[ad_1]

This article is a live version of our Unhedged newsletter.register here Send the newsletter directly to your inbox every business day

Good morning. If there are any signs in the newspapers on Sunday, inflation is back on the top of the agenda. So we have two articles today. One is about deflation—especially the deflation of Casey Wood’s Ark Innovation Fund.Email me [email protected] Or Ethan at [email protected].

What if this is just a demand shock?

This paper Since its publication about a month ago, Qiaoshui has received a lot of attention. It’s interesting to read, and very easily summarizes the team’s point of view that inflation is not temporary. The core argument is that the supply chain bottlenecks that everyone is arguing about are not a big deal. The most important is the massive surge in demand caused by fiscal and monetary stimulus measures. This is the main point:

The supply of almost everything is at an all-time high. .. This is mainly [a policy] Drive demand to fluctuate upward. Although some of the drivers of rising inflation are temporary, we see that the underlying imbalance between supply and demand is worsening, rather than improving. ..

Due to the transformation effect, there is still a lot of potential expenditure [policy] The balance sheet and extremely low real rate of return provide continuous incentives, and more fiscal stimulus measures are underway. Curbing demand will require global central banks to quickly adopt restrictive policies, which seems unlikely. .. There are not enough raw materials, energy, production capacity, inventory, housing or workers.

The gap between demand and supply is now large enough that high inflation may reasonably continue

This work is full of interesting diagrams. Two of them specifically illustrate this point. The following are the nominal demand and global supply of consumer goods in the United States:

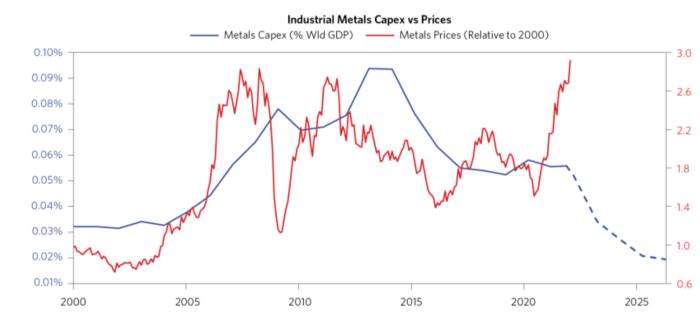

(It’s a bit frustrating that the specific data source of the chart is not given-there is only a big footnote at the end, there are dozens of data sources. See below for more details.) Next, the Industrial Metal Index and Capital Expenditure/GDP ratio:

There are many other charts that give similar views on services, employment, energy, inventory, shipping, housing, etc.

If this argument is correct, how important is it to the market? This, of course, suggests that reinflation transactions—broadly speaking, the idea that cyclical assets will outperform the broader market—will continue for some time (unless the central bank takes violent, growth-stuffing interventions). I am not sure if it implies an obvious bond transaction. We have already seen a sharp rise in the belly of the U.S. Treasury curve. It has risen by 46 basis points in 5 years since mid-September, but it has been less active in 10 years and has remained flat in 30 years. This is consistent with the surge in demand and the subsidence of inflation in just a few years, and this situation may be in line with Bridgewater’s view.

Anyway, some thoughts and questions about the argument:

-

No one denies that stimulus-driven demand is an important part of what is happening right now. Consumer and corporate balance sheets look good.The interesting question is whether Bridgewater correctly believes that the bottleneck (outside of a few fields such as automobiles) is correct no An important part of the story. Qiaoshui believes that the only bottleneck that really matters is labor (a shortage of stimulus measures, that is, worker “leverage”) and pre-pandemic energy and housing supply issues in the United States.

-

I’m not sure what Bridgewater means by “nominal demand” (they couldn’t let anyone talk to me about newspapers last week), but if it roughly corresponds to disposable personal income (as Skanda Amarnath of Employ America) As suggested to me) ), it looks like this will end soon, because there will not be another round of stimulus checks and increased unemployment benefits. The paper predicts that inflation will be “reasonably sustained,” but it did not provide a timetable. Is this statement consistent with inflation subsiding in the second half of next year, which seems to be Jay Powell’s expectation?

-

I want to know if some of Qiaoshui’s data is a bit outdated, or if there are sources that I can’t see. For example, here is their Chinese industrial production chart:

This is a strange fit recently China Manufacturing Purchasing Managers Index The report shows shrinkage, and this The OECD China Industrial Production Index has changed from a year ago:

Similarly, metal prices will not rise in a straight line. For example, aluminum prices fell by 14% in less than a month, which is certainly important to the inflation debate; copper prices have been flat since May; iron ore prices have fallen by half since this summer. Prices did rise by a big step during the reopening, but I don’t know if the imbalance between supply and demand will get worse from here, as Bridgewater believes.

Very eye-catching chart

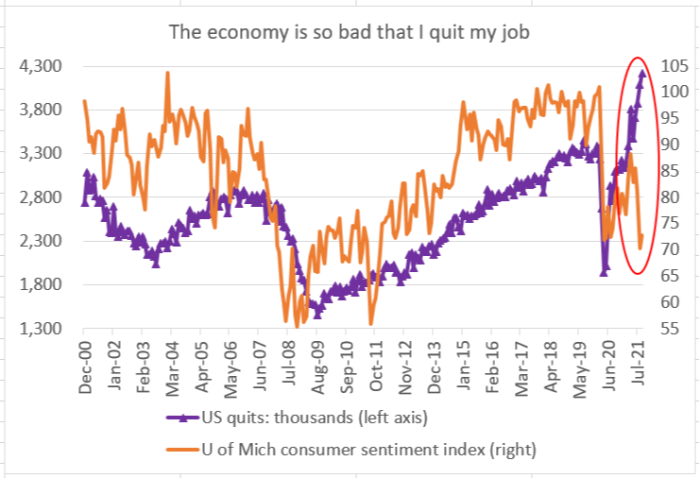

Ed Al-Hussainy of Columbia Threadneedle, Unhedged’s wise friend, once again gave a great chart:

People usually quit their jobs when they think they have other options and think the economy is good. Now, they are exiting by record numbers, but they think the economy is absolutely terrible.

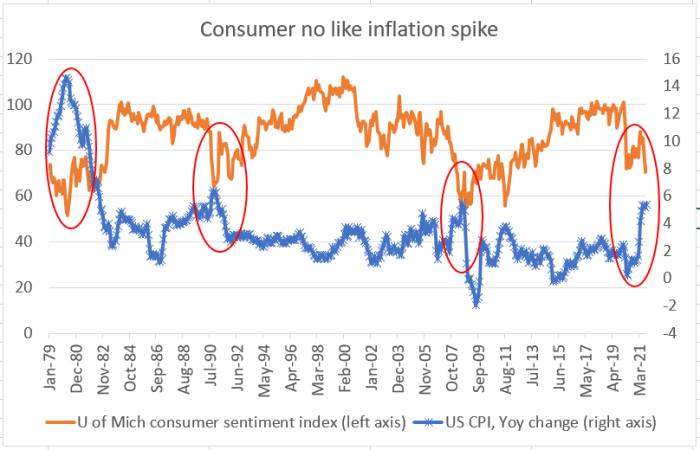

There is an explanation. Consumers really, really hate the sudden spike in inflation. The following is a long-term chart of inflation and consumer confidence:

Growth vs Ark Growth

Many people are Short Cathy Wood’s Ark Innovation ETF. You know the temptation at a glance. After a spectacular 2020, it not only lags behind the market, but also lags behind most other types of growth investment.It even lags behind Copycat Goldman Sachs ETF Launched in September to ride Wood’s tuxedo:

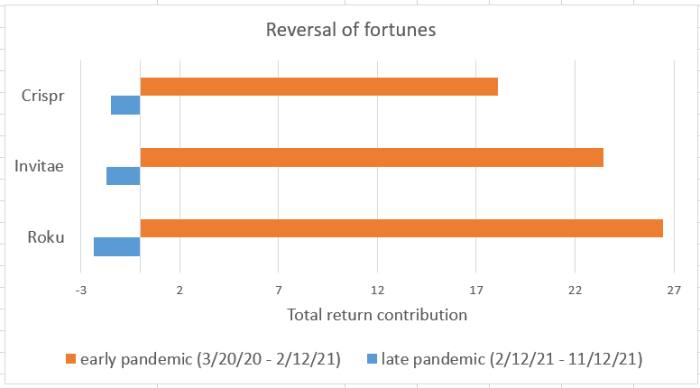

Why is Ark not acting like other technologies/growth bets? Because there is a difference between growth and frontier growth. In addition to Tesla (10% of the fund), Ark’s most successful bets during the early technological frenzy of the pandemic included Roku, Invitae, and Crispr Therapeutics. These super long shots all fell from Wood’s top five players to the bottom of the list.

Invitae and Crispr Therapeutics are dealing with promising but not yet fully mainstream genetic testing technologies. Roku is growing very fast, but it faces fierce competition from companies such as Amazon and Google for TV screens. None of these companies has a deep competitive moat.

In contrast, the popular Invesco QQQ ETF, which tracks the Nasdaq 100 index, is anchored by FAANGS. The best performing companies this year include Microsoft, Nvidia, Alphabet and Apple. The Ark proves that all growth is different. (Wu Yisen)

A good book

A moving and important piece Manuela Saragosa of the Financial Times reported on her partner’s suicide. Holidays are a difficult time. Everyone should be careful when going out.

[ad_2]

Source link