[ad_1]

This article is a live version of our trade secret newsletter.register here Send the newsletter directly to your inbox every Monday to Thursday

Good morning from London. Although demand is strong as the economy continues to rebound, shortages of workers and goods in several areas have become a major concern for many companies. To be fair, the dual combination of Brexit and the pandemic is not friendly to British companies.

Others, such as exporters of consumer goods and commodity components that are in high demand during the pandemic, are even more fortunate. Today, we use new data to show that some manufacturers can still thrive even in the face of supply shortages and transportation bottlenecks.

We hope to hear from you.Send any ideas to [email protected] Or email me [email protected]

Trade in bicycles, chips and chairs continues to surge

With the closure of most parts of the world, consumers have shifted their spending to products suitable for working from home (or actually exercising). Demand from manufacturers of sporting goods, office furniture and electronic products has soared.

Most services are domestic, while most of the goods purchased by consumers in advanced economies are imported. This means that this trend should benefit trade. However, the world’s manufacturers also have to deal with factory closures, supply chain blockages and other pandemic-related chaos.

Last week we had the honor to sit down with a team from Trade Data Monitor, a database used by policymakers and trade organizations to track trade trends, which provides us with a lot of new evidence on how these pros and cons are balanced.

The chart below compares the first four months of this year with the same period in 2019, and shows that the export value of motor manufacturers-this category includes products such as televisions, electronic circuits and motors-has surged, surpassing the $1 trillion mark.

Auto trade is still declining, but imports of semiconductor chips for various purposes, from notebook computers to car seat belts, are on the rise.

At the beginning of the pandemic, due to the shift from offices and schools to remote work and distance learning, the demand for electronic devices such as laptops and iPads increased, and the demand for these chips increased. As automakers reopened in the second half of last year, these chip makers were struggling to meet demand. This year, a new outbreak of Covid-19 among employees in factories in China and Taiwan has forced them to shut down production lines.

However, the export value is still rising. In the first four months of this year, semiconductor trade increased by 21% compared to the same period in 2019. More and more of these exports come from China, which will account for one-third of revenue in the first four months of 2021.

This is not just a case Chip makers raise pricesCompared with the first four months of 2019, the number of exported photosensitive semiconductor devices has increased by 20%.

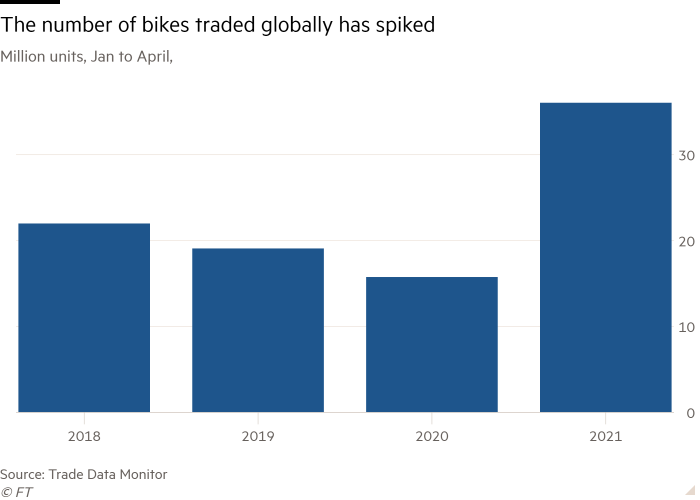

There are similar stories in the sporting goods and bicycle markets. As many people cannot go to the gym, imports of sports equipment, toys and games in the first four months of this year have increased by 35% compared to the same period in 2019. Among the countries that report data in units, the number of tennis rackets exported increased by 11% during the same period, and the number of bicycles sent to the rest of the world increased by 88%.

In the same period, the import value of furniture and other household items increased by 14%. The Trade Data Monitor shows that the number of adjustable-height swivel chairs commonly used for home office purchases has increased by 50%, and the number of other products used for home decoration (such as tufted carpets) has increased by 10%. Similarly, although furniture manufacturers have been hit hard by factory closures and logistics bottlenecks.

How do these figures affect our thinking about the macro picture of world trade? We know that global trade volume has been rising steadily since its decline in May last year, surpassing pre-pandemic levels at the end of the year, and continuing to rise throughout 2021.

But the recent rise is mainly due to rising demand for commodities. While this will undoubtedly help, data from Trade Data Monitor shows that manufacturers of consumer products and their components also play a role.

We expect them to continue to contribute in the next few quarters, as the backlog of corporate orders has increased. Françoise Huang, an economist at the credit insurance company Euler Hermes, predicts that due to the “extremely low inventory levels” of many developed countries, global trade volume will increase by 8% in 2021 and its value will increase by 16%.

What happens after this year depends on how long you think the pandemic will last. Capital Economics macro economist Jack Allen Reynolds predicts that “as consumption patterns return to normal”, supply chain disruptions will ease in 2022.

He said: “This will mean a decline in demand for electronic products and demand for semiconductors, while demand for services will continue to recover, helping to alleviate some of the most serious supply problems.”

Although we like to promote trade, we hope he is right and the blockade will be a thing of the past.

Trade ties

Supply chain dilemma Continue to create chaos.’S boss APM terminal Very unusual steps have been taken to advise consumers to stop buying so many things in order to reduce their demand for port services.

Mortenen Gestorft, The operator’s CEO, marking it as “Vicious circle” Surging demand and logistics bottlenecks. Furniture retailer Is the newest part of the economy Strive to meet demand For their merchandise.At the same time, there are more Bad news for automakers, With the head of the Japanese chip manufacturer Renesas Say him expect Covid broke out Continue to cause damage it’s been a while.

Honda Motor already Found a fix (Nikkei, $, subscription required).It will begin to use more than half of the same parts as GM to manufacture electric vehicles for the North American market because environmental with Supply chain pressure Forcing the auto industry to readjust. Japan’s influential business lobby, The group members, already suggested (Nikkei Index, USD) Exempt passengers who are fully vaccinated Starting from the 14 days of mandatory quarantine in the country, Japanese companies have become increasingly afraid that they might lag behind Singapore. China Investment Yes Inflow (Nikkei, $) Simandou Mountain in Guinea is said to have the largest Undeveloped iron ore reservesBecause it seeks to reduce its dependence on Australian mining exports. Claire Jones and Francesca Lagarado

[ad_2]

Source link