[ad_1]

Earlier this year, due to shortages of wood, resin, and steel, half of his furniture manufacturer’s 600-item catalog was out of stock, and Phillipe Moreau had to be creative to keep Temahome’s production line running.

“We play everywhere,” said the CEO of the French manufacturer of wooden tables, shelves and TV stands. “If there is no black panel, we will switch to oak or white panels.”

All over the world, all manufacturers from cabinets to cars or computers are still struggling to deal with Logistics tightening This disrupts the supply of basic inputs, threatens the post-pandemic economic rebound and pushes up inflation.

As the economy reopened, consumer demand continued to rise. In Europe, these shortages caused inflation to reach Ten years high -This factor may cause the European Central Bank to reduce its 185 million euro pandemic stimulus plan this week.

Furniture is the latest industry to feel pressure from the supply chain, and it outlines a wider range of issues. Even large companies like IKEA have been affected.The Swedish flat-panel furniture manufacturer said it was “unpredictable” when the normal supply would resume, because the “perfect storm” included Shortage of truck drivers in England.

IKEA global supply manager Henrik Elm (Henrik Elm) said of the outage: “We don’t naively think it will end in the next few weeks or even months.”

A quarterly survey by the European Commission showed that a record one-third of EU furniture manufacturers said they were affected by supply shortages. Globally, high transportation costs and delivery delays due to severe weather and the shutdown of major ports in Asia due to Covid-19 are important key points.

Moreau of Temahome said that transportation is a “nightmare”, even “screws or small parts from Asia may take three months”, and he is also the head of the French furniture trade agency. “We shipped 16 containers to the United States in June and July, but by August they still failed. Delivery time to the United States has doubled.”

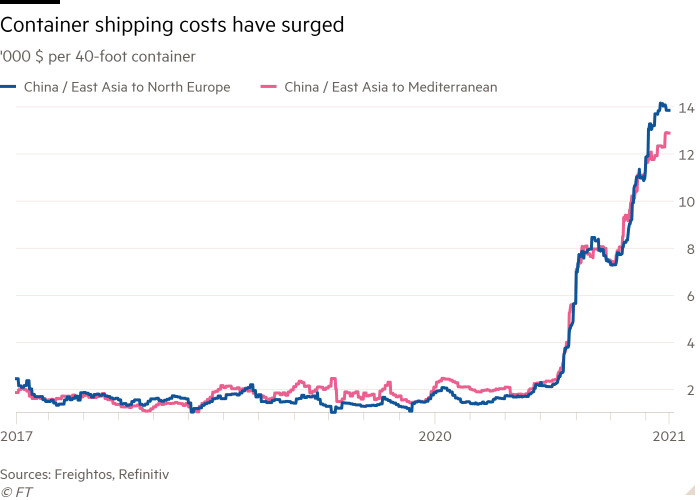

Transportation costs have soared. According to data from data provider Freightos, the cost between China and Europe is nearly seven times higher than in August last year.

To solve this problem, IKEA Said It is transferring some supplies to the train. The company added: “We will use rail transportation from China to Europe to free up container capacity, and we can use it to ship more goods to the United States.”

At the same time, in the U.S., the supply of timber, usually transported by truck, through the southern states has been affected. Hurricane Ida, Attacked the Gulf Coast of Mexico last week.

Even so, global timber prices have halved from the historical highs set in May, but they are still higher than pre-pandemic levels. Other industries are not so lucky.

Nearly half of EU rubber, machinery, and computer manufacturers, as well as most electrical equipment manufacturers, report supply shortages. Nearly 60% of automakers are still affected.

In Germany, car production is 30% lower than the level before the outbreak, and Volkswagen plans to add additional flights to clear the backlog.But new The delta variant of the Asian outbreak Have Close the port And the semiconductor manufacturing facilities there are hindering the plan. This is a common problem throughout the industry.

“If you need to receive goods from Asia, it will be difficult to find the container, which obviously causes difficulties,” said Matteo Tiraboski, executive vice president of the Italian Brembo Group, which makes automotive brake systems. But Brembo’s help is that it purchases some supplies locally, which puts the company “in a very advantageous position.”

Others are struggling to meet demand. A DIHK survey of German companies found that 83% of companies reported that the prices of raw materials, intermediate products and commodities increased in August or there were delivery problems.

This will have broader economic consequences. Temahome and other companies that sell products in more than 45 countries around the world lack input, which limits exports and drags down the growth of the euro zone.

At the same time, the gap between orders and output-reached a record high in August. IHS Markit’s Eurozone Manufacturer Purchasing Manager Survey -Increase inflationary pressure.

In July, producer prices in the Eurozone rose at an annual rate of 12%, the fastest rate on record since 2001, while consumer inflation in August reached a 10-year high of 3%.

When the interruption will be resolved is still an open question. It also varies from industry to industry.

Volkswagen believes that by the third quarter of this year, the supply of computer chips “will remain very unstable and tight.”

But Ana Boata, head of macroeconomic research at the credit insurance company Euler Hermes, believes that full normalization will not happen until 2023. This is the result of ten years of insufficient investment in shipping. Morten Engelstoft, CEO of APM Terminals, also warned that the surge in demand would create a “vicious circle.” Suggest Shipping groups need a slowdown in consumption to catch up.

Others are more hopeful. Giovanni Arvedi, founder and president of the Italian steel maker Arvedi Group, said that the steel market “exploded at the beginning of this year… but this is no longer the case” because the closed blast furnace restarted.

The optimistic general view is that as demand rebounds in Western economies, labor and input shortages will be eased, leading to “just more fragmented” recovery. .. ING Senior Economist Bert Colijn (Bert Colijn) said:

This seems to be confirmed on Tuesday, when official data show Despite supply bottlenecks, German factory output rose for the first time in four months in July.

The more pessimistic view is that it is too early to draw conclusions-as suggested in a report on Tuesday The pessimistic Zew business survey.

Andreas Möller, spokesperson for German machine tool and laser technology company Trumpf (Trumpf), said: “There is still uncertainty about the stability of the global supply chain and how the handling of the coronavirus pandemic will develop. , Especially in China, Europe and the United States.” “These two factors are the Achilles heel of our global operations.”

Additional report by Richard Milne in Oslo

Trade secrets

The British “Financial Times” revised “Trade Secrets”, which is its must-read daily newsletter on the changing face of international trade and globalization.

Register here Learn which countries, companies, and technologies are shaping the new global economy.

[ad_2]

Source link