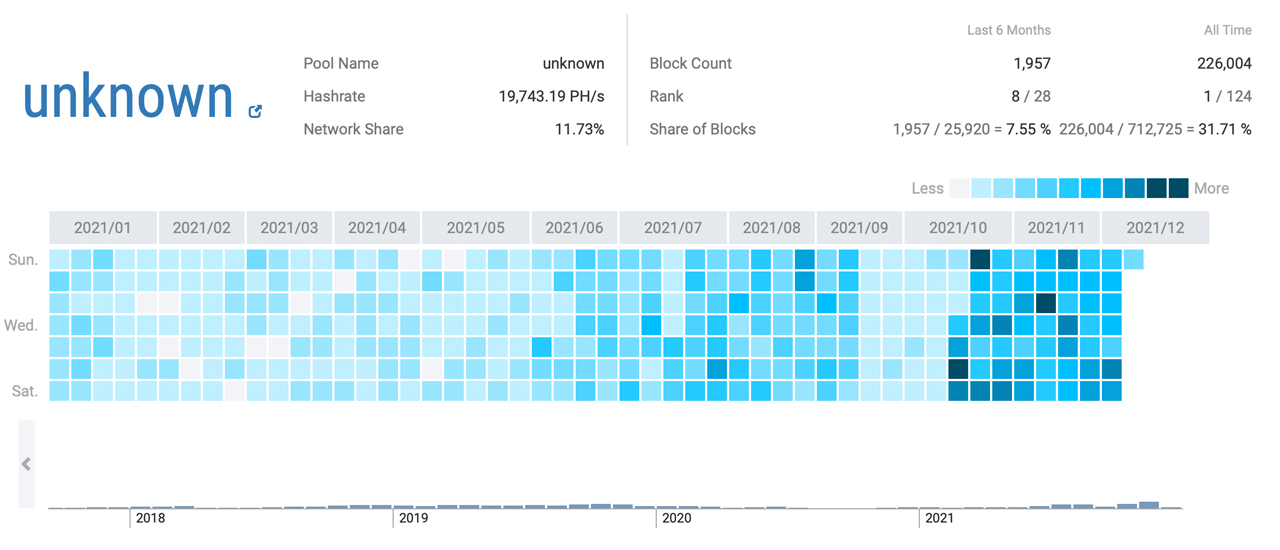

only 13 known pools Dedicated SHA256 computing power to the Bitcoin blockchain and unknown computing power, also known as Invisible miner Control 11.75% (19.84 EH/s) of network computing power.

Bitmain’s Ant Pool is the largest miner in the network today, accounting for 17.94% (30.28 EH/s) of the computing power. The second largest mining pool on December 5 was Foundry USA, which had a computing power of 16.49% or 27.84 EH/s. Just above Foundry USA is F2pool, which controls 13.20% of the computing power or 22.27 EH/s.

From mid-October to now, a group of unknown computing power or stealth miners have been prominent on the network.For 50 consecutive days, a large amount of unknown computing power has been consumed Bitcoin Piece.

Since 2009, invisible miners have discovered 226,000 Bitcoin Block rewards. In the past six months, 1,957 blocks were discovered with unknown hash rate.

The computing power comes from many regions around the world, mainly from the United States, Kazakhstan, the Russian Federation, Canada, Ireland, Malaysia, Germany, Iran and other countries.

Tags in this story

Despite the recent price drop, what do you think of the increase in Bitcoin’s computing power after the difficulty is reduced? Please tell us your thoughts on this topic in the comments section below.

Image Source: Shutterstock, Pixabay, Wiki Commons, Btc.com, Coinwarz.com,

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link