[ad_1]

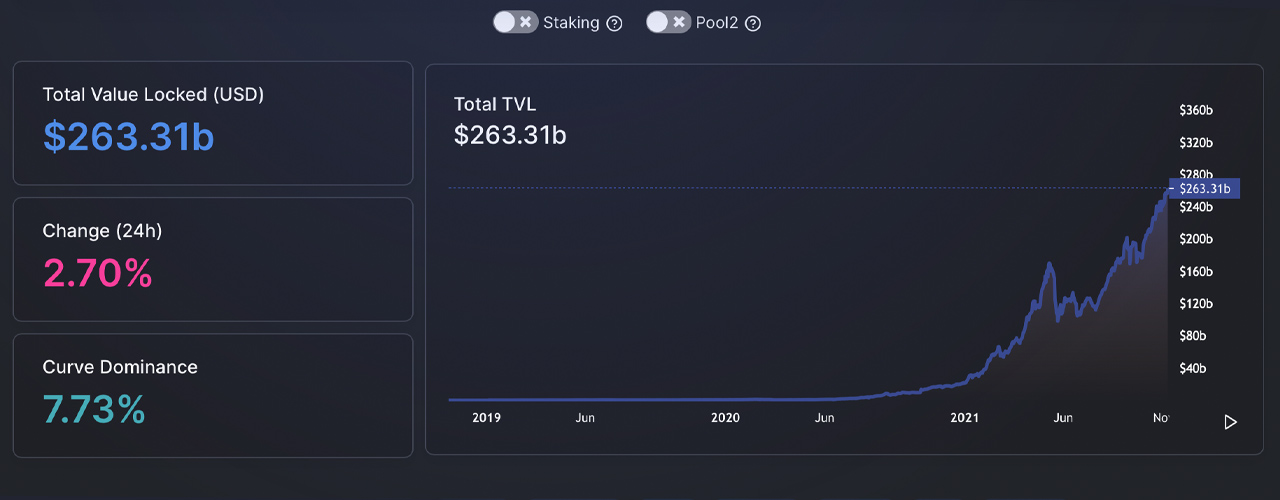

The decentralized finance (defi) protocol continues to shine, as the total value locked in defi exceeds $260 billion. Although Ethereum started the defi trend and occupied the largest share of TVL in defi, a large number of decentralized applications (dapps) are supporting a large number of alternative blockchains.

Today’s most popular Dapp supports multiple networks

According to statistics from defillama on Sunday, on November 7, the total value locked in defi was US$260 billion. When defi first started making waves, most of the dapps people interacted with took advantage of Ethereum (Ethereum) Blockchain. By the end of 2021, as cross-chain technology is hotter than ever, and dapps now support countless networks, all this has changed.

For example, the Automated Market Maker (AMM) agreement Curve holds the largest proportion of TVL, which accounts for 7.71% of US$20.08 billion. Curve also connects seven different blockchain networks, including Ethereum. Chains include Avalanche, Harmony, Polygon, Arbitrum, Fantom, Xdai and Ethereum.

Another large dapp with a TVL of USD 15.75 billion is Aave, which is a decentralized lending system and users from three different blockchains (Ethereum, AVAX, MATIC) can access dapp. In terms of cross-chain support, dapp Sushiswap has a large number of chains because 12 blockchain networks can access dapps. Palm, Xdai, Polygon, Avalanche, Celo, Okexchain, Moonriver, Harmony, Binance Smart Chain, Heco, Ethereum and Arbitrum chains.

Sushiswap and Anyswap support 12 different chains-the trend of cross-chain support continues to expand

With all these connections, the TVL of the decentralized exchange (dex) platform Sushiswap is $6.8 billion. Anyswap dapp also supports 12 different networks. The only difference between it and Sushiswap is that the dapp supports Kucoinchain. Other popular dapps that utilize multiple networks include protocols such as Abracadabra, Balancer, Uniswap V3, Renvm, Cream Finance, Synthetix, Mirror, Beefy Finance, Badger DAO, and Alpha Finance.

Of course, all these applications also support Ethereum, but with the sharp increase in Ethereum fees this year, competitors are beginning to catch up. In the past nine months, a large number of dapps have been increasing support for alternative blockchains, and this trend does not seem to stop growing anytime soon.

What do you think of the defi applications currently serving various blockchains? Please tell us your thoughts on this topic in the comments section below.

Tags in this story

Image Source: Shutterstock, Pixabay, Wikimedia Commons

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author shall not bear direct or indirect responsibility for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link