[ad_1]

When the Kansas City branch of the Federal Reserve announced in May that its annual gathering of central bank governors would be held as a face-to-face event against the dramatic backdrop of the Rocky Mountains, it marked a milestone in the United States’ recovery from the depths of the economy. Pandemic.

At that time, with the acceleration of the national vaccination campaign, the number of Covid-19 cases in the United States dropped sharply, major cities across the country were reopened, and Americans flocked to use the savings accumulated during the pandemic to eat out and travel.

With the looming trend of a quick return to normal life, economic activity buzzed in a way that hadn’t happened in more than a year.Employment growth and inflationary pressures are increasing at an alarming rate hint The first became Chorus of Calling The U.S. Central Bank began to assess when and how to reduce the many emergency stimulus measures introduced in the year.

Federal Reserve Chairman Jay Powell and New York Fed Chairman John Williams at the 2019 Jackson Hole Symposium, the most recent meeting held in person © Reuters

But the Kansas City Fed’s abrupt decision last week to convert the Jackson Hole seminar held in August each year to a virtual format for the second time in its 40-year history highlights the huge risks that the recovery still faces because of the more contagious Delta variant spread.

The big turn also highlights the high-risk balancing action that the Fed must take, as it established its first policy pivot after an extraordinary period of monetary support, which allowed Chairman Jay Powell to set a Friday The speech delivered is even more eye-catching.

“They are just facing huge and inevitable uncertainty,” said Bill Inglich, a professor at Yale University and former director of the Federal Reserve’s Department of Monetary Affairs. “We don’t know what it will be like to recover from the global pandemic, how long it will take, and the long-term structural changes that will result from it.”

Inglich said that a year later, the economy is strong and inflation is high, and monetary policy needs to be tightened more quickly because the recovery is “partial, incomplete and slow.”

Central bank officials are participating in a Extensive debate Regarding the fate of the $120 billion monthly asset purchase plan announced at the beginning of the pandemic. The Fed has stated that it will buy bonds at the same interest rate until it sees “substantial further progress” in achieving its dual goal of achieving an average 2% inflation rate and maximizing employment.

A growth queue Of central bank governors believe that the inflation target has been achieved and the Fed should consider cutting or “shrinking” its bond purchase program more directly.The labor market recovery affected by the shortage of workers has become more volatile uneasy For other officials, this means that Powell’s speech will be carefully analyzed to find any hints about the potential timing of the callback.

Mark Spindel, chief investment officer of Potomac River Capital, a Washington-based investment company, said: “This is one of the pioneering moments that everyone pays attention to every year.” “There is no perfect tightening policy. They admit that they are talking about downsizing, and they should refine this conversation so that we have some understanding of what they are going to do.”

Powell said last week that it is “not clear” whether the recent resurgence of new coronavirus cases will significantly affect the economic trajectory.But as a sign of how Delta Air Lines has shaken even its strongest beliefs, one of them Most ardent supporter Robert Kaplan of the Dallas Federal Reserve recently admitted that adjustments may need to be delayed.

Brian Sack, head of global economics at DE Shaw Group, said that he expects the Fed to express its intention in September to announce a reduction in scale at the November policy meeting. Guido Persichetti, co-head of Barclays Global Treasury Trading also predicted This sequence. Persichetti added that the actual reduction may begin in January.

As the Fed grapples with the thorny task of cutting stimulus, policymakers are also facing more and more questions about whether it can promote a fairer recovery.

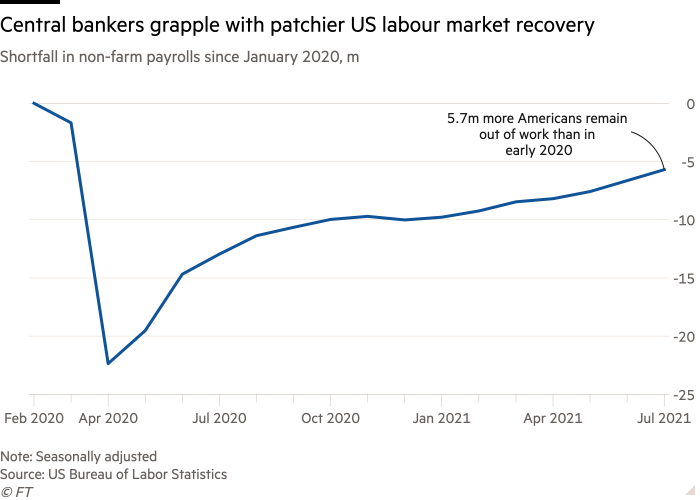

although A sharp decline With the unemployment rate reaching 5.4% last month, the number of unemployed has increased by nearly 6 million compared to February 2020. Low-income workers suffered disproportionately during the pandemic, with ethnic minorities bearing a greater burden.

Fed’s new framework Unveil At last year’s virtual meeting, the central bank took a decisive step towards achieving maximum employment. The central bank pledged to tolerate periods of higher inflation to make up for periods that were below the 2% target in the past.

“Traditionally, monetary policymakers have made mistakes in low-stress economies because inflation risks dominate decision-making,” said Karen Dynan, a professor of economics at Harvard University, who has worked in the Treasury Department and the Federal Reserve. .

“The lesson of the late 2010s is that running a high-pressure economy does benefit those who are at the bottom of the wage distribution… The new framework is indeed a wrong decision [that] side. “

However, the way this new framework works in practice has not been tested, just like consumer price increases, which injects another source of uncertainty into the outlook Soar.

Roger Ferguson, the former vice chairman of the Federal Reserve, said: “The Federal Reserve has stated that they will wait until inflation becomes a clear and real danger and will not preempt as they have done in history.” “In the end, they will have to risk falling behind the curve. Once they start, this may require a faster pace of interest rate hikes.”

For Jean Boivin, the former deputy governor of the Bank of Canada, the huge monetary and fiscal response to the Covid crisis has created another set of urgent issues that have not yet been fully resolved by policymakers.

A major unresolved issue is, given the current debt level, to what extent monetary policy can be tightened in the long run. After the unprecedented infusion of more than $5 trillion in government stimulus measures in the past year, the debt level has soared to New heights. Boivin warned that in this context, the rising cost of borrowing in the United States may be accompanied by an attempt to normalize policy amid rising inflation, which is not a “trivial” matter.

He added that financial stability risks are also crucial, as the broad market asset prices soar, the risks have become more prominent.

“Compared with the discussions of larger issues that we have been facing, the dwindling discussions are completely dwarfed [the past 18 months] Boivin, the current head of the BlackRock Investment Institute, said that given what we call a “policy revolution,” this will be the case in the next few years.

[ad_2]

Source link