[ad_1]

U.S. Economic Update

Sign up for myFT Daily Digest and become the first person to learn about US economic news.

The Fed will have to relax its PandemicA poll conducted by the Financial Times of leading academic economists shows that the economic stimulus plan will be implemented quickly and US interest rates will be raised in 2022 to cope with rising inflation.

The latest survey conducted by the Global Market Initiative of the University of Chicago Booth School of Business in collaboration with the Financial Times shows that the approach to tightening monetary policy is far more radical than the Fed’s recent forecasts and market expectations indicate.

More than 70% of respondents think Federal Reserve Interest rates will be raised by at least a quarter of a percentage point in 2022, and nearly 20% of people expect to take action in the first six months of this year. This is much earlier than 2023 from the near-zero level that Fed officials expected in June to take off today.

In order to be able to raise interest rates in 2022, most of the 49 economists surveyed FT-IGM US Macroeconomist Survey It is expected that the Federal Reserve will soon announce its plan to begin reducing or “shrinking” its monthly bond purchase program of $120 billion and complete the process by next year.

The U.S. Central Bank has pledged to maintain the current rate of purchases until it sees an average 2% inflation rate and “substantial further progress” in maximizing employment.The first goal has been achieved, and officials have Said, The second one has room for improvement.

More than 40% of economists believe that the Fed will announce the scale reduction at its November meeting, and 31% expect it to be in December.The timeline may slide if Coronavirus infection Many economists have warned that the epidemic has spread further and recruitment has stagnated-a quarter of them are not expected to announce it until next year.

The survey results collected between September 3 and September 8 are very consistent with the views put forward by more “hawks” members of the Federal Open Market Committee on Federal Reserve Policy Making. Worry Regarding the soaring consumer prices, it is believed that the US economy can afford less support.

“By 2022, the labor market will be strong enough, wage growth will be strong enough, and there will be enough worries about not wanting inflation to remain above 2% for a long time,” said Brandeis University economist Stephen Cecchetti, who has led the international The Ministry of Currency and Economy of the Clearing Bank.

Strong consumer demand, savings, serious supply bottlenecks and other shortages have pushed inflation to its highest level. Maximum speed In 13 years, worries about the continued existence of price pressures have rekindled.

Economists who rank further supply disruptions as the biggest risk have raised the Fed’s preferred inflation measure, core personal consumption expenditure (PCE), to 3.7% at the end of the year, up from 3% in the same period last year. JuneNearly 70% of respondents also said that by the end of 2022, the indicator is “somewhat” or “very likely” to still exceed 2%.

Economists believe that the inflation rate may be high enough to force the Fed to change its maximum employment target and raise interest rates before the U.S. labor market fully recovers.

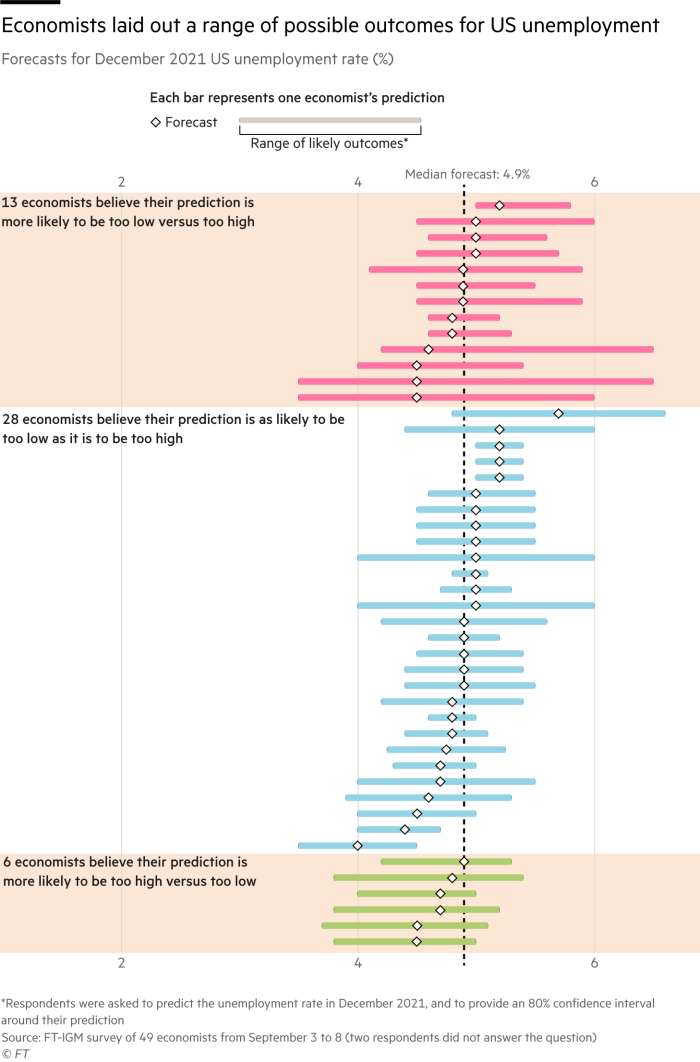

The unemployment rate is expected to remain high this year, and economists estimate the median for December at 4.9%.Since last month Circling 5.2%. 43% of respondents said that this rate of employment growth means that the unemployment rate will not fall back to the pre-pandemic level of 3.5% until 2023, while 23% of respondents believe that it may not be until 2024 or later.

“They make macro mistakes [and] Raise interest rates prematurely,” said Danny Branchflower, an economist at Dartmouth University and a former member of the Bank of England Monetary Policy Committee. He added that the unemployment rate may drop to 2.5% before it leads to inflation. , And warned that the risk of a labor market collapse is “much higher” than the prospect of rapid employment improvement.

Nicholas Bloom of Stanford University said that another risk is the recurrence of the unstable “scaling panic” in 2013, when the Fed hinted that it would withdraw stimulus measures earlier than expected. However, most economists do not agree with this view. Few people expect a sharp sell-off in the U.S. stock market or Treasury bonds in the next six months.

Menzie Chinn of the University of Wisconsin-Madison predicts that the Fed will end asset purchases in the first half of 2022 and raise interest rates later that year. He attributed the milder market reaction to the central bank’s success in clearly communicating its policy plans.

One lingering uncertainty is the fate of Chairman Jay Powell at the Federal Reserve, as his term will expire early next year. More than 80% of the economists surveyed expect him to be renominated, while 18% believe that Governor Lyle Brainard will be appointed.

About the survey

this FT-IGM US Macroeconomist Survey It is a series of public opinion surveys that require American academic macroeconomists to predict the trajectory of important indicators such as gross domestic product and unemployment rate, and provide their views on possible key policy options. The problem was developed in collaboration with the Global Markets Initiative of the University of Chicago Booth School of Business, which will conduct a survey of its main economist team approximately every two months.

Each issue of the survey will ask some of the same questions, such as questions about the US GDP growth from the fourth quarter of 2020 to the last quarter of 2021, as well as some new questions. Personal responses are anonymous.However, a list of interviewees (usually about 50 economists) may vary slightly from survey to survey. result Every investigation.

[ad_2]

Source link