[ad_1]

On Thursday, the Governor of the Bank of England, Andrew Bailey, used a huge three-card technique when introducing the central bank’s new inflation forecast and the decision to suspend an immediate interest rate hike.

Bailey said last month that the Bank of England “will have to take action” to deal with soaring inflation, thus fueling expectations of interest rate hikes. He hopes that those who listen to it will receive three different messages-in the eyes of many in the audience. , This seems to be contradictory.

First, the Bank of England’s Monetary Policy Committee is more concerned about inflation than before, and interest rates will indeed rise “in the coming months”.

Second, it is good to wait and see before taking action, because the outlook for economic growth is bleak and the overall situation is very uncertain.

Third, even though he admitted that his remarks about curbing inflation last month were “cluttered” and therefore meaningless, people should continue to listen to him.

The Bank of England’s main forecast based on market interest rates shows that the inflation rate will reach 5% next spring, and then return to below the central bank’s 2% target-which shows that traders are too excited about monetary policy tightening.

But Bailey said that the Monetary Policy Committee is now more interested in the central bank’s alternative inflation forecast based on the assumption that interest rates will remain at 0.1%.

He added that, unlike the equivalent in the Bank of England’s May and August inflation forecasts, these forecasts no longer indicate medium-term price stability.

On the contrary, the inflation rate will still be 2.8% by the end of 2023, “then your inflation rate will stay at around 2.6%. [per cent]”Until the middle of this century, Bailey said.

He hinted that the Bank of England’s alternative forecast of inflation “will require bank interest rates to rise”.

The difficulty for the Bank of England governor is that if interest rates need to be raised to control inflation, he also wants to argue that it is not necessary now.

One ostensible reason why the MPC has to wait at least until the December meeting is that its nine members will know whether the end of the government’s September vacation program will result in unemployment — so they will be able to better judge how the substantial increase in wages may contribute to sustainability. Inflation.

Bailey said the evolution of the labor market is “critical” to the scale and speed of interest rate increases.

However, the Monetary Policy Committee’s monetary policy report clearly stated that the Bank of England does not expect a significant increase in the unemployment rate, and real-time data shows that the labor market is tight.

But even if the end of the vacation plan proves to be progressing well, the minutes of the Monetary Policy Committee’s November meeting and the Monetary Policy Report highlighted other reasons why members are concerned about the fragility of the UK’s economic recovery.

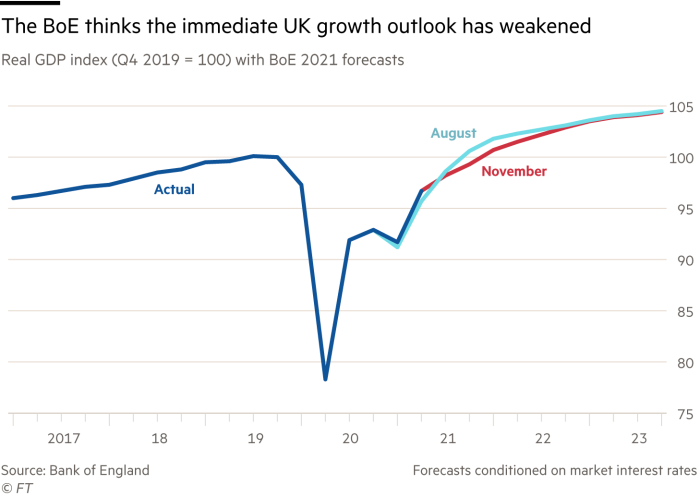

The real reason for the Bank of England’s reluctance to raise interest rates immediately is that it now expects GDP growth in the third and fourth quarters of 2021 to be weaker than forecasts in August, and activity only returned to pre-pandemic levels in the first quarter . Three months in 2022.

This is partly because there are bottlenecks in the supply chain, but also because higher inflation has eroded households’ disposable income, thus weighing on consumer confidence.

Most members of the Monetary Policy Committee are concerned that “the impact of price increases on actual household income may exacerbate downside risks to demand.” They pointed out that low-income families plan to reduce spending in the coming months.

Most members of the Monetary Policy Committee are more worried that raising interest rates prematurely will stifle the economic recovery, rather than allowing inflation to gain a foothold.

They pointed out that if the economy encounters obstacles, there is little room to reduce borrowing costs, and if inflation seems likely to be deeply ingrained, “interest rates can be raised as needed.”

Another uncertainty highlighted by the Bank of England is that it is concerned that inflation may fall much faster than its forecast suggests, which increases the risk of early interest rate hikes.

As Ben Broadbent, the deputy governor of the Bank of England, explained, this view stems from an obscure convention in the way the central bank constructs its forecasts.

The Bank of England assumes that wholesale energy prices are consistent with market expectations during the first six months of the forecast period and remain stable thereafter.

But Broadbent said that because the market expects energy prices to fall rather than stay flat in six months, the latest inflation forecast may be too high.

David Page, an economist at Axa Investment Managers, said that the general message from Bank of England officials about interest rates is that they “must take action, but they have not fully acted yet.”

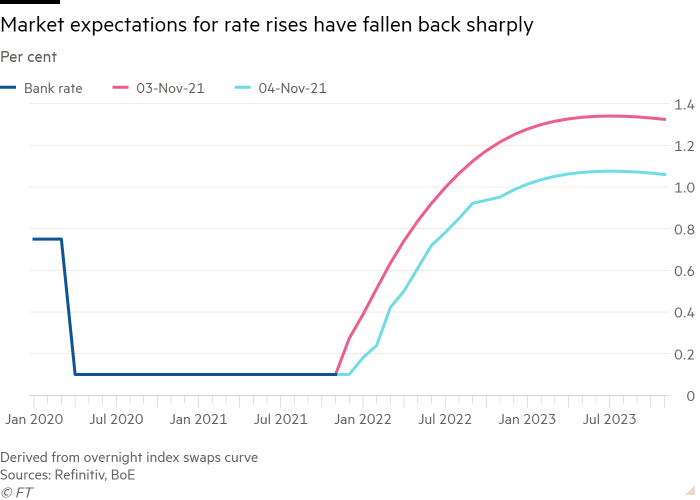

Many people in the financial markets, especially those traders who bet on an immediate rate hike, disagree with the latest announcement by the Bank of England.

Alan Monks, an economist at JPMorgan Chase, said Bailey’s remarks in the past month caused “unnecessary market volatility.”

Callum Pickering, an economist at Berenberg Bank, said that some of the Bank of England Governor’s comments were “very puzzling”, while Martin Baker of the Ernst & Young Project Club said that the guidance needed to raise interest rates in the coming months is “vague. The expression”.

However, financial markets on Thursday appeared to have generally accepted the Bank of England’s news.

Many traders believe that the first rate hike will occur at the MPC’s December meeting, but this is not yet certain, and some are betting on February.

[ad_2]

Source link