[ad_1]

Global Economic Update

Sign up for myFT Daily Digest and be the first to learn about global economic news.

House prices in many major economies are rising. This FT series explores whether these increases are sustainable.

Central bank officials obsessed with inflation are increasingly sympathetic to the plight of the millions of buyers who have been squeezed out of the real estate market because of soaring house prices. However, taking action is another matter.

U.S. Treasury Secretary Janet Yellen, Speaked last month She worries that “increasing house prices will put pressure on first-time home buyers or families with lower incomes.” She follows Christine Lagarde, President of the European Central Bank admit In June, “the disconnect between housing prices and broader economic development during the pandemic caused the risk of price adjustments”.

But since housing prices are not directly included in the overall inflation measures that affect the responsibilities of central banks in advanced economies, these institutions do not need to seek to quell prices when prices rise.

They have the mission of maintaining financial stability, but most people do not think that the real estate market is the main source of risk. Economists also cited statistical reasons for excluding housing prices from inflation measures.

Why does inflation not include the cost of home ownership?

For a long time, statisticians have refused to include house prices as indicators of overall inflation.

FT Series: Global House Prices-Raising the Roof

House prices in many major economies are rising-but is it sustainable?

part 1: How the pandemic happened Triggered the most extensive Global housing prices have prospered for more than two decades.

part 2: Buyer Flock to smaller cities in the U.S., Reiterating policy makers’ concerns about affordability and risk.

Part 3: The Netherlands is struggling to cope Social consequences Rapidly rising housing prices.

Part 4: Why do renters in Berlin want Expropriate their homes A publicly listed landlord from Germany.

Part 5: Should house prices be included in inflation data, and how does the central bank respond to the economic impact?

“The consumer price index is designed to measure consumption, and the purchase of a house is the purchase of assets that are different from other goods,” the UK National Bureau of Statistics Say In 2016, when it assessed its housing cost coverage rate in inflation.

All major statistical agencies in the world hold this view.

Just as they exclude changes in the value of other investments (such as stocks, bonds, Bitcoin or gold), they also do not want to include the investment elements of home ownership, especially the cost of land.

But this makes the housing services obtained through the purchase of houses-residence, living space, location, and tenure guarantee-divorced from many official inflation statistics.

how can that be possible?

Statisticians agree that there is no perfect solution. Conceptually pure methods have proved to be unmeasurable in practice, while actual measures have theoretical flaws.

The U.S. statistical agency estimates changes in the nominal rents of houses owned by people. They believe that rent costs are the best estimate of housing service consumption, although rent trends are often very different from housing prices.

This “rent reciprocity” method was also adopted by the UK in 2017.

The European Union has adopted a different approach. Eurostat and the European Central Bank prefer the “net acquisition” method, which aims to measure changes in the price of buying a house, rather than measuring the price of the land on which the house is built. They are still struggling with how to divide house prices into houses and land.

Although the ECB this year Require Eurostat should include the cost of owner-occupied housing in its overall Eurozone inflation calculation. The central bank has Request this Since 2000.

By 2007, Mervyn King, then Governor of the Bank of England Comment The project “doesn’t seem to be going anywhere anytime soon”-it hasn’t changed much since then. Lagarde admitted that any change will take several years to take effect.

What impact will it have?

Far below what the rapidly rising housing prices imply.

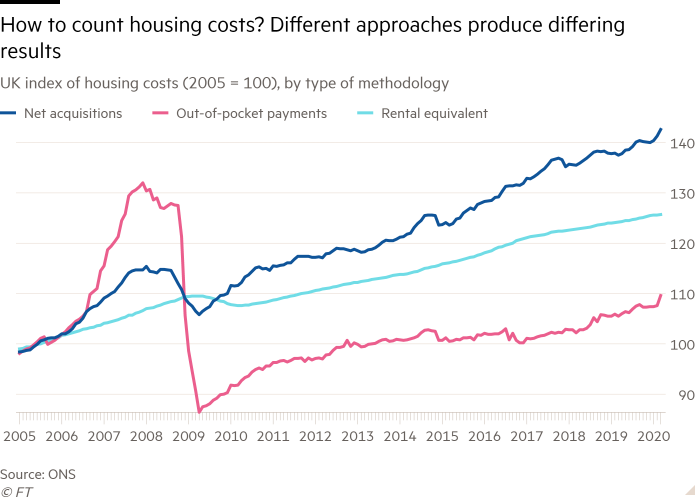

The Office of National Statistics found that between 2005 and 2020, the growth rate of the net acquisition indicator will be 65% faster than the indicator based on rent equivalent. It has the least impact on the overall speed of price growth.

Another method used in the UK Outdated Retail Price Index is to use house prices and mortgage interest rates to determine monthly cash payments related to home ownership. By this measure, real estate will drag down inflation in the past 15 years, because interest rate cuts since the financial crisis have pulled mortgage costs to historical lows.

Lagarde has said that the impact of including owner-occupied housing on overall inflation in the euro zone will be “very small.” She said: “Sometimes, these consumer costs will be higher, and sometimes they will be lower.”

BNP Paribas Asset Management Corporation Macro Research Manager Chad Bavel said: “It is unlikely to change the rules of the game for monetary policy. It will take a long time for Eurostat to implement it. At the same time, it is not clear how the European Central Bank will change the rules of the game. Housing is included in its decision.”

Should the role of the central bank change?

Earlier this year New Zealand becomes The first country to require its central bank to assess the impact of its monetary policy decisions on the government’s support for more sustainable housing prices.

If prices continue the recent rapid growth, this initially seems to be a major change that requires interest rate hikes.

In practice, however, the Reserve Bank of New Zealand gave a narrow interpretation of its new mission: to intervene when housing prices are deemed unsustainable.In its May monetary policy statement, it defined sustainability as not in the bubble field, and Announce “Structural factors explain high housing prices” and low interest rates make higher prices sustainable.

Although the Bank of New Zealand ended its asset purchase program in July, Francesco Pesole, an analyst at ING Bank, said that the Bank of New Zealand “does not explicitly mention house price inflation” even though house prices “may have played a role.”

Other governments seeking to quickly solve the problem of rising housing costs are also facing the same dilemma: raising interest rates to control housing prices may increase unemployment and depress living standards, thereby undermining financial stability. Lagarde described it as a “balance behavior.”

Therefore, the government and central banks may continue to worry about affordability—but their ability to solve it is limited.

[ad_2]

Source link