[ad_1]

Inflation in the United States has made many Americans worry about the future of their purchasing power, because the cost of goods and services is rising at a faster rate every month. The report points out that Americans are struggling to pay for childcare, groceries, gasoline, wood, medical supplies, and used cars. On Friday, Harvard economist Kenneth Rogoff told the media that inflation in the United States was “staggering” and that in terms of the direction of inflation, Rogoff emphasized that he believed that “we are in danger.” .

Members of the U.S. Central Bank begin to support reduction in asset purchases-reduction discussions may be held at the Fed’s December meeting

Friday, Reuters Report Policymakers at the U.S. Central Bank are publicly debating whether the Federal Reserve will reduce bond purchases and raise benchmark interest rates. Fed Governor Christopher Waller told the media on Friday that the scale-down should begin soon. Waller explained in New York: “The rapid improvement in the labor market and deteriorating inflation data have prompted me to tend to accelerate the pace of reduction and cancel the easing policy more quickly in 2022.”

Fed Vice Chairman Richard Clarida also talked about downsizing at the 2021 Asian Economic Policy Conference of the San Francisco Fed on Friday. “I will pay close attention to the data we have obtained between now and the December meeting, where it may be appropriate to discuss speeding up our balance sheet reduction,” Clarida emphasized. “This will be something to consider at the next meeting,” he added.

U.S. dollar purchasing power declines

After the U.S. government tried to ease the Covid-19 pandemic through blockade orders, shut down small businesses, and strangled the supply chain with coronavirus security measures, the United States experienced rising inflation. In addition, the government and the Federal Reserve have increased the US money supply in two years more than the country’s previous 242 years.

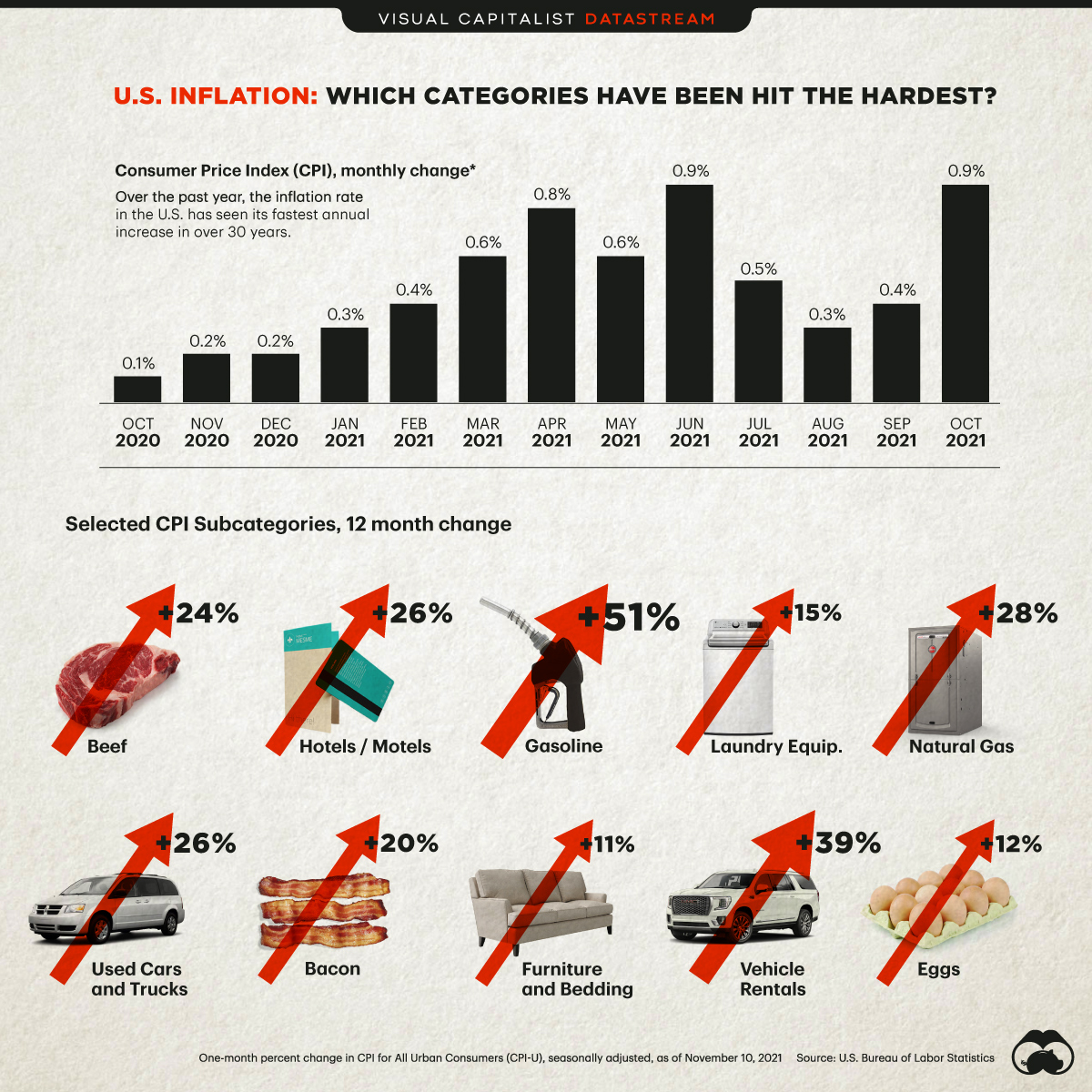

The dollar is no longer so expensive, because the cost of beef, hotel and motel accommodation, gasoline, laundry supplies, natural gas, eggs, car rental, furniture and used cars has risen. Soaring in the past 12 monthsIndicators from visualcapitalist.com show that the inflation rate in the United States has seen the largest increase in 30 years. In addition, the prices of fuel, transportation and meat products increased the most, rising from 24% to 39% in just one year.

Childcare and other expenses related to childcare are also surging Bars and restaurants are Fighting with inflation, Labor crisis and supply chain tightening occurred at the same time.Nationally, the price has been Rise to the highest In the Midwest and South of South Dakota, North Dakota, Nebraska, Iowa, Kansas, and Minnesota.

The mainstream media continued to claim that inflation is a good thing, reporters insisted that “news inflation driven by the rich”, MSNBC deleted the tweet, claiming that “the inflation we see now is a good thing.”

Despite rising inflation, mainstream media (MSM) headline News I have been telling the public for months such as “don’t worry about inflation.” The New York Times tried explain Inflation this week is “related to economic recovery” and the recent MSNBC Deleted tweets This claims, “The inflation we are seeing now is a good thing.”

Sarah Jeong, an American journalist who worked for The New York Times, Verge and Vice Media, was strongly opposed to her comments on inflation.

“Wow, the income of the working class keeps up or exceeds inflation, but my capital gains are not. Boo f ***ing hooooo,” Zheng Tell Her 118,000 Twitter followers.In another controversial statement, Zheng Tweet: “Everything you see about inflation in the news is driven by the wealthy people getting rid of their sh** because their parasitic assets are not as good as they want, and they are afraid of unemployment benefits + economic checks +15 minimum wage + labor shortage is the reason.”

Harvard Economist: In terms of the direction of inflation, “I think we are on the cutting edge.”

Americans spending more dollars on goods and services has already caused losses to people’s funds. Data shows that the so-called wage rise in the United States does not seem to keep up with the pace of inflation.There are already many report Present Verifiable data Shows that rising American wages cannot compensate for rising inflation.

On Friday, Harvard economist Kenneth Rogoff spoke on the radio show “Maria’s Morning”, the economist explain Inflation in the United States is “staggering.” The former IMF chief economist told Maria Bartiromo that he believed that in terms of inflation, “we are on the cutting edge” and that the Fed’s “temporary” forecast “has a 50-50 opportunity or less” is correct.

“I think it is obvious that the first stimulus measures after Biden takes office may be implemented by the end of 2020. [was] The game is a bit late,” Rogoff explained in an interview. “They exacerbated inflation, as well as the supply chain and everything else,” he added.

Tags in this story

What do you think of rising inflation in the United States and how politicians, Fed policymakers, and mainstream media experts are responding to these data? Do you think inflation will be “temporary” or will it last for a long time? Please tell us your thoughts on this topic in the comments section below.

Image Source: Shutterstock, Pixabay, Wiki Commons, The Intercept, Archive.org, visualcapitalist.com,

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link