[ad_1]

Global inflation update

Sign up for myFT Daily Digest and be the first to learn about global inflation news.

This article is a live version of Martin Sandbu’s free lunch newsletter.register here Send the newsletter directly to your inbox every Thursday

There is a major economic issue that has drowned most of the other debates: whether inflation is getting out of control, and if so, whether the government and central banks need to apply the brakes immediately.

The figures published in the news headlines do look worrying. The following is the year-on-year growth of the US consumer price index:

In the Eurozone, the Annual Inflation Index (HICP) A 10-year high:

However, there is a problem with these charts and headings: they obscure that inflation is actually slowing.

Under normal circumstances, year-on-year price growth is a good indicator of inflation trends, because it is not affected by seasonal fluctuations (think seaside hotel prices during the holiday season), and the force of inflation will not change That quickly. But the pandemic has messed up our economy. Supply, demand, and the prices formed by them change so fast that the one-year difference in price levels cannot well guide the current price trend. For example, today’s prices may be much higher than a year ago-but today they are falling rapidly (this happened in the US CPI in November 2020 and the Eurozone HICP in July 2021).

In this case, looking at instantaneous price inflation (monthly changes in prices) will provide more information. To avoid seasonal issues (those holiday hotel rooms), we can use seasonally adjusted monthly percentage changes in the price index.This is the situation of the U.S. CPI, which is July Grow at the slowest rate Since February:

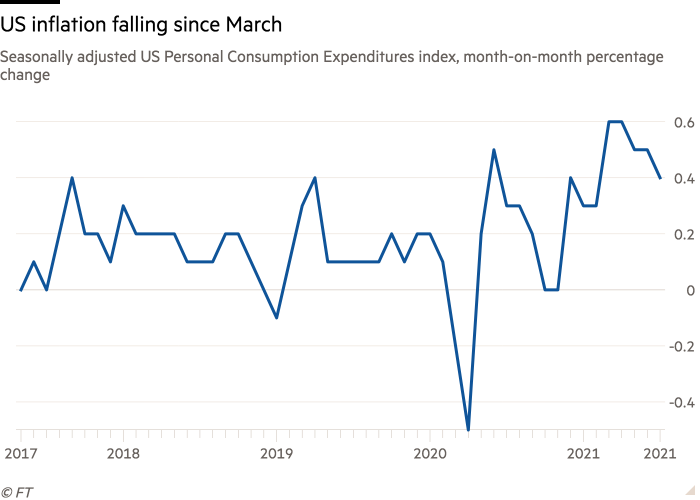

When looking at the personal consumption expenditure index, the deceleration is even more pronounced, with U.S. central bank officials favoring CPI:

According to this indicator, this is a goal set by the Fed’s interest rate makers. Inflation has been declining every month for four months, once again falling to its lowest level since February.

To be sure, these levels are still high-if they last for a year, they will accumulate to an annual inflation rate of 5% to 6%. The point is that they are their lowest point in a few months. When you see these year-on-year price changes accelerate, keep this in mind-they reflect more of what happened last year than what happened now.

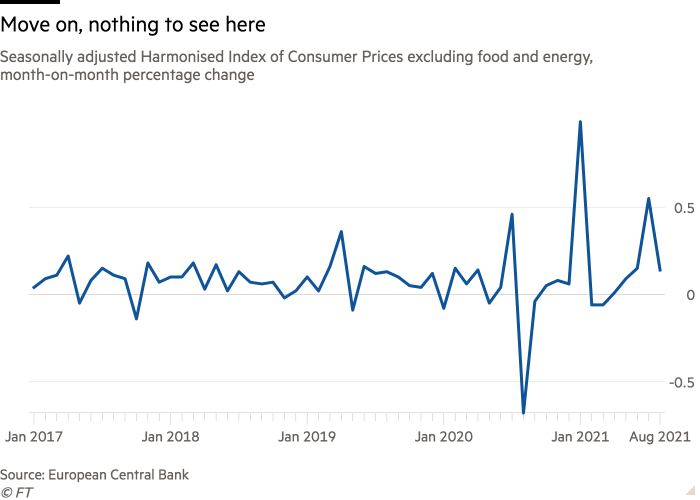

This pattern can also be seen in the Eurozone, although it is weaker there. Take a look at the monthly percentage change chart of the seasonally adjusted version of the official price index targeted by the European Central Bank (the same as the year-on-year change chart drawn above):

Inflation has actually fallen to almost normal levels last month. A core inflation indicator (excluding fluctuating food and energy prices) is even more sluggish on a monthly basis-with the exception of several monthly increases, inflation behaves as it did before the pandemic.

These simple graphics will not resolve the dispute. Inflation may still get out of control. However, if we recognize the fact that at least the current inflation appears to be slowing, that would be a better debate.

If we think about why it slows down, it might get better.I wrote a few months ago that if price pressure is driven by bottlenecks, we should Think of the economy as a ketchup bottle From which “no one will come/then many people will” as Richard Amor says. This may just be because we have moved from the “no” stage of the ketchup bottle economy to the “massive” stage.

recently Blog post, Jared Bernstein and Ernie Tedeschi of the White House Council of Economic Advisers emphasized that many Deflation Power hangs over the American economy. The expansionary effect of budget policy depends on changes in the deficit (or surplus), not its level. Therefore, as huge epidemic spending subsides, even if the deficit is still large, the economy will slow down due to fiscal policy. They point out that the infrastructure, training, and education investments their government is promoting should increase productivity over time, thereby dissipating price pressures as supply capacity expands to meet demand.

Regardless of what happens to the Biden administration’s infrastructure proposal, I think we may have seen this anti-inflation productivity impact already in play.In my FT column this week, I think we should Welcome labor shortage We see it as a harbinger of productivity prosperity.A good example: my colleague Taylor Nicole Rogers on how U.S. retailers are using QR codes Automate tasks previously done by shop assistants. As shown in the chart below, the OECD’s forecasts show that labor productivity in almost all the largest high-income economies has accelerated during the entire three years of the pandemic (including crashes and rebounds) compared to the previous three years.

If this is confirmed, it should help curb inflation and bring higher-paying jobs when bargaining. It is still in the early stages, and this hope may prove to be unrealistic. However, in order to balance the spread of the doomsday, let us not ignore the very pleasant surprises brought to us by the recovery after the pandemic.

Other readability

-

All the presentations at the Jackson Hole Symposium last week are now in Available online. Market newsletter by my colleague Robert Armstrong Unhedged (I strongly recommend you subscription) Has covered a particularly interesting paper How inequality affects long-term interest rates.

-

I represent my colleague Gideon Rachman in his podcast Regarding global politics, I interviewed Sarah Chayes to find out what is wrong with Afghanistan and its views on domestic issues in the United States.

Digital news

Newsletter recommended for you

Unhedged — Robert Armstrong analyzes the most important market trends and discusses how the best people on Wall Street respond to these trends.register here

Lex communication — Check letters from Lex centers around the world every Wednesday, and check the best comments of the week every Friday.register here

[ad_2]

Source link