[ad_1]

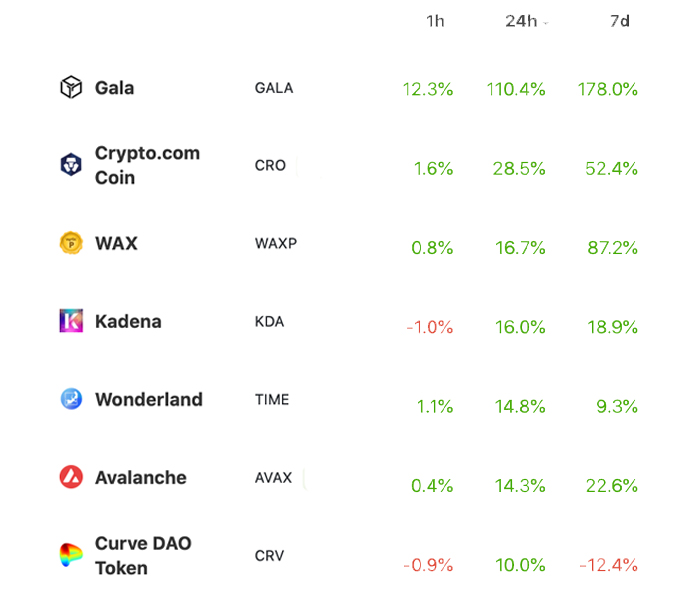

Although digital currencies like Bitcoin and Ethereum have depreciated by about 10% in the past 7 days, compared with the first two leading crypto assets, the decentralized finance (defi) economy has weathered the storm. In the past 24 hours, a large number of blockchain game coins, defi tokens and metaverse assets (such as Gala, crypto.com coins, wax, kadena, wonderland, and avalanche) have seen double-digit growth.

TVL in Defi defends against the storm of the crypto economy

Although Bitcoin (Bitcoin) Hovering above the $60,000 area during consolidation, the defi economy and many other crypto assets have achieved considerable gains. Statistics from defillama.com show that on November 9, the total lock-up value (TVL) in the defi agreement reached US$275 billion, but today it only dropped by 6.54% to US$257 billion. The defi agreement Curve occupies an 8% dominant position in the TVL of US$257 billion and US$20.63 billion.

Curve’s TVL is followed by Makerdao ($18.16B), Aave ($15.59B), Convex Finance ($15.34B) and WBTC ($14.66B). In terms of TVL in defi, the top three chains today include Ethereum (Ethereum), Binance Smart Chain (BSC) and Solana (SOL). Ethereum On Wednesday, $172.22 billion or 66.93% of the total TVL was captured in defi. BSC has 19.56 billion U.S. dollars or 7.60%, and SOL has 13.32 billion U.S. dollars or 5.17%.

7 The 24-hour increase of tokens reached double digits, the cross-chain bridge TVL fell 6.3% in 30 days, and Uniswap ranked first in the trading volume of Dex today

The biggest increase in the past 24 hours was the blockchain gaming currency event (GALA), which rose 110.4% today. Crypto.com coin (CRO) rose 28.5%, wax (WAXP) rose 16.7%, kadena (KDA) rose 16.0%, wonderland (TIME) rose 14.8%, avalanche (AVAX) rose 14.3%, curve dao token (CRV) ) Increased by 10%. The above seven tokens were the only tokens that achieved double-digit gains in more than 10,000 crypto assets on Wednesday.

Other notable gains include theta Fuel (TFUEL) up 8.3%, kucoin token (KCS) up 5.2%, nem (Watch) Rose 5.2%, polygon (MATIC) rose 4.8%, and iota (MIOTA) rose 4.3% in the past 24 hours. According to Dune Analytics, the total value of Defi cross-chain bridging operations is approximately US$23.98 billion, while the total value of Ronin Bridge is US$7.5 billion. The 30-day cross-chain bridge TVL change showed that the bridge TVL fell by 6.3%.

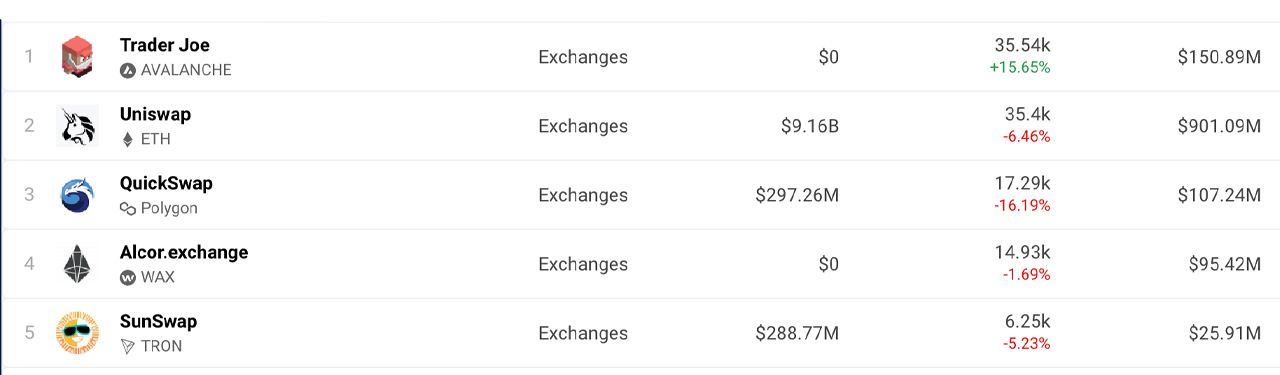

Today’s top five decentralized exchange (dex) platforms include Uniswap (Ethereum), Trader Joe (Avalanche), Quickswap (Polygon), Alcor.exchange (WAX) and Sunswap (Tron). According to the record of dappradar.com on November 17, in the past 24 hours, Avalanche-based Trader Joe has seen $150.89 million in dex swaps, while today’s leader Uniswap processed $901 million.

What do you think about the rise of blockchain game coins, defi tokens, and metaverse assets in a downturn in the crypto market? Please tell us your thoughts on this topic in the comments section below.

Tags in this story

Image Source: Shutterstock, Pixabay, Wiki Commons, defillama.com, dappradar.com, coingecko.com

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link