[ad_1]

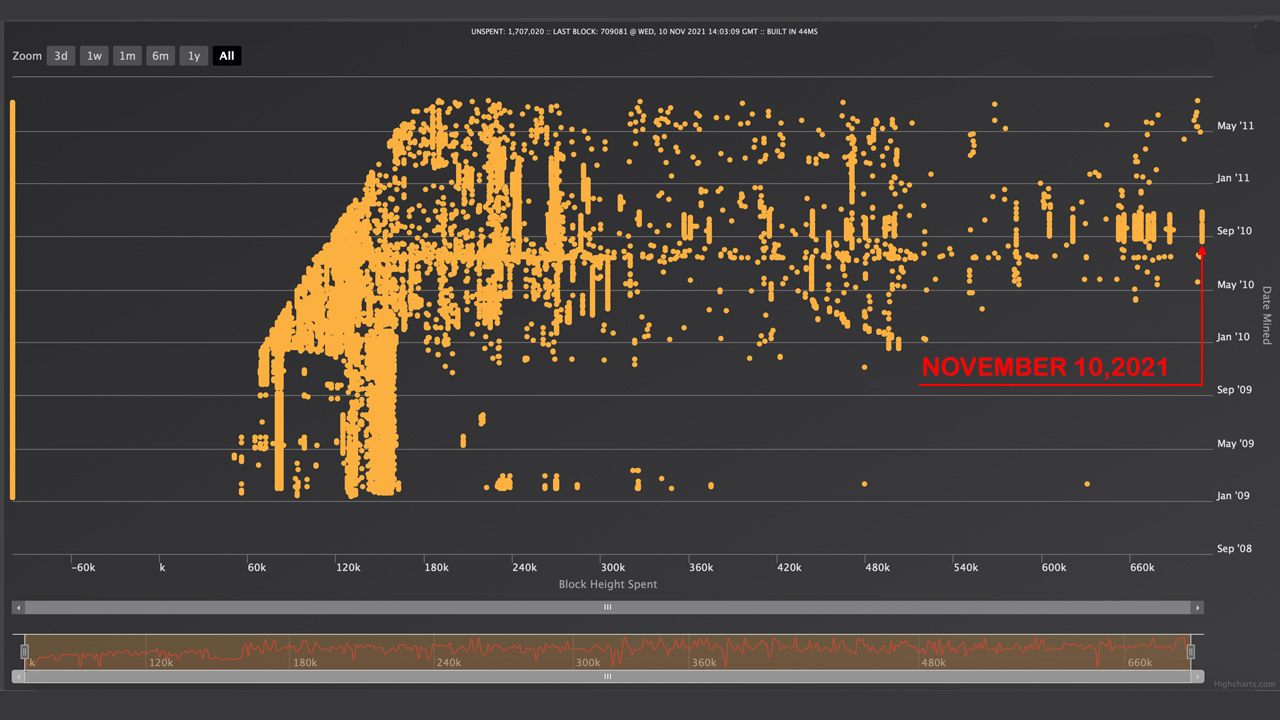

154 days ago, a mysterious Bitcoin mining entity spent a series of 20 block rewards in 2010, which have been idle for more than ten years. Since the capture of this entity in 2020, our news station has been investigating the behavior of this Bitcoin whale. Now, after appearing on June 9th, that is, on November 10th, the mysterious whale returns again and spends another 1,000 bitcoins, which are rewards from 20 blocks mined more than ten years ago.

1,000 “sleeping bitcoins” worth US$68 million, waking up after ten years of dormancy starting in 2010

Last year, after the market massacre on March 12, 2020 (also known as “Black Thursday”), Bitcoin.com news discovered that a large whale spent 20 consecutive blocks of rewards, which were derived from blocks mined in 2010. From here on, Captain Ahab like Herman Melville, our investigation led our news station to discover countless whale sightings, a large number of 2010 Bitcoin (BTC) Block reward strings were also used in 2020 and 2021.

According to our schedule, the entity will be on March 12, 2020, October 11, 2020, November 7, 2020, November 8, 2020, December 27, 2020, January 3, 2021 (12th anniversary of the founding of Bitcoin) Bitcoin block rewards spent 20 years ago, January 10, 2021, January 25, 2021, February 28, 2021, March 23, 2021, 2021 June 9th. Now, five months later, on November 10, 2021, the mysterious whale is reincarnated again with 20-year-old Bitcoin block rewards, spending 1,000 Bitcoin At block height 709,029.

The 1,000 Bitcoins of 2010 transferred on November 10 were discovered by Bitcoin.com, a Bitcoin blockchain analysis tool. Bitcoin parserThe 20 block reward payout occurs after 1:30 AM (Eastern Time) on Wednesday. The transfer of 1,000 so-called “dormant bitcoins” also followed exactly the same pattern as the whale’s previous spending, indicating that it may be the same bitcoin mining entity.

These specific block rewards were mined during August, September and October 2010.Another similarity is that the miner spent the corresponding Bitcoin Cash (BCH) Compared with the original Bitcoin in 2010 (Bitcoin) address. 1,000 Bitcoin cash Transfer at Bitcoin Cash block height 713,430.this Bitcoin cash About an hour later Bitcoin Be transferred and Bitcoin (BSV) Bind to coins remain idle. The mysterious 2010 mining whale followed this convention in every 20 block reward string consumption.

The whale may be transferred to an escrow account or the coin can be held as the “raw bitcoin” of VIP exchange customers

In addition, the whales at the time 1,000 BTC merged To an address (just like all the time before), and then distribute the coins to the wallet, of which there are 10 Bitcoin Each.Whales too Consolidate 1,000 BCH Then divide the coins into 50 batches Bitcoin cash Every wallet. In an interview with Bitcoin.com News, the creator of Btcparser.com believed that these coins may enter the escrow account. “That P2SH address looks like an escrow account,” he said. “When Bitcoin is received, the former owner gets paid, and then the new owner Bitcoin Wallet,” added the researcher on the chain.

Allocation looks like it can also transfer coins to exchanges. January 27, 2021, Bitcoin.com news and other on-chain researchers Assuming this is possible Since 2010, Coinbase has been the ultimate recipient of these “forgotten bitcoins”. Essentially, this batch of 10 Bitcoin It can be held by an exchange and is called a “withdrawal pocket”.

Tokens may be held by the VIP user base of crypto exchanges because these tokens are considered “Raw bitcoin.’ Had Long-standing rumors “Raw Bitcoin” can be more than 20% higher than the spot price. “Raw Bitcoin” is a coin that has been mined but has never been associated with other transactions, while Bitcoin is associated with unfavorable behavior.

The cryptocurrency community does not know who the miners were in 2010, but it is clear that the entity mined a lot of Bitcoin in the early days. The 1,000 so-called “sleeping bitcoins” traded today were worth 68.4 million U.S. dollars at the time of transfer, and Bitcoin Cash (Bitcoin cash) Costs US$712,070.

It is also worth noting that the term “spend” or “spend” in this article does not necessarily mean that Bitcoin is “sold” to a third party to obtain fiat currency or other encrypted assets.A series of 20 block rewards and 1,000 bitcoins were screened into the wallet, 10 of which Bitcoin Each wallet most likely still belongs to the original owner.

What do you think of mining entities spending 20 block rewards with 1,000 Bitcoin strings in 2010? Please tell us your thoughts on this topic in the comments section below.

Tags in this story

Image Source: Shutterstock, Pixabay, Wiki Commons, holyroger.com, Btcparser.com,

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author shall not bear direct or indirect responsibility for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link