[ad_1]

Although supply chain disruptions, rising energy costs and rising wages have led to a surge in inflation, and the rebound in Covid-19 cases has dampened market sentiment, business activity in the Eurozone has picked up this month.

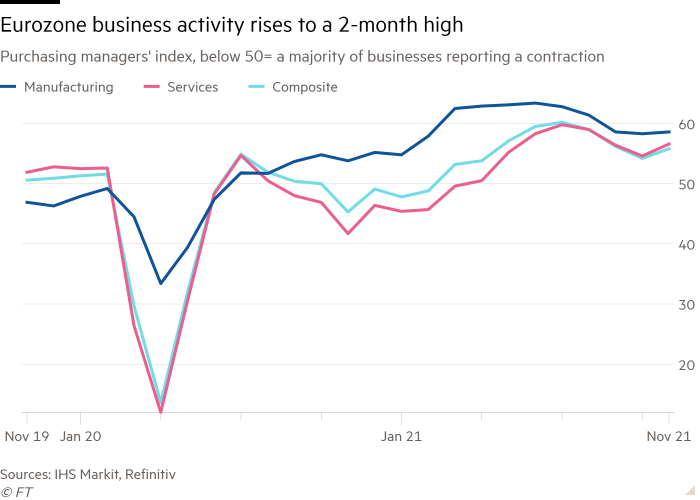

The Eurozone IHS Markit Comprehensive Purchasing Manager Survey is a monthly survey that grasps the pulse of business activities. It shows that the cost and average selling price of goods and services have risen at the fastest rate since the survey began in 1998.

Companies report that shortages are pushing up the prices of many goods and services, while increasing transportation costs, rising energy prices and increasing staff costs. As companies seek to pass on higher costs to customers, especially in Germany, sales price inflation in the manufacturing and service industries has also accelerated to the fastest level recorded in the survey.

However, the Eurozone IHS Markit Comprehensive Purchasing Managers Index, which measures economic health, unexpectedly rose from 54.2 last month to a two-month high of 55.8 in November.

This figure is based on data collected from November 12 to 19, which is stronger than the forecast of economists surveyed by Reuters to drop to 53.2, reflecting higher-than-expected data in Germany and France.

Official data released by Eurostat earlier this month showed that the Eurozone’s overall inflation rate rose to 4.1% in October, the fastest growth rate since the establishment of the monetary union. Tuesday’s data indicated that November will increase further.

Isabel Schnabel, a member of the European Central Bank’s board of directors, told Bloomberg that although it is “reasonable” to assume that inflation is lower than the ECB’s target of 2% in the medium term, inflation risks are “biased to the upside”.

Capital Investment’s macro economist Jessica Heinz said that the unexpected rise in the Eurozone’s comprehensive PMI in November “shows that the region’s recovery has not lost further momentum”, but added that “because the supply shortage is still severe, the new crown pneumonia epidemic The tightening of restrictions and price pressures on the index seem likely to intensify and fall again.”

IHS Markit’s Chris Williamson said that the strong expansion of business activity in November “is unlikely to prevent the Eurozone from suffering a growth slowdown in the fourth quarter.” He added that due to supply delays, soaring costs and renewed fears of the new crown virus , Business optimism has fallen to its lowest level since January, “increasing the near-term downside risks to the euro zone economy.”

The survey showed that the service industry outperformed the manufacturing industry for the third consecutive month, setting the strongest activity growth in three months.

Driven by strong demand for technology equipment, household goods, and food and beverages, the manufacturing industry has also seen growth. In contrast, the automotive industry, which has been severely affected by supply chain disruptions, has seen production declines for the third consecutive month hindering growth.

Among manufacturers in the entire Eurozone, due to supply shortages and transportation issues, supplier delivery times have increased at one of the fastest rates on record, only a slight slowdown from October.

Companies continue to recruit workers quickly, but they still have a backlog of jobs, especially in German factories.

Growth in Germany and France accelerated, with the latter recording the largest increase in service activities in the past four years, offsetting the impact of the second consecutive month of decline in factory output. Markit also reported that the manufacturing and service industries in the rest of the region are growing faster than France and Germany.

Schnabel of the European Central Bank said that stricter Covid restrictions “may have a easing effect on activities in the short term”, especially in contact-intensive service industries. “But I don’t think this will undermine the overall recovery.”

[ad_2]

Source link