[ad_1]

This article is a live version of our Unhedged newsletter.register here Send the newsletter directly to your inbox every business day

A few weeks ago, a reader commented that they like this newsletter because it has more questions than answers. This is especially true in today’s version. If you have some answers, please email me: [email protected]

Noise in the actual rate of return

Earlier this week, before the Chinese market began to throw toys out of strollers, the leading story The content of the British “Financial Times” market page is about the actual rate of return hitting a record low. This is bollocks par (or, translated into an American swear word, nut picture):

The real yield on the 10-year U.S. Treasury bond fell further to below zero on Monday, as growing concerns about the prospects for economic growth have exacerbated the recent bond market rebound.

The idea here-this is a very common idea-is that major changes in the actual rate of return tell us some useful information about economic growth. But how do we track the actual rate of return?

They are usually considered to be the nominal Treasury bond yield minus expected inflation. But this is not how they are actually calculated; in fact, they have not been calculated at all. We just take the yield of Treasury Inflation Protection Securities (Tips) as the real interest rate, and then subtract the yield from the yield of standard Treasury bonds to get inflation expectations. The following is the recent performance of these three people (using the 10-year period):

Broadly speaking, since April, both the Tipps yield and the Treasury yield have declined simultaneously, which means that inflation expectations have stabilized and real interest rates have fallen, so they are “worried about the prospects for economic growth.” But here are two things that make me find it interesting, and make me suspect that the actual rate of return may not tell us what we think they are telling us. One is secondary and the other is primary.

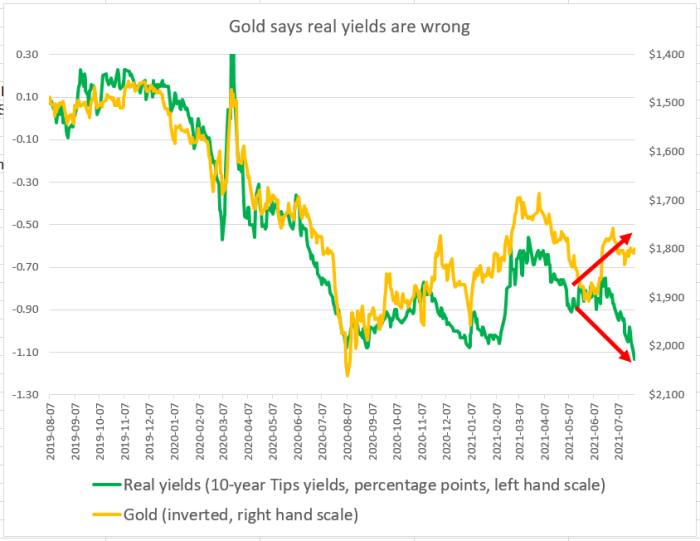

The secondary problem that César Pérez Ruiz of Pictet Wealth Management pointed out to me is that the price of gold has not risen. Gold is strongly negatively correlated with the actual rate of return (gold does not generate any revenue, so the opportunity cost of owning it decreases with the actual returns available elsewhere). But in the past few months, as real yields have fallen to historical lows, the price of gold has fallen. Below is a chart of gold and Tips yields (data from the Federal Reserve). The price of gold is inverted to show the correlation and its recent breakdown:

As Ruiz said, why is the price of gold at $1,800 instead of $2,100? He believes that gold prices expect economic growth to be disappointing, so inflation will decrease and real interest rates will rise.

His view of growth is likely to be right (I guess he is), but please be aware of the implications for how the market works. It shows that, in a sense, there is no inflation premium added to the real interest rate that corresponds to the overall level of economic growth. Conversely, changes in inflation expectations will push up or down the actual rate of return, depending on the role of the nominal rate of return.

If you think that the nominal rate of return is not only determined by economic expectations, but also depends on “technical” supply and demand/investment portfolio issues, this makes sense. But it questions the assumption that the decline in the actual rate of return is best understood as a reflection of growth expectations.

Now is the second and more important interesting thing. From August of last year to February of this year, the actual rate of return has been lower than the level of the long, dull, pre-vaccination phase of the pandemic. Before we know the effectiveness of the vaccine, are the current growth prospects really as bleak as it was then? We expect earnings in the second quarter to increase by about 70%; GDP is expected to reach 7%; and the inflation rate is around 5%. As bad as a year ago?

The picture portrayed by Treasury bonds and tip yields is problematic-which again shows that these two securities may not be economic indicators, but the products of more or less eclectic forces of supply and demand.

If you think that the government bond market might send bad signals about the economy, it’s easy to guess the static source: the Federal Reserve and its $120 billion monthly bond purchases. If the Fed is not in the market, what will be the yield on US Treasury bonds and tips?

The Fed did buy tips—in fact, according to data from the United States, it now has about one-fifth of the supply of these tips. Federal Reserve and Securities Industry and Financial Market AssociationIn contrast, this proportion is close to 29% of outstanding U.S. Treasury bonds and bonds, but the Fed’s Tips and its share of total outstanding debt have grown faster than U.S. Treasuries in the past year .

I asked James Athey of Aberdeen Standard Investments this question, and he gave the following picture-it sounds a lot like the way Ruiz looks at things:

The problem here is that compared with nominal treasury bonds, Tips’ liquidity is an order of magnitude lower, and investors use less — therefore, Tips’ market efficiency is not high, and nominal treasury bonds show a pioneer status.

This brings me to my working model: nominal value comes first, the market has some ideas [inflation expectations] Should be so real [rates] Move as remainder. .. IE. The tipping rate of return is only used to generate an “acceptable” (equilibrium? market-derived?) break-even inflation rate, given a nominal interest rate.

Therefore, the Fed lowered the real yield by buying Tips, and it bought a larger amount of U.S. Treasury bonds, which also depressed the real yield. Because the Fed was unable to control inflation expectations, the nominal interest rate fell. In the case of stable inflation, the real interest rate also Expectations must be lowered.

The more you think about these things, the less the actual rate of return is like a good growth indicator. We don’t know the true level of the real interest rate. More importantly, we cannot be sure whether the Federal Reserve’s intervention will symmetrically affect U.S. Treasuries and Tips, so it is not clear whether changes in real yields can tell us all about economic growth.

Bob Michele of JPMorgan Chase Asset Management told me, “Right now, the rate of return is whatever the central bank wants them to be”, but he suggested that we can refer to historical experience to determine the actual rate of return and the nominal rate of return without Fed intervention:

Before the pandemic, the real yield on 10-year U.S. Treasury bonds averaged approximately +0.5% during 2014-19. If we look at the current actual yield level (-1.13%) and replace it with an average value of 0.5%, the 10-year yield will increase from 1.63% to 2.88%.

But it may be conservative to use the post-financial crisis and pre-pandemic rate of return as a guide. Before the financial crisis, quantitative easing was not a standard part of the Fed’s arsenal:

I like to watch the 1992-94 experience. That was when the Federal Reserve implemented a very aggressive monetary policy after the savings and loan crisis—but there was no quantitative easing program to distort the market. In other words, they leave the yield curve to investors like me to set the price! The 10-year UST transaction price was nearly 4% higher than the federal funds rate in November 1992, more than a year before the Federal Reserve raised interest rates for the first time in January 1994. Due to the lack of a quantitative easing program, the 10-year UST transaction price is about 2.5-4% higher than the federal funds rate-based on this comparison, this means that today’s yield is 2.5-4%.

If Michel’s argument is correct in the direction, then not only do we not have a good grasp of the economic situation that today’s actual yield tells us (because we don’t know whether the impact of QE on U.S. Treasuries and Tips is symmetrical), but we It should be prepared that when the Fed scales back its asset purchase program, the interest rate environment may change significantly.

A good book

An academic Paper Implies that U.S. Treasury bonds are actually too cheap, in all things (hat hint Marginal revolution point out).

[ad_2]

Source link