[ad_1]

Although it is widely believed that gold is the best hedge against inflation, a report written by author Kelsey Williams now questions this long-standing claim. In the report, Williams believes that the current gold price of about $1,810 per ounce is far below the average price of commodities in 1980.

Gold price rise lags inflation

Williams’ assertion shows that the appreciation of gold in the past 41 years has lagged behind the rate of inflation.in a report Published by FX Empire, the author uses nominal and inflation-adjusted gold prices to illustrate this point.

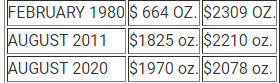

For example, according to the table shared in the report, the nominal price of gold rose from US$664 per ounce recorded in February 1980 to US$1,825 per ounce in August 2011. However, if adjusted for inflation, the price rose the fastest in February 1980, reaching US$2,309, while the price in August 2011 was US$2,220.

A similar trend was observed in August 2020, when the price of gold hit an all-time high of US$2,070. For example, the same table shows that when the price in August was $1,970, the inflation-adjusted price of the commodity was actually $2,078.

Why did the actual price of gold fall

Williams’ example may mean that investors who traditionally hold positions in gold are not actually the best protected. The author himself put forward his own views on the reasons for the actual drop in the price of gold. He said:

Since the increase in the price of gold over time reflects the continued decline in the purchasing power of the U.S. dollar, it cannot be expected to exceed the previous peak price on the basis of inflation adjustments. For the same reason, it is not unreasonable to expect it to match the peak. One factor that may limit gold prices from matching previous price peaks is that the overall impact of Fed inflation continues to have smaller and smaller effects.

Although the author did not propose a better means of holding value than gold, the report does show that gold has not kept up with the rate of depreciation of the U.S. dollar.

Do you agree with the price of gold that Williams said? Tell us what you think in the comments section below.

Image Source: Shutterstock, Pixabay, Wikimedia Commons

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author shall not bear direct or indirect responsibility for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link