[ad_1]

Financial markets expect the Bank of England to raise interest rates as early as next spring because there is evidence that the hot labor market in the UK is stimulating wage and price increases.

Before the tough shift at the central bank’s meeting last week, traders had expected interest rates to rise to 0.25% for the first time from a historical low of 0.1% at the end of 2022.But within a week after the meeting, they had Pricing Changes between next February and May meetings.

The bank’s monetary policy committee places the labor market on The core of its judgment Moreover, unlike many economists, it is now believed that the unemployment rate has peaked.

Christian Schultz, chief economist at investment bank Citi UK, said: “If the bank is right and the unemployment rate has peaked, then the unemployment rate will rise. [interest rates] In February. “

The data released since the Bank of England meeting does not indicate that the labor market is cooling, even though the Delta coronavirus variant spread in the UK in July.

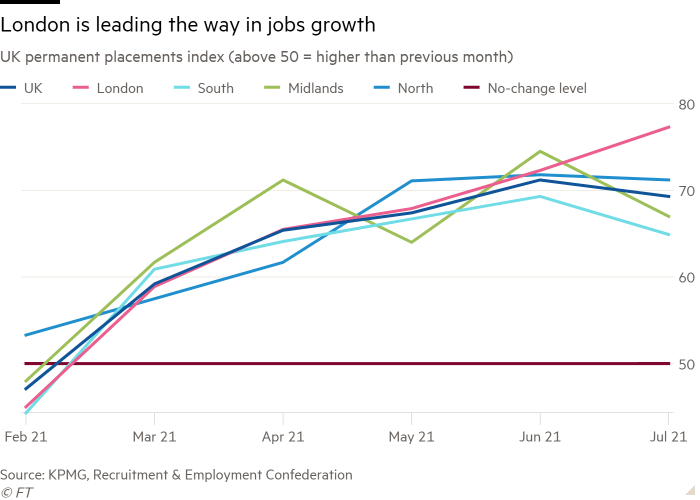

The consulting firm KPMG and the Recruitment & Employment Confederation found in their monthly reports on labor market trends that employment placement has hardly declined from the record level in June and has been weaker in the country before The region began to take off, especially in London, where Covid-19 has hit employment hardest.

A KPMG/REC survey found that companies in all industries are facing serious recruitment difficulties due to low employee availability. In July, the number of employers who said raises increased for the fourth time in a row.

Kate Shoesmith, REC’s deputy chief executive officer, said that now is “a good time to find a new job,” and recruiters are working hard to meet employers’ requirements.

However, the Bank of England is concerned that higher salaries will result in companies having to raise prices, and thus doubts its core forecast that inflation will reach a peak of close to 4% later this year and will slow in 2022.

Monetary Policy Committee Say Last week, it will “closely monitor new evidence about labor market development, particularly the unemployment rate, and broader easing measures. [in the economy] And potential wage pressure”.

The committee is willing to ignore what it considers to be temporary “friction” because some industries suddenly open up and many companies are looking for employees at the same time. But it added that it would be concerned about broader evidence that staff shortages have led to wage increases.

At the August meeting, the Bank of England’s regional agent pointed out that there was a “shortage of heavy truck delivery drivers” and a greater shortage of people looking for jobs. However, other data released after the meeting showed that the vacancy surge is much broader than logistics.

According to the recruitment advertisement data of the recruitment website Adzuna released by the National Bureau of Statistics, the volume of online job advertisements in various industries is higher than the level of 2019.

Tony Wilson, director of the Employment Research Institute, said that the latest evidence from the labor market suggests that the unemployment rate may fall from the 4.8% recorded by the National Bureau of Statistics in the March to May quarter.

“Given the high demand, the huge challenge will be to get more people back into the labor market and help the long-term unemployed. [find jobs] It also helps those who have lost or changed jobs to find new jobs quickly,” he said.

However, this view depends on whether Covid is brought under control in the fall so that the economy can continue to recover quickly. Samuel Tombs, a British economist at the consulting firm Pantheon Macroeconomics, said that if the number of cases and hospitalizations increases, the economic growth rate will slow down, and if the fall epidemic intensifies, the Bank of England may even have to relax again. policy.

“Compared with last winter, the Monetary Policy Committee may first relax policy by lowering bank interest rates rather than expanding quantitative easing,” Tombs said.

During labor shortages, one of the traditional escape valves of the British economy is immigration, especially under the EU’s freedom of movement rules.

However, Madeleine Sumption, director of the Immigration Observatory at Oxford University, said it is difficult to know whether the lack of immigration has exacerbated the labor shortage. She said that the new coronavirus has undermined the reliability of immigration statistics.

Although there may be no sudden outflows of foreigners during the pandemic, Sumption said the evidence shows that “something very extreme will definitely happen in 2020. [inward] Migration, and a lot less. .. This is a major breakthrough from the previous model. ”

At the Ministry of Finance, officials quickly dismissed claims that Brexit and lack of migrant workers caused labor shortages, with the exception of London, but Chancellor of the Exchequer Rishi Sunak worried about the consequences. He told his friends that rising inflation and perhaps rising interest rates are one of his biggest concerns, which has increased the pressure on public finances from rising government debt repayment costs.

The Bank of England hopes that the end of next month’s vacation plan can eliminate some of the heat in the labor market this fall. As the government withdraws support, companies will have to take back hundreds of thousands of previously hired workers or lay off workers.

MPC’s hypothesis is that the end of the employment support program will encourage more people to find jobs and reduce wage and price pressures, which supports its guidance that only a “modest” increase in interest rates is needed in the next three years.

It believes that under the hot surface, there is “a lot of labor market weakness”, but hopes to see more evidence of cooling after the summer to keep it relaxed on inflation for the rest of 2021.

[ad_2]

Source link