[ad_1]

The real estate price pandemic has spread all over the world. From Turkey to New Zealand, from Russia to Australia, house prices have soared in the past year.

According to research by real estate agent Knight Frank, overall, in the 12 months to the end of June, house prices in 55 countries/regions rose by 9.2%. Developed countries lead with a growth rate of 12%, far ahead of developing countries’ growth rate of 4.7%.

The price surge is the result of central banks releasing large amounts of cheap funds to the market. This is their concerted contribution to helping the global economy avoid disaster during the Covid-19 outbreak. These funds help to reassure investors that asset prices will stabilize in the face of the economic shock of the pandemic.

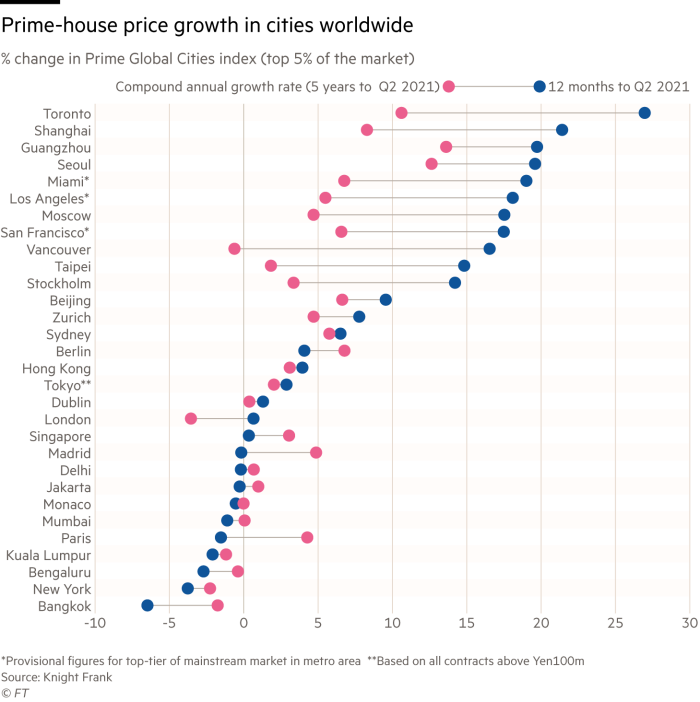

However, as shown in the chart, the rise mainly bypassed London and New York, as well as other leading global cities such as Tokyo, Hong Kong and Paris. Although prices in these cities are at historical highs, they are still at historical highs. Instead, gains occurred in the centers where investors saw opportunities to catch up: San Francisco, Los Angeles, and Toronto, as well as Shanghai, Seoul, and Moscow, for example.

In some cases, expats have been buying real estate in their home countries, usually because they fear that in the post-pandemic world, moving around the world may be more difficult. Along with them are domestic and foreign investors, including many wealthy families motivated by ultra-low interest rates. Add to their real estate portfolio.

How much can the price rise? There are signs that the continued appreciation of real estate and financial asset prices may now be accompanied by more general price increases, triggered by the economic recovery after the pandemic and the re-emergence of various commodity shortages. Microchip arrive truck driver.

The central bank governor initially insisted that the price increase was temporary. However, they don’t seem to be sure now. The surge in energy prices and the echoes of the 1970s are disturbing, when oil supply shocks triggered years of continuous inflation. At the same time, labor shortages are fueling wage increases, and wage increases tend to spiral upward as companies compete with each other for employees.

All of this has put pressure on the central bank to raise interest rates from the ultra-low levels for most of the past decade. All other things being equal—it’s undeniable that they are very few—this will weaken the surge in real estate prices. As Knight Frank said: “Despite strong price growth, there are signs of weakness in demand in some markets.”

What happens next depends on how you raise interest rates. Financial traders are betting on a gradual increase, which is the least likely to undermine confidence. This is the possible goal of the central bank. For years, they have been tirelessly boosting economic growth at near-zero interest rates, and if it can be avoided, they are unlikely to change gears suddenly.

But there is a risk that central banks may be forced to take unexpected harsh actions, especially if their response proves to be too long.

Nevertheless, it seems obvious that no matter how volatile the market, most of us seem to have an innate love for physical assets, starting with having a place we can call home.

For the rich, the attractiveness of property is particularly noticeable. Wealth management companies say that wealthy people invest about a third of their assets in real estate, and in Asia, this number has risen to nearly half. They like to make homes in major cities, seaside resorts and ski villages. They buy apartments near famous private hospitals and first-class schools and universities.

Changes in interest rates may affect the timing of such purchases and the price paid, but the basic attractiveness has not diminished.

Stefan Wagstyl is the editor of FT Wealth and FT Money. Follow Stefan on Twitter @stefanwagstyl

This article is part of Financial Times Fortune, An in-depth report on philanthropy, entrepreneurs, family offices, alternative investments and impact investing

[ad_2]

Source link