[ad_1]

source: Statistics_Data_Facts

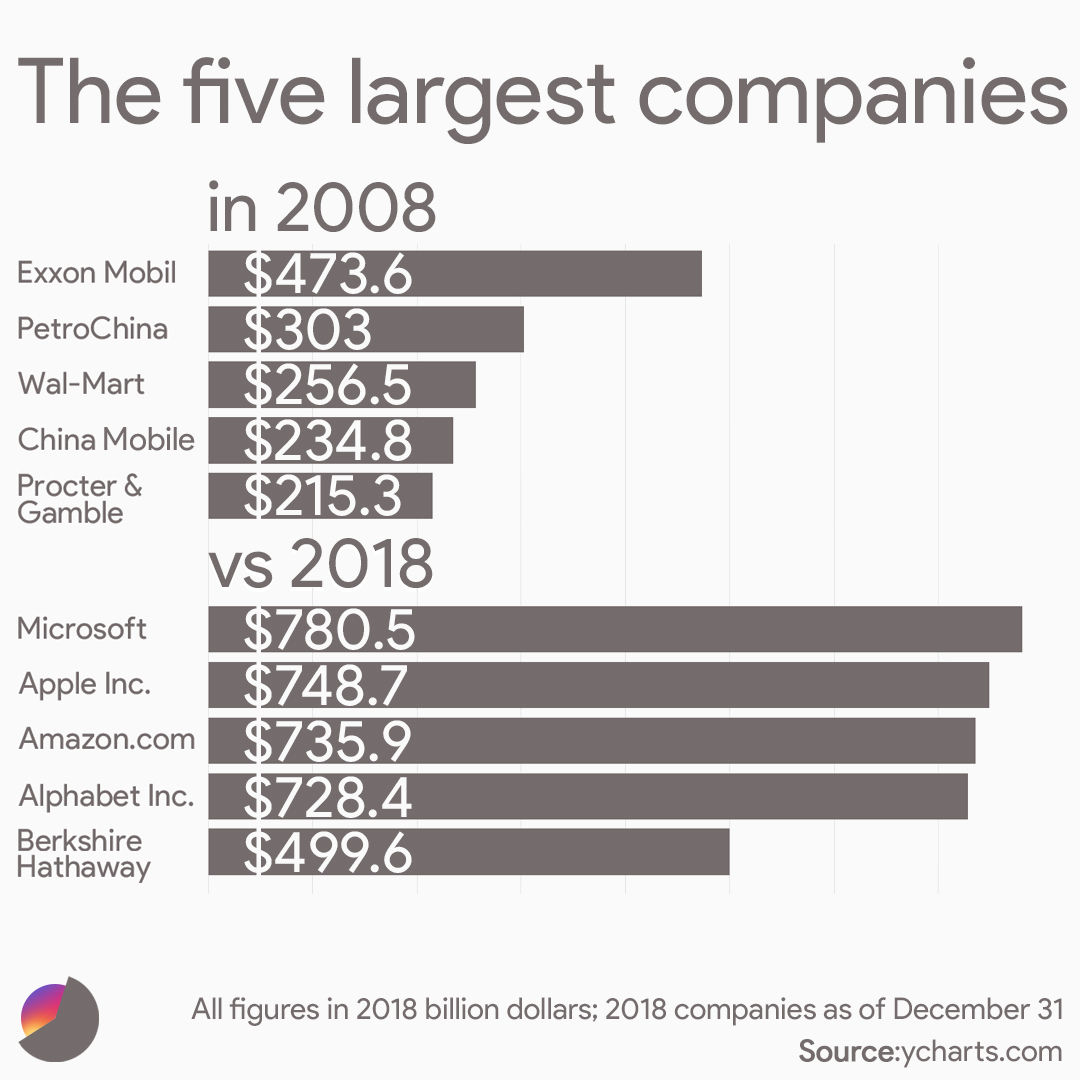

This table circulated around the summer, and it appeared again, ostensibly as evidence of massive asset inflation.

I don’t like these things. It is technically accurate, but lacks context. If we consider the relevant market history and what happened before, we have a framework to better understand what happened in the top 5 companies that decade.

The start date of this era is 2010, which is shortly after the end of the Great Financial Crisis (GFC), but it is exactly 3 years after the market surpassed the pre-GFC high. Therefore, it started with an artificial low-in mid-2010, the S&P 500 was higher than the March 2009 low (down 57%), but still 34% below the October 2007 S&P 500 high . SPX will not be able to return to its pre-global financial crisis level until March 2013.

The period 2010-2020 did include a pandemic collapse, which (coincidentally) fell by 34%. But this also includes the beginning of the recovery. By August 2020, the broad-based S&P 500 index has returned to breakeven.But those companies in the top 5 have benefited from the pandemic blockade and Work at home; They promoted the stock market’s recovery.

And, not surprisingly, they returned to breakeven even faster: by April, Amazon had surpassed the pre-pandemic highs of 2020; Apple, Facebook, and Microsoft by May. Not surprisingly, these names are as hot as they are: the environment of the modern era is unique, and their advantages are very suitable for meeting the challenges of the times.

In any 10-year operation, you won’t be surprised to see a 100% rise in stocks. Anything that compounded at a rate of 7.2% per year would take ten years to double. Therefore, it is fair to guess that the average total return for any randomly selected 10-year period should be 100%.1

Consider how unusual things have been in the past ten years: In 2010, Apple sold the iPhone 3G instead of today’s iPhone 13. Its market capitalization is US$180B, compared to US$2.45 trillion today. Amazon’s market value in the days before AWS was even smaller, at $56B, and today it is $174 trillion. Since 2010, the technology industry has changed the world and has become the most valuable company in the process.

I would love to know how the 5 largest companies will compete against the broader S&P index during the 10-year rolling period. How big are the large-cap stocks driving the market as a whole? Does their strength appear in different parts of the cycle? This is an interesting question.

~~~

For a larger context, let us consider a slightly different example.

If we look back 2 years, what will happen from 2008 to 2018? It turns out that merging a complete GFC crash and recovery can significantly change the outcome. This is not the usual ten years, but the top 5 does (more or less) indicate a doubling:

_______

1. In real life, it may not be twice as accurate, because all 10-year periods are not accurate averages (they are distributed About That average).

[ad_2]

Source link