[ad_1]

Some bond bulls bet that the world’s largest fixed-income market will get rid of the impact of US inflation soaring to a 30-year high due to the long-term transformation of the US economy.

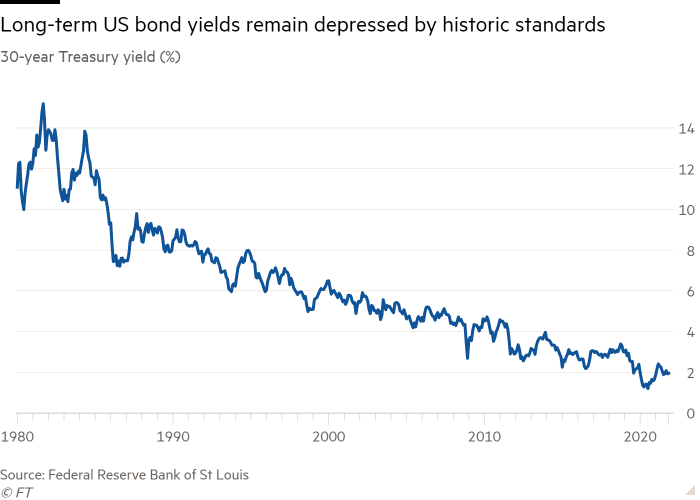

Data Display Consumer price Earlier this month, the U.S. Treasury bond market rose 6.2% in the year to October. However, despite the expected long-term price increase, the debt yield due in the next few decades is still far below the peak in 2021.

For some long-term bond bulls, the indifference of the market in the face of soaring prices—usually the kryptonite of debt investors—proves the view that inflation will not have a lasting impact on the market, when the economic recovery dust settles. , The pattern of low interest rates before the pandemic will remain basically unchanged.

“The important thing is not this week [gross domestic product] Print or next [consumer price index] Steven Major, head of fixed income research at HSBC, said that whether it is the print edition or the next Fed meeting, fundamentals are factors that drive long-term development. He believes that these fundamentals include the huge debt burden and aging population of the United States.

Robert Tipp, head of global bonds at PGIM, also said that in the long run, demographic trends and fiscal fundamentals will support the price of US government bonds—inversely proportional to yields.

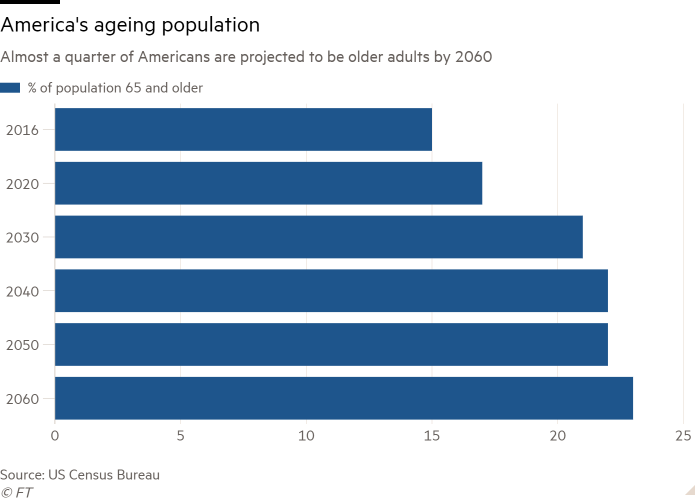

The argument made by the bulls is that Americans who are about to retire — a large and wealthy generation — will increasingly turn to low-risk investments that can provide a steady stream of income over a long period of time, such as national debt. This group is expected to grow rapidly in the next few years, with the proportion of Americans aged 65 and over rising from approximately 17% in 2020 to 21% in 2030. U.S. Census Bureau.

Some bond analysts believe that the debt burden that the United States has accumulated in recent years due to fiscal expenditures and tax relief is partly to support the US economy during the pandemic, and may also limit the possibility of future borrowing and further inhibit growth prospects. In 2020, the federal debt held by the public as a percentage of GDP reached 100% for the first time since World War II, and it is expected to continue to rise. Congressional Budget Office estimate.

These long-term trends are driving rising inflation and economic growth, both of which are pushing up yields on 10-year, 20-year, and 30-year bonds. Many investors who are betting that inflation will continue to rise are betting on long-term Treasury bonds.

For bond bears like Sonal Desai, chief investment officer of Franklin Templeton, there is no evidence that inflation will ease significantly. She pointed out that the Fed will continue to buy bonds next year, albeit at a slower pace than the peak of the pandemic, just as the government is deploying “another year of large-scale fiscal spending.”

“The overall policy is still very expansionary. So these factors combined make me think that inflation may continue for a long time,” Desai said.

The bond bull argument is not just about long-term trends—they believe that growth and inflation will not rise to levels that will change the course of these broad economic transformations. In terms of inflation, the bond bulls are in line with the Fed: they believe that although inflation is currently heating up, it is mainly driven by temporary forces such as supply chain disruptions.

Some investors who recognize the long-term volatility that Major and Tipp are concerned about say that they believe these trends are unlikely to be the main drivers of returns in the coming year.

Gregory Whiteley, portfolio manager at DoubleLine Capital, said that these long-term drivers “will continue to be a force to lower interest rates in the future, but in the short term, I will pay more attention to cyclical and technical factors that drive higher yields.” These include inflation. Rising, above-trend growth, and European and Japanese pension funds’ demand for US Treasuries.

Bond bulls believe that the Fed’s decision earlier this month to start slowing down its $120 billion monthly asset purchase program—which would snatch the largest buyer in the U.S. Treasury market—is unlikely to have a lasting impact on U.S. Treasury yields, and Point out the lack of any long-term correlation between bond supply and its price.

“So the argument for bond supply is that more bonds are coming. More supply brings the intuitive view that yields must rise,” Major said. “I don’t see any empirical evidence that this will happen. Frankly, I think this view is nonsense.”

Other investors are relatively relaxed about the Fed’s imminent exit, because this will happen when the US Treasury — and other large bond issuers around the world — reduce the scale of borrowing from the level reached during the worst of the pandemic.

“I don’t know if the reduction necessarily means a substantial increase in production, especially because the net supply in many places will not actually be more than in the past few years, despite the fact that purchases will cease,” said Isobel Lee, Global Bond Director at Insight Investment.

“We are not facing some kind of cliff edge,” she said.

[ad_2]

Source link